Development

State Takes Over Operations Of KPLC Orders Forensic Audit

The Government has directed Kenya Power to immediately suspend ongoing and pending negotiations with independent power producers.

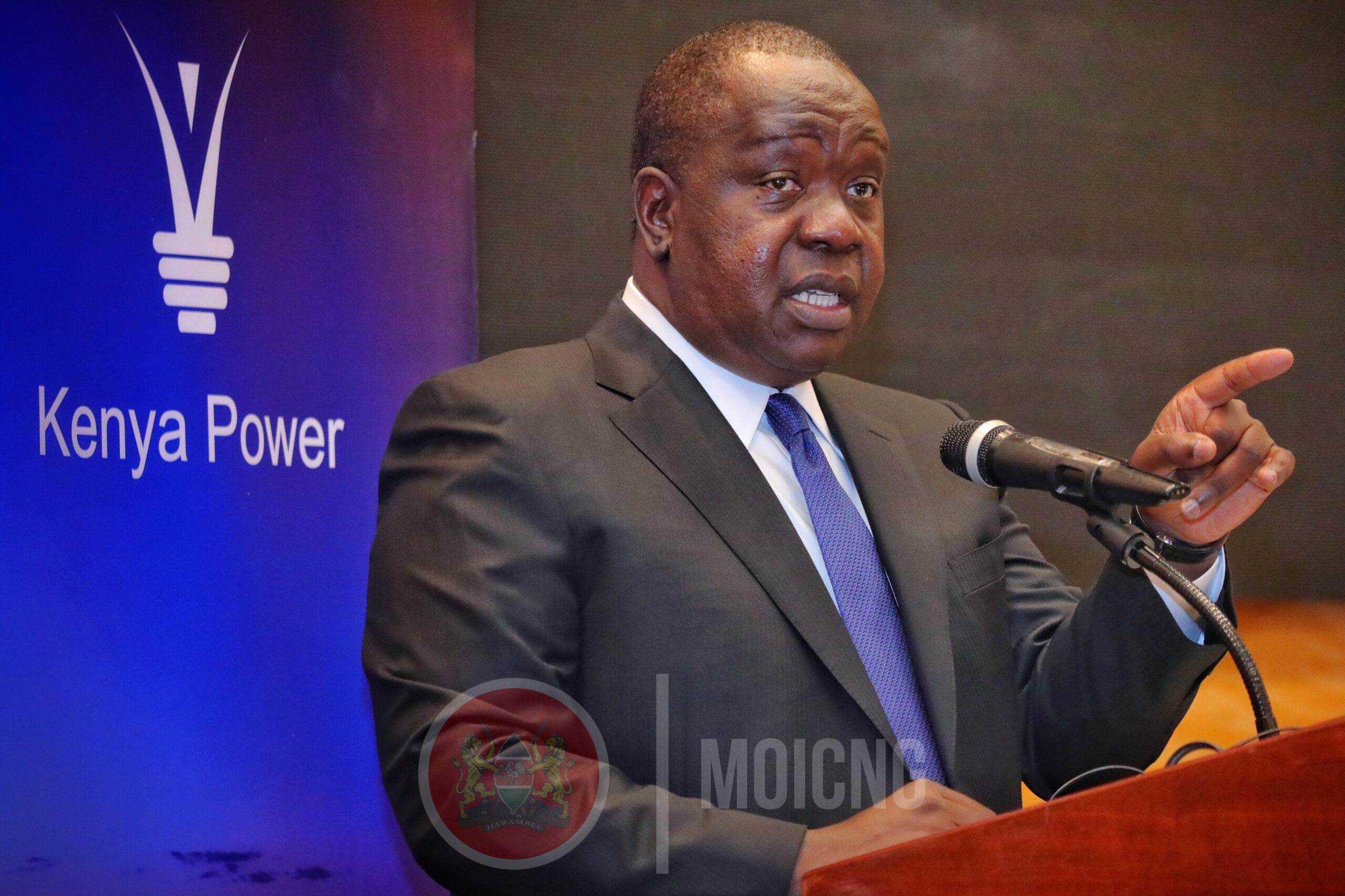

Interior CS Dr. Fred Matiang’i said the Company should also prioritize a review of existing agreements in a drive to lower cost of electricity in the country.

