Business

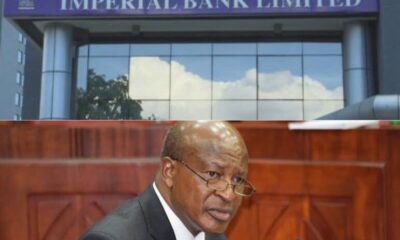

US-Based Amassment Corporation Bids To Acquire Collapsed Imperial Bank

US-based financial company Amassment Corporation has tabled a second bid to acquire the assets of the collapsed the Imperial Bank. They cited readiness to lower KDIC’s contribution in the acquisition.

The firm had, in their initial bid, stated that they want to assume all remaining Imperial Bank deposits amounting to KSh49.03 billion with an equal face-value amount of loan assets including 50% of the current loans in litigation.

Amassment Corporation had also stated that KDIC should contribute cash capital of 20% of what the corporation owes to remaining depositors into the special purpose firm, in order to partially compensate for value declines sustained by loan assets, litigation costs, as well as losses from non-performing loans that they will assume.

Kenya Depositors Insurance Corporation (KDIC) thwacked the firm’s bid and said that their offer for Imperial Bank assets was below par.

On 15th August, KCB announced that it won’t be buying all of Imperial Bank’s assets. CEO Joshua Oigara said KCB’s initial review had identified Sh10 billion loans that the lender intended to take over out of Imperial Bank’s nearly Sh25 billion loan book, but the amount has dropped sharply after the lender failed to validate a huge chunk of the assets.

“It has taken long to resolve the transaction. The assets do not match. Initially we had estimated $100 million (Sh10 billion) as we announced last year, but what we see after due diligence is that this has come down to less than half. We see less loans that we will be able to take now even though this does not stop us from going back and relooking into the entire portfolio of the original loans,” Mr Oigara said.

In October 2015, Central Bank placed the Imperial Bank under receivership. This was arrived at after it emerged that the lender was operating two sets of books, with a potential fraud of $449 million that placed depositor funds at risk.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News1 week ago

News1 week agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations2 weeks ago

Investigations2 weeks agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy1 week ago

Economy1 week agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa2 weeks ago

Africa2 weeks agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Grapevine5 days ago

Grapevine5 days agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

News2 weeks ago

News2 weeks agoTragedy As City Hall Hands Corrupt Ghanaian Firm Multimillion Garbage Collection Tender