Business

West Sugar Kenya And Vartox queries Mumias receivership accounts

Published

3 years agoon

A secured creditor wants KCB appointed receiver manager Ramana Rao summoned over a report concerning the accounts of Mumias Sugar company, which he filed in court in January.

Vartox Resources Inc, one of the creditors of the ailing miller says Rao should appear in court and explain the books of accounts of the miller for the last two years.

In an application supported by rival West Kenya sugar company, Vartox also wants KCB group chief executive officer Joshua Oigara to appear in court for cross-examination.

Through lawyer Ismael Abbas, Vartox also claimed that Rao has failed to produce a detailed valuation report as ordered by the court.

Abbas submitted that it has become necessary for Rao to be cross-examined on the inconsistencies, falsehood and coverup that he has engaged in during his time as receiver manager of Mumias Sugar.

He said Rao’s recent actions to lease the assets of Mumias Sugar to Sarrai Group Limited is littered with inconstancies.

“As the applicant’s application dated January 28, 2022 is under insolvency Act 2015, there is no provision for a viva voce hearing unlike in civil cases and the applicant does not have ant way to question Rao on the many inconsistencies to bring him to account for his law as administrator and receiver of Mumias,” said Abbas.

He further submitted that Rao has conducted himself in a manner meant to disenfranchise other creditors and stakeholders of Mumias Sugar, who have a debt portfolio exceeding Sh30 billion.

Abbas said the affairs of Mumias are of significant public interest as held by the court in a ruling on 19 November 2021.

Senior Counsel Paul Muite, who represents West Sugar supported the application saying Rao and KCB should come and explain the inconsistencies.

West Sugar has challenged the lease to Sarrai Group wondering how as the highest bidder, the miller missed out on the 20-year lease.

“He should not only be removed as an administrator, his conduct makes him unsuitable for a receiver or administrator,” Muite submitted.

Muite questioned what Rao is hiding since he has not availed the lease documents as requested

He urged the court to direct Rao to produce all documents supporting every entry that appears in his “abstract” filed with the court on January 18, 2022.

Muite said other than cross-examination, the two should also produce all documents including e-mails, letters and all correspondence exchanged with Rao, all board resolutions and approvals given to the administrator in relation to the leasing of Mumias’ assets to Sarrai Group.

Rao was given the nod to lease Mumias Sugar after receiving bids from several entities.

“Rao has leased the Company’s sugar factory and related assets to the lowest bidder in circumstances that point towards fraud since the 20-year lease executed will expire with Mumias continuing to be mired in debt with its assets potentially wasted and the only financial beneficiaries of the 20-year lease are the lowest bidder and the 1st Respondent. None of Mumias’ historical debts will ever get repaid in those 20 years,” added lawyer Abbas.

Rao allegedly discarded the highest bidder’s bid on the basis that it would not achieve the goals of the lease which was to turn around the Company to profitability.

Rao proceeded to award the bid to the lowest bidder after carrying out a technical evaluation but which losing bidders say was marred by opacity and serious anomalies.

The lawyer said Rao has not explained to Vartox or any of the other creditor how a bid of Sh6 billion over a period of 20 years will revive Mumias whose debts are in excess of Sh30 billion.

“In attempting to justify his flouting of the court orders, the 1st Respondent has relied on provisions of the repealed Companies Act that no longer exist in law. He has attempted to justify filing an abstract because Section 351 of the repealed Companies Act provided for the filing of abstracts,” lawyer Abbas added.

He added that Rao needs to be cross-examined on the basis for his reliance on repealed statutes which impact on his competency to act as a receiver considering he is unable to follow simple court directions and is relying on repealed statutes to carry out his duties.

He pointed out that Rao spent more than Sh 71 million paying lawyers and unnamed consultants and has also procured valuation reports after paying Sh21.9 million.

“Despite requests to him to supply details of these payments and the valuation reports, Rao has ignored these requests”.

Rao, he said, operated Mumias’ assets as though Mumias is his personal property.

“Apart from operating the Ethanol plant when he had no mandate to because KCB’s security did not extend to the Ethanol plant, he has refused to account for any of the proceeds from the operation of the Ethanol plant,” he said.

“Furthermore, he has borrowed money through an overdraft from KCB to the tune of Sh216 million in unclear circumstances, thereby further compounding Mumias’ woes and increasing its debt portfolioand the interest alone on the KCB overdraft amounts to Sh. 23 million, a figure that is more than 1 months’ lease rental that is being paid by the lowest bidder.

He said Rao should be crossexamined so that he can explain in detail the borrowings, what he has used the money for and how it impacted Mumias’ balance sheet as well as when the applicant’s outstanding debt will be cleared based on the current lease to the lowest bidder”, he added.

No cross-examination

Last momth, PVR Rao opposed calls by creditors of the miller to be cross-examined over its accounts for the last two years.

Two creditors- a lawyer who previously acted for the company and who is owed Sh96 million and a supplier, sought to cross-examine Mr Rao over the accounts he filed in court last month.

Lawyer Jackline Kimeto wanted Mr Rao to answer questions surrounding professional and legal fees, which run into millions of shillings, donations, public relations expenses, security costs amounting to more than Sh150 million, repairs and maintenance of the distillery and the factory, among others.

It is also her view that the money the receiver generated in the last two years should have paid KCB’s debt.

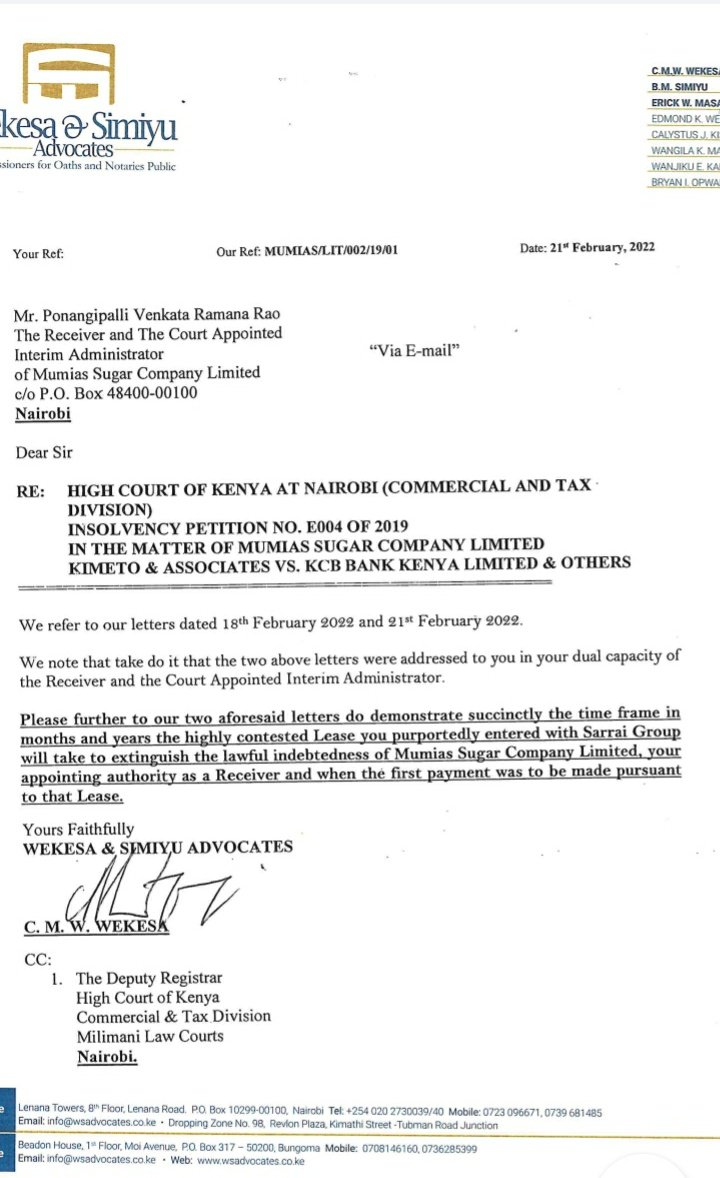

Another law firm, Wekesa and Simiyu Advocates also wants Mr Rao to demonstrate the time frame that the highly contested lease will take to repay KCB’s debt.