Matiang’i, said the decision was in line with the recommendations of the Presidential Task Force on the Review of PPAs entered into by KPLC following widespread concerns of high electricity bills.

“We are all concerned about the cost of power. Our bills are too high, and we have taken tough decisions to deal with challenges in this sector with the focus being the bringing down of the cost of power,” he said.

The CS was speaking after a meeting the KPLC Board, the company’s senior management team, and officials from the Ministry of Energy.

He revealed that the Government has declared KPLC a “Special Project” and an inter-ministerial team has been set up to audit and oversight the power-distributor urgently.

“We are going to do a forensic audit of some of our systems and procedures at KPLC. We are working jointly at an inter-ministerial level to reduce the system losses including the theft of power. We will address all challenges that result in passing unnecessary costs to consumers.” He said,

The multi-agency team comprising of the DCI, Financial Reporting Center (FRC), Assets Recovery Authority and other investigative agencies will be assembled to investigate alarming system losses within KPLC, procurement practices, insider trading, conflict of interests and suspect transactions involving KPLC staff and others.

“For a while, KPLC has been running at a loss, with all indicators pointing to ineffective Power Purchase Agreements (PPAs) that have left the company heavily indebted while ironically paying for excesses energy it does not need in take-or-pay arrangements blamed on poor negotiations and vested interests,” He said.

Matiang’i said besides high fixed capacity charges amounting to Kshs 47 billion, the PPAs are bound by Commercial Operation Dates (CODs) that are not aligned with the company’s power demand. This has often resulted in excess power generation even when the demand is low.

In the 2019/2020 Financial year, KPLC posted a loss before tax of Kshs 7 billion. Its negative working capital position for the fourth consecutive year has also raised substantial doubt about its ability to sustain operations.

The system losses stood at 23.47 percent, exceeding the 19.99 percent limit approved by the Energy and Petroleum Authority (EPRA). This is attributed to lack of internal control measures put in place to mitigate losses including governance.

The company’s obligations to pay for goods and services that were acquired from suppliers were also not met with a long outstanding balance of Kshs 1.3 billion resulting to discontentment of financiers and suppliers.

The CS SAID the company did not submit to the Unclaimed Financial Assets Authority Kshs 1.2 billion of deposit refunds to consumers, unidentified receipts, unpaid customer electricity deposits, unpaid wayleaves compensation, and unclaimed dividends and stale cheques as required by the Unclaimed Financial Assets Act 2011.

Dr. Matiang’i exuded confidence that the proposed changes will yield the much-desired results and assured Kenyans that the unit cost of electricity billed to clients will soon go down.

He was accompanied by Principal Secretaries, Gordon Kihalangwa and Julius Muya, KPLC Board Chair Vivian Yeda, and Ag. KPLC Managing Director Rosemary Oduor

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 days ago

Grapevine2 days agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle5 days ago

Lifestyle5 days agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Americas1 week ago

Americas1 week agoEpstein Files: Bill Clinton and George Bush Accused Of Raping A Boy In A Yacht Of ‘Ritualistic Sacrifice’

-

Business2 weeks ago

Business2 weeks agoCooking Fuel Firm Koko Collapses After Govt Blocks Sh23bn Carbon Deal

-

Business2 weeks ago

Business2 weeks agoABSA BANK IN CRISIS: How Internal Rot and Client Betrayals Have Exposed Kenya’s Banking Giant

-

Investigations7 days ago

Investigations7 days agoEpstein Files: Sultan bin Sulayem Bragged on His Closeness to President Uhuru Then His Firm DP World Controversially Won Port Construction in Kenya, Tanzania

-

News1 week ago

News1 week agoAUDIT EXPOSES INEQUALITY IN STAREHE SCHOOLS: PARENTS BLED DRY AS FEES HIT Sh300,000 AGAINST Sh67,244 CAP

-

Business1 week ago

Business1 week agoKRA Can Now Tax Unexplained Bank Deposits