News

Harassment Cases Of Borrowers By Digital Lenders Decline By 75%

-

News1 week ago

News1 week agoHow Chinese National Xiao Kexian, Ge Li, Hang Ming, Jacinta Moraa, Purity Njeri, Hongdon Chen, Xu Pengfei and Hanmeng Qui defrauded Bangbet Millions to start their own betting firm

-

Politics2 days ago

Politics2 days agoFormer Kesses MP Swarup Mishra in Crisis: Is Raila Odinga His Last Lifeline?

-

Politics2 days ago

Politics2 days agoCS Joho Entangled in Deepening KMA Power Struggles

-

News1 week ago

News1 week agoMan Charged With Sh70M Runda Land Fraud

-

News1 week ago

News1 week agoTRV Towers Ltd Directors Charged with Embezzling Sh112 Million from Company

-

News1 week ago

News1 week agoNGO CEO Nelson Mukara Sechere Charged Over Sh20M Cooking Oil Fraud

-

News2 weeks ago

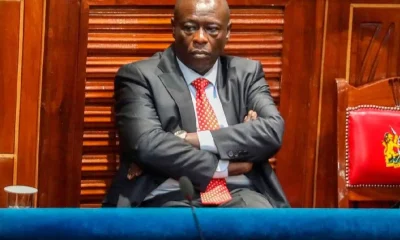

News2 weeks agoGachagua Impeached As Kenya’s Deputy President

-

News2 weeks ago

News2 weeks agoRuto Nominates Kindiki As Next Deputy President