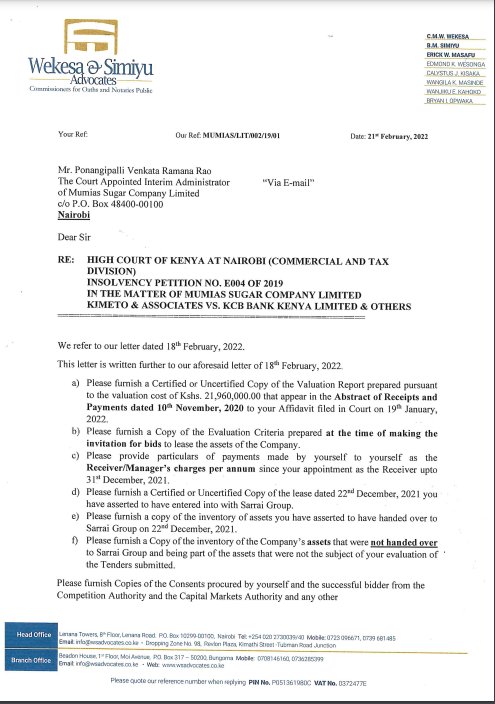

Also sought is a copy of the evaluation criteria prepared at the time of making the invitations for bids to lease the assets of the company and Mr Rao’s charges per year, since his appointment as the receiver up to December 31, last year.

“Please furnish copies of the consents procured by yourself and the successful bidder from the Competition Authority and the Capital Markets Authority and any other statutory bodies as condition precedents prior to entering any lease and handing over the company assets to Sarrai Group,” the letter adds.

Mr Rao awarded the 20-year lease to Sarrai Group in December but several bidders have challenged it in court.

Wekesa and Simiyu advocates wrote a letter to Ramana Rao demanding the manager to demonstrate the time frame in months and years that the highly contested lease will take to “extinguish the lawful indebtedness of Mumias Sugar Co.

Legal battle over the Mumias Sugar Company lease award continues to rage on,with Wekesa & Simiyu Advocates law firm now demanding a copy of the lease agreement entered between the receiver-manager Ponangipalli Venkata Ramana Rao & Sarrai Group in December, 2021.

Mr PVR Rao, the administrator of Mumias Sugar, told the High Court that it is not correct to assume that the highest financial bid should have won the 20-year lease, but he had to consider the technical aspects, besides the financial proposal.

His lawyer, Senior Counsel Kimani Kiragu, said it was his considered opinion that West Kenya, which bid Sh36 billion for Mumias, was not interested in the revival of the miller but intended to stall the operations to ensure it continues to enjoy the monopoly in the sugar industry.

“I clearly indicated that the bids I received would go through both technical evaluation and financial evaluation. It is not correct to proceed, as West Kenya and Tumaz & Tumaz have done, on the basis that the highest financial bid alone would be the winner,” Mr Rao said in an affidavit.

Mr Kiragu further said West Kenya failed to demonstrate how it would pay Sh150 million per month, and Sh1.8 billion per annum, for the lease as captured in its financial bid.

In the affidavit, Mr Rao said he was aware that the Rai Group, which is linked to West Kenya, took over Pan Paper Mills Limited in Webuye in 2016, but the paper-making company has not been in operation for more than 11 years.

The court heard that the bid was for the leasing of assets for 20 years, and not for a sale, as mistaken by farmers and suppliers who filed the case challenging the lease to Sarrai Group.

Mr Kiragu said the Mumias Sugar assets are mainly industrial and are prone to degradation due to corrosion if they are left non-operational for a long time.

He disputed claims that he rushed the process but took about a month to finalise the evaluation and award the lease to the Sarrai Group.

He said Tumaz & Tumaz a company associated with businessman Julius Mwale was trying to fill the gaps in its bid by submitting a fresh one through the court case, and that the company was trying all means to scuttle the process by filing the court cases.

Jaswant Rai of West Kenya has faulted the lease saying the bidding process was shrouded in secrecy and lacked accountability and transparency.

Pulling back revival of Mumias Sugar

When lawyer Jackline Kimeto filed an insolvency petition against Mumias in April, 2019, she was hopeful that her move would pressure the miller into paying her Sh76 million debt.

The miller’s shame

Ms Kimeto had defended Mumias in a suit filed by Kenya Power in 2015, seeking Sh1.1 billion in unpaid electricity bills. She also handled other cases for the company.

But her petition pulled a thread that would eventually undo the seams holding together what was left of Mumias’ clothing, exposing the miller’s shame: It was flat broke and headed down the murky waters of bankruptcy.

More than 80 creditors joined the insolvency suit. Five months later, KCB placed Mumias under receivership. The lender appointed Ponangipalli Venkata Ramana Rao as receiver manager.

On September 25, 2019, the NSE suspended trading of Mumias’ shares on account of the receivership. Mr Rao’s first move was to fire all 900 workers as he started reviewing the miller’s books and operations. The number of staff was a pale shadow of Mumias’ heyday, when more than 9,000 people were on its payroll.

Unhappy with KCB’s move, Ms Kimeto filed an application challenging the manner in which the lender placed Mumias under receivership. She filed a second application seeking to have an administrator appointed to take over the miller’s management.

High Court judge Mary Kasango issued orders temporarily barring Mr Rao and KCB from selling or transferring Mumias’ assets, pending determination of Ms Kimeto’s application.

As the lawyer’s application was still lingering in legal red tape, a section of creditors was growing disgruntled with Mr Rao and KCB. They felt that the receiver manager was biased towards KCB at the expense of other creditors.

Creditors resolved in an October 16, 2019 meeting to have an administrator who would be answerable to anyone owed money by the collapsed miller.

Barely three weeks later, Mumias lenders met with representatives of the Kakamega County government and resolved to form a steering committee that would oversee the revival of the miller.

The committee was to have Ashitiva Mandale, George Kashindi, Lynette Okiro and Ms Kimeto. The final slot was reserved for a representative of the National Treasury. The group would work with Mr Rao.

When Mr Rao took control, the firm had not produced sugar for more than a year. More than 25,000 farmers dumped Mumias over non-payment of their dues. Strangely, ethanol had become the biggest and only reliable source of income for the miller.

Blessing in disguise

The receiver manager halted the remaining operations, pending a restructuring process that would be guided by a detailed review of issues affecting the company.

On March 15, 2020, President Kenyatta announced a partial economic shutdown after Kenya reported her second and third Covid-19 cases. It was doom for most companies.

But for companies like Mumias, it was a blessing in disguise because ethanol suddenly became the most sought after raw material because there was not enough hand sanitiser to satisfy the local demand.

Even the police were surrendering ethanol confiscated from illicit brewers to make more sanitiser. Mumias had resumed ethanol production one month before the partial economic shutdown. At some point, the miller was producing 150,000 litres of ethanol a day.

There was, however, a pause between December 2020 and February 2021 following a molasses shortage. Mr Rao eventually sourced for molasses from rival millers and resumed the ethanol production.

Mumias also received a huge boost from the Kenya Revenue Authority (KRA), which opted to waive a Sh11 billion tax bill, a huge chunk of the miller’s debts. In April last year, Mr Rao said he intended to lease out Mumias’ assets for a 20-year period that would ensure the miller’s survival and repayment of debts.

Tycoon Narendra Raval emerged as the most interested candidate through his Devki Group of Companies. Court proceedings would later reveal that the Devki Group had placed a Sh60 billion bid for the 20-year lease. But Mr Raval’s firm did not want the public scrutiny that stakeholders were demanding and withdrew the bid on June 4.

