Business

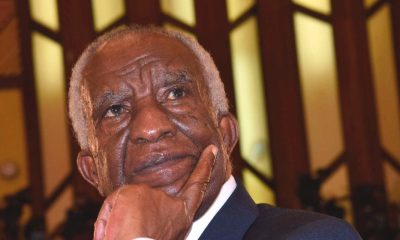

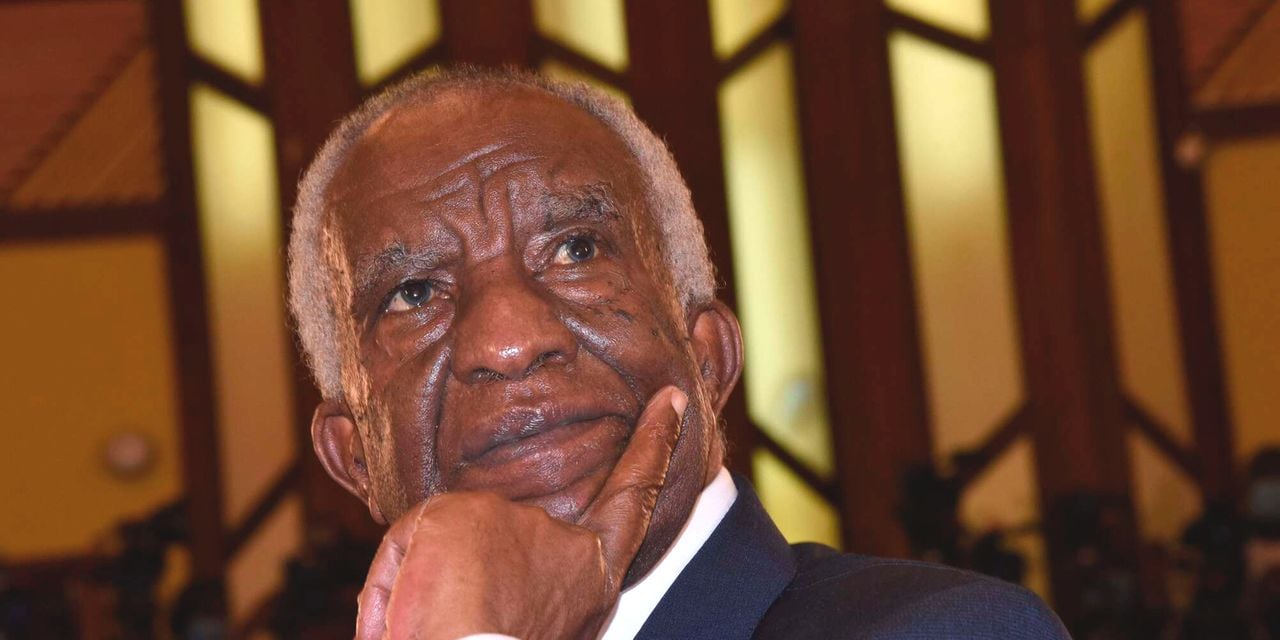

Peter Munga To Be Auctioned Over Sh433.76M Loan Default

The shares, valued at approximately Sh604 million, are set to be auctioned by ABC Bank to recover a Sh433.76 million loan defaulted by Equatorial Nut Processors, a company in which Munga holds a 92% stake.

Renowned billionaire businessman Peter Munga, the founder of Equity Bank, has suffered a legal setback after the High Court dismissed his application to block the auction of his 75 million shares in Britam Holdings.

The shares, valued at approximately Sh604 million, are set to be auctioned by ABC Bank to recover a Sh433.76 million loan defaulted by Equatorial Nut Processors, a company in which Munga holds a 92% stake.

In a ruling delivered on Wednesday, High Court Judge Alfred Mabeya stated that Munga, as a guarantor of the loan, had no valid grounds to prevent ABC Bank from attaching his shares. The court emphasized that the businessman had willingly offered his shares as collateral and was legally bound to repay the loan following the default by Equatorial Nut Processors.

