Business

Google Has Suspended Hundreds Of Unlicensed Loan Apps In Kenya

Alphabet-owned Google has suspended hundreds of loan apps in Kenya providing unsecured personal or business loans. The apps had been taken down after failing to comply with Google’s new policy requiring digital lenders to submit proof of licence, according to a TechCrunch report.

It is unclear how many apps have been booted out but expert estimates suggest that the ballpark figure could be around 500 with popular apps like MoKash and Okash receiving the axe. Up until last month, over 600 apps were active on the Play Store but that number has come down to under 200 as of Friday (March 24).

After Kenya’s central bank issued regulations for Digital Credit Providers (DCPs) last year, the US-based tech giant also published its new policy in January, requiring credit-providing applications to obtain licences from the top bank.

According to reports, only 22 digital creditors such as Tala, Pezesha and Jumo had managed to get the licence from the Central Bank of Kenya (CBK) till January.

The regulations state that any digital lender that is yet to get a licence from CBK can receive an interim approval for Google which is only valid for 45 days. Once the period lapses, the company should either have received the approval or file a declaration that its permit was still pending.

However, if the company failed to do so, its interim approval will be rescinded and it will be removed from the app store.

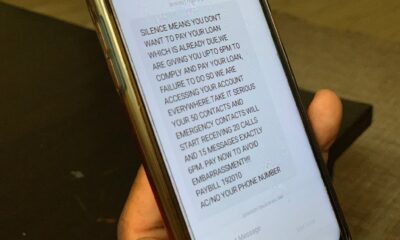

The unregulated loan app business has been booming across most countries. However, the exorbitant interest rates and predatory practices employed by the companies to exact the loan amount has tarnished the reputation of the particular digital sector.

The situation has become so dire that the Central Bank of Kenya issued a warning to mobile loan providers in 2019, urging them to cap their interest rates and refrain from using aggressive debt collection tactics. However, the warnings seem to have fallen on deaf ears, as many loan providers continued with their predatory practices.

This is where Google’s action comes in. In a statement, the tech giant announced that it had removed several loan apps from the Google Play Store for violating its policies on loan repayment terms and debt collection practices. Google stated that the loan apps in question had been found to be taking advantage of vulnerable borrowers, engaging in misleading and exploitative lending practices, and using aggressive debt collection tactics.

This move by Google is commendable and is likely to have a significant impact on the Kenyan mobile loan industry. Without access to the Google Play Store, loan providers will find it difficult to reach new borrowers, and those who have already downloaded the apps will not receive updates or security patches. This means that borrowers who use these loan apps are likely to be exposed to security risks, such as identity theft, and will have no recourse if their data is compromised.

In conclusion, Google’s suspension of several mobile loan apps in Kenya is a step in the right direction towards addressing the problem of predatory lending practices in the country. However, more needs to be done to protect vulnerable borrowers from these exploitative practices. The Kenyan government and regulators need to work together to ensure that loan providers are held accountable for their actions and that borrowers are protected from abusive lending practices.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business3 days ago

Business3 days agoCooking Fuel Firm Koko Collapses After Govt Blocks Sh23bn Carbon Deal

-

Business2 weeks ago

Business2 weeks agobetPawa Empire Crumbles: Mr Eazi’s Betting Gambit Unravels Amid Partner’s Shadowy Deals

-

Business1 week ago

Business1 week agoMinnesota Fraud, Rice Saga, Medical Equipment Deal: Why BBS Mall Owner Abdiweli Hassan is Becoming The Face of Controversial Somali Businessman in Nairobi

-

Politics1 week ago

Politics1 week agoYour Excellency! How Ida’s New Job Title From Ruto’s Envoy Job Is Likely to Impact Luo Politics Post Raila

-

Investigations2 weeks ago

Investigations2 weeks agoEXPOSED: SHA Officials Approve Higher Payments for Family, Friends as Poor Patients Pay Out of Pocket

-

News1 week ago

News1 week agoKenya Stares At Health Catastrophe As US Abandons WHO, Threatens Billions In Disease Fighting Programmes

-

Business2 days ago

Business2 days agoABSA BANK IN CRISIS: How Internal Rot and Client Betrayals Have Exposed Kenya’s Banking Giant

-

News2 weeks ago

News2 weeks agoDCI Probes Meridian Equator Hospital After Botched Procedure That Killed a Lawyer