Mr Rao was then summoned by the Senate to explain the leasing plans. He revealed that he had sourced for potential strategic investors.

The companies he had approached were the Devki Group, Catalysis Group (Russia), Sarrai Group (Uganda), Kruman Associates (France), Kibos Sugar, Third Gate Capital Management, Godavari Enterprises and Premier JV (India).

On June 18, activist Okiya Omtatah filed a suit at the High Court’s Constitutional and Human Rights Division in Nairobi seeking to have Mr Rao removed, and the National Treasury compelled to revive Mumias.

Conflict of interest

He argued that Mr Rao had acted unprofessionally by failing to explain the formula used to settle on the eight bidders. He also raised a potential conflict of interest on the receiver’s past dealings with the Devki Group.

Mr Rao had sold scrap metal to Devki Group while managing affairs of Kwale Sugar during a past receivership spell. Mr Omtatah also argued that Mr Rao had failed to issue any specific details to the public on Mumias’ state of affairs since taking over as receiver manager.

After Mr Rao conducted a fresh tendering for leasing, Mr Omtatah successfully sought orders compelling him to file financial statements and bids placed by the bidding companies. The documents would reveal that Mr Rao settled for the third lowest bid price of Sh6.2 billion, floated by Uganda’s Sarrai Group.

One of Mumias’ key suppliers, Gakwamba Farmers Cooperative Society, would join Mr Omtatah in protesting the manner in which Mr Rao was handling the deal.

Gakwamba filed a suit in the Commercial & Admiralty Division of the High Court in Nairobi on August 2 last year, faulting Mr Rao for entering negotiations with Devki Group and sought orders barring any deal.

“Mr Rao and KCB have not carried out an objective cost-benefit analysis to determine whether the so-called strategic investor is the most effective way of reviving MSCL and ending the suffering of its sugar farmers and other stakeholders,” the society argued.

Gakwamba owns 1,000 ordinary Mumias shares. Farmers under the group are also owed over Sh25 million for cane supplied. The group argues that Mr Rao should not be allowed to lease out Mumias assets through private treaty, and only a process accessible to the public should be implemented.

Justice Wilfrida Okwany agreed with the farmers. On September 23, the judge ordered that Mr Rao open bids in the presence of all bidders. Interestingly, the bids remained a closely guarded secret before Mr Omtatah later secured orders compelling Mr Rao to file the information in court.

Three days after the farmers filed their case, Mr Rao advertised a fresh procurement process for the leasing deal. Not all were happy with the move. Lawyer John Khaminwa had at this point joined the insolvency petition against Mumias. He is owed money by the miller, but wanted to support its revival rather than liquidation.

On September 16, Mr Khaminwa filed an application in the insolvency suit seeking to have Mr Rao cited for contempt of court. The lawyer argued that the court orders stopping sale and transfer of the company’s assets also covered leasing deals, hence Mr Rao was in violation.

Insolvency suit

Mr Rao and KCB opposed the application, holding that during the lease period all assets would still be owned by Mumias. A week later, KCB and Mr Rao filed an application in the insolvency suit, seeking to stop the Senate from further summoning them or interfering with the Mumias receivership.

The two argued that the Senate was interfering with their rights by giving instructions on how to handle the collapsed miller’s affairs. The Senate had on September 29 – a day before Mr Rao and KCB filed their application – requested the receiver manager to comply with the court orders.

Justice Alfred Mabeya had taken over the insolvency suit, and delivered one ruling to handle four applications – Ms Kimeto’s seeking to stop selling of Mumias assets, her request for appointment of an administrator, Mr Khaminwa’s contempt of court allegations and Mr Rao’s bid to stop Senate summons and directions.

In his November 19, Justice Mabeya agreed with Ms Kimeto on the need for an administrator. He, however, appointed Mr Rao the administrator while upholding his role as receiver manager.

The judge held that the Senate had not done anything to indicate interference, as it had only sought clarity from Mr Rao and requested that he comply with court orders. But the judge issued orders barring the Senate from directing Mr Rao on how to conduct business in his receiver manager capacity.