“In the absence of such payment, the court finds that the prayer for a permanent injunction preventing ABC Bank from realizing the security is untenable and is disallowed,” Justice Mabeya said in the judgment, which was delivered by his counterpart, Justice Francis Gikonyo.

The court also dismissed Munga’s application for a temporary injunction, filed in October 2024, to restrain ABC Bank, ABC Capital, and Equatorial Nut Processors from advertising, selling, or transferring his shares. The application sought to prevent the auction of the shares, which were used as security for a loan facility advanced to Equatorial Nut Processors to fund a World Food Programme contract.

The Loan Dispute

The dispute stems from a loan facility provided by ABC Bank to Equatorial Nut Processors, a macadamia, peanut, and cashew nut processing company located near Maragua town. Munga, who serves as a director of the company, signed a personal guarantee and indemnity in favor of ABC Bank, agreeing to repay the loan in the event of default.

When Equatorial Nut Processors failed to meet its repayment obligations, ABC Bank issued a demand letter to Munga on September 24, 2024, requiring him to pay Sh433,767,398.33. The bank threatened to sell his Britam shares if the payment was not made.

Munga, however, contested the bank’s demand, arguing that he intended to use the shares to secure another loan. He also claimed that the demand letter violated the in-duplum rule, which caps loan interest at the principal amount. Additionally, he maintained that other securities registered before his shares should be prioritized under the doctrine of priority.

Court’s Decision

In its ruling, the court rejected Munga’s arguments, stating that his plans to use the shares as collateral for another loan were irrelevant to the debt owed by Equatorial Nut Processors. The judges noted that Munga, as a guarantor, had assumed full responsibility for repaying the loan, including any outstanding principal, accrued interest, fees, and penalties.

“By executing the deed of guarantee, the plaintiff [Munga] assumed responsibility for the outstanding loan balance. This meant that the plaintiff is legally bound to repay the entire loan amount,” the court said. “The lender is entitled to initiate recovery actions directly against the plaintiff without first being required to pursue the borrower.”

The court also dismissed Munga’s claim that he would suffer irreparable loss if the shares were auctioned, noting that the shares’ value (Sh280 million) was insufficient to cover the loan amount (Sh433.76 million). The judges emphasized the need to balance Munga’s right to property with ABC Bank’s right to recover its funds.

A History of Debt Tussles

This is not the first time Munga has faced debt-related challenges. In 2023, three of his properties were set to be auctioned over unpaid dues. In 2017, he narrowly averted the auction of five houses in Nairobi’s Kasarani area, valued at Sh400 million, after making a last-minute payment to Jamii Bora Bank (now Kingdom Bank).

Despite these setbacks, Munga remains a significant player in Kenya’s business landscape. He directly owns 75 million shares in Britam and holds substantial stakes in two investment vehicles—EH Venture Capital and EHL 2022—which collectively own 405 million Britam shares worth Sh3.26 billion.

The auction of Munga’s Britam shares could have ripple effects on the insurer’s stock performance and investor confidence. Britam, a leading insurance and investment firm, has seen its shares fluctuate in recent years, and the sale of such a large block of shares could further impact its market valuation.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Development3 days ago

Development3 days agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations1 week ago

Investigations1 week agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Business2 weeks ago

Business2 weeks agoSafaricom Faces Avalanche of Lawsuits Over Data Privacy as Acquitted Student Demands Sh200mn Compensation in 48 Hours

-

Investigations1 week ago

Investigations1 week agoHow Close Ruto Allies Make Billions From Affordable Housing Deals

-

Entertainment2 weeks ago

Entertainment2 weeks agoKRA Comes for Kenyan Prince After He Casually Counted Millions on Camera

-

Politics2 weeks ago

Politics2 weeks agoI Personally Paid For Your Ticket To Visit Raila in India, Oketch Salah Silences Ruth Odinga After Claiming She Barely Knew Him

-

Business1 week ago

Business1 week agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal