Africa

A Manowari Project: How Peter Munga Ripped Us Off, Mauritius Commission Report On The Sale Of The Britam Shares Wreaths

Published

4 years agoon

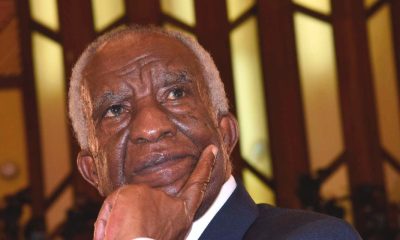

According to the review of the commission report commissioned by the Mauritius government to determine if they got upper hand or shortchanged in the sake of Britam shares where Peter Munga bought Sh7.17B worth of the shares, Guns have been blazing to the former Equity Bank and Britam chairman whom is being accused of duping the ‘naive’ Mauritius negotiators to ‘rip them off.’

One chapter in the report is solely dedicated to Munga and how he cunningly walked away with most shares are the least price and how when the Mauritius cried to the River, he was laughing all the way to the bank.

Munga dubbed the buying of Britam shares as a ‘Manowari Project’ a Kiswahili word that the committee would later come to find out and loosely translate as ‘rip-off’

Below is the excerpt of the chapter from the report;

THE SALE OF THE BRITAM SHARES – A MANOWARI PROJECT

In this penultimate Chapter, just before the Recommendations, it serves to know what is the truth which has emerged. The sale of the Britam shares was by law the responsibility of the then MFSGG&IR through the then Minister. When we speak of good governance, it implies 8 essentials: government that is participatory, consensus oriented, accountable, transparent, responsive, effective and efficient, equitable and inclusive all resting on the rock of the rule of law. The sale of the Britam shares may be said to have failed on each of these essentials.

Two key persons whose intimate knowledge of the whole matter was next to none would put it succinctly. Dawood Rawat would put what had happened in one curt sentence. And Mr Peter K Munga would describe it all in one Swahili word. The truth lies in what they said and the way they said it. More about what they said below.

Ex-Minister Bhadain would put his hands in the fire, while maintaining that he was not involved, argue that there was nothing wrong. Those few who handled the matter stood by that equally. They were directly involved. But there were others who held the contrary, even on partial facts and on the face of it. The Commission dug up all the relevant and material facts.

It concludes therefrom that there were many things wrong. What were they? Why did it go wrong? How did it go wrong? Where did it go wrong? Wherefore did it go wrong? When did it go wrong? Who got it wrong? The Commission would give it the same name as did no lesser a person than Mr Peter Munga himself. It was a Manowari project, par excellence. What is Manowari. It is a Swahili word which Mr Peter Munga himself utilised to describe this project. We explain below what it means and how he, of all people, described it so aptly. Why he utilised the word is manifest.

1. WHAT WENT WRONG?

Those who stated that there was nothing wrong argue that the sale price of the shares was determined by the open market price at the time of sale. They advance that the market value of the shares had fallen drastically with the decision of the Mauritian government to revoke the license of BBCL which had a serious knock-on effect in the non-banking sector: in this case, the value of the Britam shares.

On the face of it, the argument looks valid and persuasive except for the fact that the assumptions on which it is based are fallacious.

The Commission checked the facts: it found that the price of the shares in November 2015 when the Kenyans had offered to buy them at MUR4.3bn was comparable to the price on 10 June 2016, the day of the sale and signature of SPA when they were sold at MUR2.4bn i.e. the price inserted in the tentative MOU. That happened to be the time when the share price was at its lowest on the NSE.

Mr Peter Munga obviously had with remarkable ruse walked out of his MUR4.3bn offer and able to drive home to the Mauritians that the share price had fallen in between. And the ex-Minister and his team had bought that argument without doing their factual due diligence. Or if they had cross-checked, they had chosen to simply ignore. The market price value argument then is a red herring which the Kenyan party had used to hoodwink the Mauritian party which had swallowed it wholesale. They were taken for a ride. And they would want others to join them in the ride. The Commission discredits it.

A thousand words would not convey what Mr Dawood Rawat expressed in a few words, coming out of the mouth of someone whose deep intimate knowledge in the matter is incomparable. “What oft is said but never so well expressed” goes the expression. He commented:

“The Kenyans either duped the Mauritians or made a covert deal which is rather intriguing.” Dawood Rawat, weekly, Issue No 3261. The Britam Scandal. The Inside story of the Fiasco, Issue 3261, p23.