Mr Khaminwa’s contempt of court application was also dismissed, as Justice Mabeya ruled that the leasing would not lead to a sale or transfer of Mumias assets. “Mr Rao is at liberty to proceed with the process of leasing the Company’s assets subject to strict observance of the Competition Act, 2010 Laws of Kenya,” the judge said.

The fresh bidding round attracted six companies. The Jaswant Rai family’s West Kenya Sugar proposed Sh36 billion and became the highest bidder following the Devki Group’s exit.

Tumaz and Tumaz Enterprises, owned by Butere-based businessman Julius Mwale, was the second highest bidder with Sh27.6 billion. A group of French and Turkish investors, through Kruman Finances Limited, bid Sh19.7 billion.

The Sarrai Group, owned by Jaswant Rai’s brother Sarbi, bid Sh6.2 billion. Only Kibos Sugar and Pandhal Industries had lower bids than Sarrai’s as they each wanted to pay Sh5.9 billion. The Sarrai Group got an early, but short-lived Christmas gift as Mr Rao declared the Ugandan firm the best bidder on December 22.

The firm was to take over Mumias operations, excluding ethanol production. Rumours of disgruntled bidders threatening court action started flying almost immediately. Tumaz and Tumaz Enterprises was the most vocal, stating that it was one of the highest bidders.

Kakamega County filed a suit at the Vihiga High Court seeking to stop Mr Mwale’s firm from interfering with Mr Rao’s decision.

Highest bidder

Mr Rao filed a similar suit in Nairobi, arguing that Mr Mwale was planning to disrupt his plans to rescue Mumias through the leasing deal. On January 14 this year, five farmers challenged Mr Rao’s decision to pick Sarrai, arguing that the receiver manager conducted an opaque process.

Lambert Lwanga Ogochi, Augustino Ochacha Saba, Prisca Ochacha, Robert Mudinyu and Wycliffe Barasa Ngong filed yet another suit. Justice Wilfrida Okwany issued orders barring Sarrai Group from starting operations.

West Kenya, Tumaz and Tumaz Enterprises, Gakwamba Farmers Cooperative Society and Mumias Outgrowers Company have since been enjoined in the suit. West Kenya maintains that it was the highest bidder but was unfairly locked out.

In response, Mr Rao argues that in overlooking West Kenya, he was following Justice Mabeya’s orders to comply with competition laws. He argued that if West Kenya would have acquired the lease, the Rai family-owned firm would have become a monopoly in the sugar industry.

The receiver manager adds that West Kenya had several cases against former workers and competitors, and that the Rai family firm did not submit a detailed investment plan in the bid.

Gakwamba Farmers claim that the five farmers who obtained orders stopping Sarrai from proceeding with the leasing deal are strangers sponsored by West Kenya.

In the insolvency petition, Dubai-based Vartox Resources Inc and Ms Kimeto have also challenged Sarrai’s leasing deal, arguing that the process was opaque and intended to benefit only KCB and Mr Rao.

The two argue that Sarrai’s Sh6.2 billion bid was not sufficient to pay Mumias’ debts, yet other firms would have cleared the miller’s liabilities in less than 10 years.

Vartox says that Mumias owes it Sh6 billion, which was secured with the miller’s ethanol plant. The Dubai firm holds that Mr Rao has refused to acknowledge its rights to the plant despite several notifications.

The plant is also collateral for loans that Ecobank and France’s Proparco issued to Mumias. Ecobank, Proparco and Vartox appointed Harveen Gadhoke as the plant’s receiver manager.

All focus is now on the case filed by the five farmers. Justice Okwany will hear the parties on March 14. Orders seeking to stop the Sarrai Group from taking over Mumias operations will lapse on the same day.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

📩 Got a Tip, Story, or Inquiry? We’re always listening. Whether you have a news tip, press release, advertising inquiry, or you’re interested in sponsored content, reach out to us! 📬 Email us at: [email protected] Your story could be the next big headline.

