News

How Nairobi Scammers Defrauded UK National Millions in a Fake Gold Deal

The group claimed they could supply 112 kilogrammes of gold, with 31 kilogrammes offered as collateral to secure both a previous USD 400,000 payment made in 2022 and further payments planned for early 2025.

A London based businessman has told a Nairobi court how a slick network of fraudsters lured him into an elaborate fake gold trade that ended with more than Sh200 million vanishing into advocate accounts, safe vaults and endless paperwork that never produced a single gram of real gold.

Satbinder Singh, a UK national and director of Ireland registered firm Asianic Limited, gave chilling testimony before Principal Magistrate Paul Mutai detailing how what began as a promising bullion investment morphed into a textbook Nairobi gold scam involving forged documents, fake taxes, phantom penalties and staged airport drama.

Singh told the court that in 2024 he travelled to Kenya with his associate Marco Colombo Conti, chasing a lucrative opportunity to buy gold from East Africa, a region long marketed to foreign investors as a bullion gateway but increasingly notorious for high end fraud.

In Nairobi, they were introduced to Alain Mwadia Nvita, who presented himself as the chief executive of Quantum Minerals, a supposed gold trading company. Nvita was accompanied by Lehman John Raymond, introduced as his cousin, and later by Frank Kiteti, a Tanzanian national described as their regional agent.

The pitch was seductive. The group claimed they could supply 112 kilogrammes of gold, with 31 kilogrammes offered as collateral to secure both a previous USD 400,000 payment made in 2022 and further payments planned for early 2025.

Singh testified that the earlier USD 400,000 had been paid by Conti during a separate visit to Kenya in June 2022 when he was negotiating to buy 100 kilogrammes of gold from a man identified as Alain Lukuse, another name the prosecution is now treating as part of the same web of deception.

To formalise the deal, Singh was invoiced through a company called PATVAD Trading. On February 5, 2024, Asianic Limited was billed 162,420 euros, followed the same day by a second invoice of 548,830 euros, allegedly to cover taxes. Both payments were wired to a Stanbic Bank account held by Mosota Abunga and Associates Advocates LLP.

Singh told the court alarm bells rang when he queried why fresh taxes were being demanded yet the earlier USD 400,000 was said to have covered statutory charges. He was assured the issue was resolved because the taxes were now secured against the 31 kilogrammes of gold collateral.

Two days later, another invoice followed. This time it was 14,112 euros for freight charges, also paid to the same advocate’s account.

The court heard that the supposed gold collateral had been stored at a private vault facility identified as MySafe. On February 9, 2024, the businessmen collected the 31 kilogrammes and took it to PATVAD’s offices, where it was split into two consignments and packed into blue metallic boxes.

Singh said the boxes were sealed, stamped and signed, and he personally recorded videos and photographs of the packaging and accompanying documents. The plan was to hand carry the gold to Italy on a commercial flight, a claim investigators say mirrors a common script used in fake bullion schemes.

At the airport, Singh and Conti waited in the lounge for Daniel, a director of PATVAD Trading, and Kiteti to deliver the sealed boxes and final paperwork. They never arrived.

Instead, the businessmen were told there was a problem with one document. As boarding time approached, Singh hesitated to leave Kenya without the gold. He was eventually persuaded to fly after being told the issue could not be resolved immediately.

What followed was the hook. Singh testified that he was later informed customs authorities had imposed a 20 percent penalty on the consignment, valued at USD 1,562,000, due to an alleged discrepancy in the declared quantity of gold. If the fine was not paid, he was warned, the gold would be confiscated.

Under intense pressure from Nvita, Singh and his associates flew back to Nairobi on February 20, 2024. In a desperate attempt to salvage the deal, they paid the demanded USD 1.5 million.

The gold never came.

Between February and June 2024, Singh said he was fed a steady stream of excuses, new procedural hurdles and subtle attempts to extract even more money. By June 20, convinced he had been conned, he reported the matter to the Directorate of Criminal Investigations.

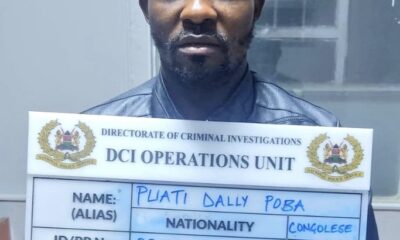

The DCI arrested Daniel of PATVAD Trading, Nvita and Kiteti, who are now facing fraud charges.

Investigators say the case bears all the hallmarks of Nairobi’s entrenched fake gold industry, where scammers pose as miners, exporters or government connected brokers, launder payments through law firm accounts to add legitimacy, and exploit foreign investors’ limited understanding of Kenya’s regulatory environment.

The trial is ongoing, with prosecutors expected to call financial crime experts and DCI officers to unravel how millions moved through the banking system without a single verifiable gold export taking place.

For Singh, the courtroom testimony was less about the money and more about exposing a system that nearly perfected the art of deception.

“I trusted the documents, the offices, the lawyers and the process,” he told the court. “Everything looked real. That is how they got us.”

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business2 weeks ago

Business2 weeks agobetPawa Empire Crumbles: Mr Eazi’s Betting Gambit Unravels Amid Partner’s Shadowy Deals

-

Business1 week ago

Business1 week agoMinnesota Fraud, Rice Saga, Medical Equipment Deal: Why BBS Mall Owner Abdiweli Hassan is Becoming The Face of Controversial Somali Businessman in Nairobi

-

News1 week ago

News1 week agoDCI Probes Meridian Equator Hospital After Botched Procedure That Killed a Lawyer

-

Politics1 week ago

Politics1 week agoYour Excellency! How Ida’s New Job Title From Ruto’s Envoy Job Is Likely to Impact Luo Politics Post Raila

-

Investigations2 weeks ago

Investigations2 weeks agoEXPOSED: SHA Officials Approve Higher Payments for Family, Friends as Poor Patients Pay Out of Pocket

-

Business1 day ago

Business1 day agoCooking Fuel Firm Koko Collapses After Govt Blocks Sh23bn Carbon Deal

-

News1 week ago

News1 week agoKenya Stares At Health Catastrophe As US Abandons WHO, Threatens Billions In Disease Fighting Programmes

-

Politics2 weeks ago

Politics2 weeks agoJaramogi Clan Tells Raila Jr, Winnie Against Disrespecting Their Uncle Oburu, Warns of Curses