Mr Dawood Rawat made both scenarios mutually exclusionary. The Commission takes the view that one scenario does not exclude the other. The deal was covert and the Mauritians were duped. And who is the one who gained by it, only the front-liners will know.

Basically, Mr Peter Munga, on the facts ascertained, was duping the Kenyans and the Mauritians alike. He was able to do that because he was astute enough to making a covert deal with the Mauritians. Would it surprise anyone that he had himself given this project a fitting name of considerable eloquence: a Manowari Project.

Intrigued by this lone Swahili word in the business language of the deal which was all through in English, the Commission went to source in search of its meaning. Manowari is, no more and no less Swahili for the Mauritian word “sous-marin”! With all its connotations. It had struck no one from the Mauritian side to as little as inquire why the term Manowari had been used. Had anyone done so, front-door governance would have prevailed over back-door governance. Why would any buyer for that matter of public assets give such a connotative name to a project of billions? This was not an intended police raid, still less a projected strategy for a battle-ground. Be that as it may, this is the way Mr Peter Munga shrewdly decided to get his way, having rallied some Kenyan high officials to his cause. On the surface of the sea, all was smooth, clear and quiet to the public eye. It was all happening below the surface. The term “sous-marin” was a perfect fit to describe the process. He was the sole bidder and he dictated the terms hidden from the public eye, with indulgences, accommodation and illusory terms.

In sum, what went wrong was that:

(1) the Mauritians were duped and (2) Mr Peter Munga had a Manowari deal with them!

2. WHY DID IT GO WRONG?

Now for why did it go wrong? Many things went wrong. The ex-Minister and his small team were no match for Mr Peter Munga, a business tycoon of considerable clout, and his small team. The latter travelled to Mauritius on 14 November 2015 on a tourist visa, a couple of days prior to the Nairobi meeting of 18 November 2015. Not the SA but Afsar Ebrahim of BDO took him to ex-Minister Bhadain on the same day where a strategy was developed between themselves as to how the transaction should pan out. He was fully aware that MMI Holdings had offered MUR4.3bn. Then he, Mr Peter Munga, left Mauritius on 16 November 2015 and chaired a meeting in the afternoon of 18 November 2015 in Nairobi in presence of Kenyan government officials to agree, after a fifteen-minute deliberation, to match the price offered by MMI Holdings. A meeting in Kenya was proposed to MOFED for early March. It did not take place. The then Minister of Finance had left office by end of February 2016. MOFED exited the scene. The MFSGG&IR too over. On 8 March 2016, Mr Peter Munga landed in Mauritius with his small team dealt with BDO and left having signed an MOU which was more in the nature of a formal contract than an MOU with all the terms laid down in black and white for MUR2.4bn. It happened on 12 March 2016, the Independence Day of Mauritius, a non dies. After the ex-Minister left office, Mr Peter Munga visited Mauritius on 05 February 2017 on a business visa. His whereabouts are unknown.

Whom did he meet? How he met them? For what he met them? Only those who received/met him will know. These are questions the Commission would have asked him, had he co-operated fully with the Commission. But after the Kenyans had represented to the Commission that they would co-operate fully with the inquiry, they walked out of their talk when the stage had reached for them to answer the crucial questions in the investigation.

When the BDO witnesses had been questioned about this important meeting of 14 November 2015 between Mr Peter Munga and the ex-Minister Bhadain, their prevarications were so obvious that they would provoke anyone on enquiry. They low- keyed the meeting saying at first that it was a mere courtesy call. No more than 5 minutes or so. Probed further, one finally agreed that it was more than that. The Commission found out that it was a crucial meeting. The Commission retrieved an email which Mr Peter Munga had written to the ex-Minister Bhadain let the cat out of the bog. Substantial matters were discussed and decisions arrived at, including an agreement that he, Mr Peter Munga “will continue engaging BDO & Co, the Special Administrator on the lines agreed during our meeting.” BDO was in copy of the e-mail of Mr Peter Munga to the ex-Minister. But it did not produce that document to us despite having been required to produce all the e-mails exchanged in relation to the transaction. That is not the only vital document which BDO failed to produce to the Commission.

Admittedly, if the meeting had been for Mr Peter Munga to merely express the Kenyan position to the ex-Minister that a foreign buyer (MMI Holdings for that matter) was not welcome as a buyer, one could dismiss it as an innocuous meeting which Ministers usually have with key persons in the discharge of their duties and responsibilities of being fully informed. But here there was more than that: an agreement had been reached between the ex-Minister and Mr Peter Munga in presence of Mr Afsar Ebrahim of a line of action which had to be followed. That rings much more like a private office transaction than that of a public office.

The Mauritian counterpart of the deal could have very well used a double screen to protect themselves: (i) a legal consultant and (ii) a Transaction Advisor. A legal adviser for the transaction as a whole would have first queried the couple of dubious words and phrases used in the MOU, amongst which the term “a pool of investors.” This non-legal term would have blown the eyes of any student of law but which was glossed over by each and every member involved in the small Mauritian team including the law professionals vetting the individual documents. One law professional went to the extent of stating it was current practice to use such terms and it is found in Company Law. He never produced anything to show that such a malpractice was current and legitimated by the Companies Act. The historical long-standing Chambers of Mossack Fonseka has crumbled and disappeared for that reason. On the contrary, all others, questioned on this strange term, agreed that it was not in order. If such a malpractice is current practice in certain law Chambers, we have serious cause for concern. A Transaction Advisor would have advised on the method to be used to obtain the best price of assets of such value.

In sum, regarding why it went wrong, it is because a line of action had been agreed upon between ex-Minister Bhadain and Mr Peter Munga, the details of which only those who participated in the meeting will know: Mr Peter Munga, the ex-Minister, Mr Afsar Ebrahim and Mr Khapre. The ex-Minister stated he had nothing to do with the sale. Mr Afsar Ebrahim stated it was a mere courtesy call. The SA did not attend the meeting. He only stated he wished he had been handling the matter. The opaqueness characterizing this meeting would have been dissipated had Mr Peter Munga had co-operated.

HOW DID IT GO WRONG?

1492. How did it go wrong? The manner it went wrong was that Cabinet was kept in the dark all through. Why did not the ex-Minister think it fit to engage collective responsibility of Cabinet for a transaction of such a magnitude and such national sensitivity simply boggles the mind. Even FSC was kept in the dark. Worse, there was misreporting and underreporting to the Board in the periodical meetings. What is shocking is that the parties had entered into an NDA which is not in itself wrong. An NDA is used to protect trade secrets and sensitive information regarding the parties and the manner in which they conduct their business. But a properly constituted NDA has limits to which it can go. In this case, properly read, it meant complete secrecy of the whole transaction. Albeit very widely worded, it still left the possibility that disclosure was subject to the consent of parties. However, that saving clause was never used by the Mauritian party to apprise either Cabinet or FSC. Indeed, it was not until a PNQ was raised in Parliament long after the fact that the public came to know – not what was happening – but what had already happened. In other words, the nation was presented with a fait accompli. In the words of the ex-Minister in answer to the PNQ: “Now it is a done deal.” It is not unreasonable to conclude that had the matter been broached in Cabinet, a lot of the mischief in and surrounding the transaction would have come to light. And it may well have been prevented.

In sum, as to how it went wrong, the black-out surrounding the transaction was meticulously adhered to all through and the widely expressed NDA was applied not in the best interest of the seller.

4. WHERE DID IT GO WRONG?

Where did it go wrong? It went wrong where Mr Peter Munga and the ex-Minister agreed on 14 November 2015 to “continue engaging BDO & CO, the Special Administrators (sic) on the lines agreed during our meeting”. The Mauritian party had thereby fallen into the net of Mr Peter Munga’s covert deal, his project “sous-marin” or his Manowari Project. Mr Peter Munga was a Kenyan business tycoon. He was, in fact, the principal all through but projecting himself as an agent of a number of investors who never in fact existed and using Kenyan officials to have his way. It was all he, Mr Peter Munga, who was buying it. There was in fact no pool of investors, after all. It was not a question of Mr Peter Munga being agent of any principal. He was at once the agent and the principal, a one-man show. This would have come to light once some basic due diligence had been done prior to sale. But it was kept from the public eye. Was the SA in charge? He denied that he was. He only wished that he were.

In sum, as to where it went wrong: where the deal was done hidden from the public eye, public affairs run along business lines. Not a single record exists at the Ministry to show for it. All information was gathered from other places.