You may like

-

American Couple Agrees to Withdraw Ksh.220M Fraud Case Against Julius Mwale After Out-of-Court Deal

-

Court Ruling Deepens Rift in Billionaire Rai Family’s Succession Battle

-

Billionaires Narendra Raval, Jaswant Rai and Tanzanian Rostam Aziz Under Fire as MPs Probe Sh15bn Tax Exemptions Bleeding Economy

-

Bitter-Sweet: The Reignited Rai Brothers’ Feud Threatens Mumias Sugar’s Revival

-

South Sudan Threatens To Shutdown Stanbic Bank In Sh722M Row With Airline

-

LSK Considers Barring Ugandan Lawyers Over Karua’s Licence Dispute

Kenya Power on the Spot Over Sh274M Paid to ‘Absent’ Consultant

Boniface Kariuki To Be Laid To Rest In Kangema

PHOTOS: Gachagua Lands in Seattle to Kick Off Two-Month US Tour

This Was No Protest But A Failed Coup Attempt, Murkomen Decries

Insider Wars: How Choice For Flagbearer Now Threatens to Split Opposition Camp Ahead of 2027

I Was Helping My Boss Organise a Surprise for His Wife Only to Discover I Was the Side Dish Being Surprised

Trump Presses African Leaders To Take Deported Migrants, Sources Say

Ruto Re-Gazettes Appointment of Erastus Ethekon As IEBC Chairperson Along Six Commissioners Moments After Court Ruling

High Court Upholds IEBC Appointments But Quashes Gazette Notice Over Legal Violation

PS Bitok Demands Arrest Of Alliance Teacher In Student Sexual Grooming Saga

From Billionaire to Broke: The Fall of Humphrey Kariuki’s Empire

How NCBA Software Engineer Opened Floodgates For Mobile Banking System Fraud

Investigation Exposes Alleged Sex Crimes at Alliance Girls High School Amid Institutional Cover-Up

EXCLUSIVE: How Corruption and Mismanagement Have Brought Kenyatta National Hospital to Its Knees

Housing PS Charles Hinga Entangled in Sh 2B Tender Scam

WATCH: New CCTV Footage Reveals Police Brought Ojwang to Hospital Already Dead

Inside the Kibaki Estate Dispute: Power, Bloodlines & the Unfolding Legal Drama

Details Emerge In How ‘Death Squad’ Hatched Plan To Keep Dark Ojwang’s Interrogation Secret in Cell Ending in Death

New Details Reveal How Ojwang Was Tortured into a Coma in Karura Forest in the Presence of a Senior Officer

Former PS Warns of Hidden Hand Behind Mwaura’s Sh1.6B HF Group Acquisition, Predicts Delisting

Most Popular

-

Investigations7 days ago

Investigations7 days agoInvestigation Exposes Alleged Sex Crimes at Alliance Girls High School Amid Institutional Cover-Up

-

Grapevine2 weeks ago

Grapevine2 weeks agoCS Alfred Mutua Embroiled in Custody Battle After A ‘Quick’ Moment With Kenyan Girl in Dubai

-

Opinion2 weeks ago

Opinion2 weeks agoWhy Ruto Dumped Isiolo Governor Abdi Guyo: A Political Betrayal in the Making

-

News2 weeks ago

News2 weeks agoOle Kina Fragrance Sets Kenyan Market Abuzz with Million-Shilling Expansion

-

Americas7 days ago

Americas7 days agoHow A Nigerian Yahoo Boy’s Elaborate Plan to Scam Trump Backfired As FBI Goes After Him

-

News1 week ago

News1 week agoOutrage as Kenya Agrees to Buy Defence Equipment From UK in Ksh12.5 Billion Deal

-

Politics3 days ago

Politics3 days agoMoses Kuria Resigns from Kenya Kwanza Government

-

News6 days ago

News6 days agoIrony of Lydia Mathia Seeking Court Interventions Months After Calling Court Orders ‘Mere Papers’ While Spearheading Evictions