News

JKIA And KBC Risk Being Auctioned

The Kenyan Government risks an auction of key public institutions such as KBC and JKIA if it fails to meet its debt repayment commitments.

Kenya’s current public debt has exceeded the mark set by the Public Finance Management Act. The act allows every government to borrow only up to 50 percent to the GDP ratio.

Kenyan Parliament has now raised red flag over the bloating public debt induced by hefty borrowing. Emgwen MP Alex Kosgey has proposed the amendment of the law to regulate government borrowing. He termed the current debt standing at Ksh. 5.6 trillion as extreme.

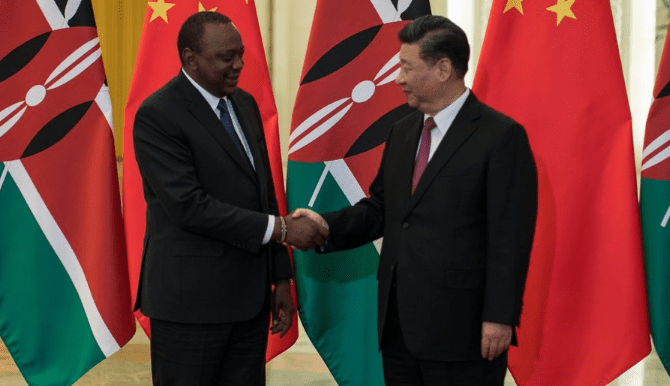

Currently, President Uhuru Kenyatta and opposition leader Raila Odinga had a trip to Beijing, China. Government handlers had hinted that the trip aimed at securing another possible loan of up to Ksh.368 billion that had been meant to extend the Standard Gauge Railway (SGR) from Naivasha to Kisumu.

However, President Uhuru Kenyatta on Friday countersigned two project delivery agreements amounting to Ksh.226 billion through a concessional financing and Public Private Partnership (PPP).

But there is a proposal before National Assembly’s Budget Committee that wants government borrowing permanently capped at Ksh.6 trillion.

Speaking before the committee, Sigowet Soin MP Mr. Koros said that Kenyans should not allow a state whereby the Treasury or the Presidency or anyone to just decide they want to borrow this much yet mwanachi is already over-strained by the current public debt.

Also Read:

According to Treasury, as at December last year, the public debt stood at a outrageous Ksh.5.3 trillion, with that amount expected to hit a record high Ksh.6.3 trillion by this year.

With China being the top lender, the Kenyan taxpayers are sweating to repay the Chinese government Ksh.637 billion with interests accumulated.

Kenya owes Japan and France a staggering Ksh.166 billion, with that amount even higher when all the interests are accumulated. This even as Germany, Italy, Belgium, USA and Finland are all training their eyes on Kenyan taxpayers to pay back their Ksh.63 billion.

Already, the government has listed three non-performing loans including Ksh.7.9 billion by the State Broadcaster KBC, Tana & Athi Rivers Development Authority’s Ksh.1.2 billion loan as well as the East African Portland Cement that has a loan of Ksh.1.5 billion.

These institutions now stand at a risk of facing auction should the government fail pay back the various debts.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations2 weeks ago

Investigations2 weeks agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations7 days ago

Investigations7 days agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners