Business

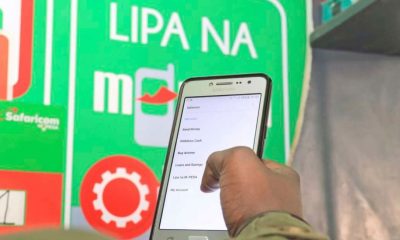

NCBA And KCB Customers To Have Their Accounts Blocked If They Default On Repaying Fuliza

For those who hold bank accounts in NCBA and KCB you might want to pay keen attention to this.

M-Pesa users who default on their Fuliza loans will have access to their funds in M-Shwari and KCB M-Pesa accounts blocked or used to settle their outstanding balances.

This is according to an update to the terms and conditions that will give Safaricom the mandate to hold onto users’ funds on the two mobile money accounts in the event users default on the overdraft facility.

According to the new terms, KCB and NCBA may hold users’ funds in M-Shwari and KCB M-Pesa as collateral and security for any Fuliza loans that are outstanding.

“You hereby agree and confirm that NCBA and KCB are entitled in its discretion to prevent or restrict you from withdrawing in whole or in part the funds in your accounts for so long as and to the extent of the amount outstanding in respect of your loan without KCB or NCBA giving any notice to you and/or without incurring any liability to you whatsoever in that connection,” reads the terms and conditions that come into effect on November 14, 2021.

The updated terms further indicate that the right to hold on to users’ funds and using the same to offset Fuliza loans will also apply on savings and mobile saving accounts they hold with service providers.

The new terms also introduce a 1.083 per cent interest rate on Fuliza, whereas previously, the service charged a facility fee of the same amount.

Safaricom says the updated terms are not new but a standard for banking products.

“The new terms clarify the fact that Fuliza may be offered across additional M-Pesa products,” Dennis Mbuvi, a communication officer at Safaricom said in response to inquiries.

“As a financial service, Fuliza is offered by KCB and NCBA as licensed by the Central Bank of Kenya (CBK) hence the lien clause which is standard for banking products and also there in the current terms,” he said.

This is however the first update Safaricom is making on the terms and conditions of Fuliza since its introduction in January 2019.

A previous set of terms and conditions from the company’s website makes no mention of the lien clause on KCB M-Pesa accounts or of the 1.083 per cent interest rate.

The updated terms are expected to cut the rate of loan defaults on Fuliza, discouraging the practice where users rack up outstanding principal and interest repayments and abandon their lines after they default.

It is also expected to affect users who take loans from Fuliza, KCB M-Pesa and M-Shwari at the same time, relying on savings in their mobile wallets or transaction histories to build their credit score.

Data from Safaricom’s latest annual report indicates that Fuliza is currently the most lucrative mobile lending product for the firm.

It recorded a 61 per cent growth in revenue year-on-year to Sh4.5 billion as at the end of the last financial year, and more than 100 per cent growth in daily active users, who stood at 1.4 million daily. The fund disbursed Sh351 billion at the end of the last financial year, up from Sh245 billion last year, with a repayment rate of more than 98 per cent.

M-Shwari on the other hand recorded 3.9 million active users as of the end of the last financial year, with Sh571 billion in deposits and Sh94 billion in loan disbursements.

KCB-M-Pesa on the other hand reported a 100 per cent repayment versus disbursement rate while even as revenue and monthly active customers fell by a third in the last financial year.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Americas6 days ago

Americas6 days agoEpstein Files: Bill Clinton and George Bush Accused Of Raping A Boy In A Yacht Of ‘Ritualistic Sacrifice’

-

Business7 days ago

Business7 days agoCooking Fuel Firm Koko Collapses After Govt Blocks Sh23bn Carbon Deal

-

Business6 days ago

Business6 days agoABSA BANK IN CRISIS: How Internal Rot and Client Betrayals Have Exposed Kenya’s Banking Giant

-

Business3 days ago

Business3 days agoKRA Can Now Tax Unexplained Bank Deposits

-

Investigations1 week ago

Investigations1 week agoPaul Ndung’u Sues SportPesa for Sh348 Million in UK Court, Accuses Safaricom Boss of Sh2.3 Billion Conspiracy

-

Americas6 days ago

Americas6 days agoEpstein Files: Trump Accused of Auctioning Underage Girls, Measuring Genitals and Murder

-

Investigations2 days ago

Investigations2 days agoEpstein Files: Sultan bin Sulayem Bragged on His Closeness to President Uhuru Then His Firm DP World Controversially Won Port Construction in Kenya, Tanzania

-

Africa1 week ago

Africa1 week agoSafaricom Faces Explosive Market Abuse Claims as Ethiopia’s Telecom Giant Threatens Return to Monopoly