5. WHEREFORE DID IT GO WRONG?

Wherefore did it go wrong? The end objective was to pay the policy-holders by 30 June 2016. The pressure had been lifted with a loan from the Bank of Mauritius and there were still other local assets to be sold. Accordingly, there was no “feu en la demeure” unless it was a false fire alert. There was no absolute necessity for the prices and the terms to be agreed and cast in stone on 12 March 2016, the independence day of Mauritius, and at that indulgent price. Had the matter gone to Cabinet, the ex-Minister would have benefited from the cover of collective responsibility. Would also have emerged the fact that Cabinet had earlier decided that the shares should be transferred to NPFL and not sold. Even FSC was kept in the dark. Had it been kept abreast, even FSC would have reminded the team that the shares were not to be sold yet. Why did they sell then? The ex-Minister was as good as running a one-man government in a democratic society.

It is not that the ex-Minister was in the dark that the Central Bank had advanced MUR3.5bn for the repayment of the policy-holders. In his reply to the PQ of B/31 of 29 March 2016, this is what he made public:

”The then Minister of Finance and Economic Development, Mr V. Lutchmeenaraidoo dealt with the Central Bank and got a loan of MUR3.5bn. …. Our priority is to alleviate the suffering of the victims of BAI fraud, the Super Cash Back Gold policy holders. We will repay them first and then, of course, we will, through the recovery process, address the issue of 3.5bn for the Central Bank.”

Why did they sell and not transfer them to NPFL leaving it to NPFL to decide what to do with them and how to do it according to NPFL’s exigencies? A question that looms large over the head of those who stated he had nothing to do with it at all.

Indeed, given an opportunity to review his stand through a Salmon notice, the ex-Minister confirmed that he had nothing to do with the sale; it was all MOFED.

And what is more, the transaction was done with great astuce. For cosmetic compliance with Cabinet decision, the transaction was christened a transfer-sale: transfer to NPFL to sell in one transaction. Form had primed over substance and opaqueness over openness.

In sum, the ex-Minister and his team chose to sell the shares not only against Cabinet decision but also when the urgency to pay the policy-holders with those proceeds of sale had been mitigated by several material factors. Why did they sell then?

6. WHEN DID IT GO WRONG?

When did it go wrong? It had started going wrong from the very first all through to the end. But it all started with the ill-drafted, ill-conceived amendment to Section 110 of the Insurance Act which was introduced in the NA, and rushed through it. This was decried by the members of the Opposition. But what the Opposition did not know was that the Bill had never received Cabinet approval. Cabinet had simply noted the existence of such a proposed amendment. The amendment had also vested power in the Minister to enter into the affairs of FSC, an independent Regulator. By the same token, a political adviser was appointed Vice Chairperson of the Commission. The law had also created the creature, the SA, whose powers and functions were dubious. That was the beginning of the wrongs. That tied in with the unethical appointment of BDO, a decision reportedly taken in the office of ex-Minister Bhadain with other Ministers to boot. But the one which primes all is the one- to-one meeting which the ex-Minister had with Mr Peter Munga, the sole buyer, on 14 November 2015, to reach an agreement between the two parties of the line of action which was to be adopted through the engagement of BDO and the SA.

In sum, les carrottes etaient cuitent when lack of border control at vital institutions of the State allowed institutional manipulation. Section 110A and Section110B – from a dubious drafting source – of the Insurance (Amendment) Act was rushed through Parliament by the ex-Minister, an amendment which had not obtained Cabinet approval, as per our records. That brought in its trail other wrongs one after the other, above all concentrating power of action – legal and factual – upon the Minister. An eye opener to how vulnerable our democracy is institutional subterfuges.

7. WHO GOT IT WRONG?

The Mauritian side got it wrong altogether. Mr Peter Munga was a business tycoon and all the Mauritian professionals involved put together were no match for him singly alone. He was able to dictate both time and terms, price and party. That the Mauritians enjoyed the trip Mr Peter Munga gave them is evident from the public statements made on it in Mauritius and in Kenya.

True it is that the decision to sell to the Kenyans was taken by MOFED. But MOFED had also decided that it should be sold at a price to match the price offered by MMI Holdings or do better and had held to that line steadfastly until MFSGG&IR took over. The sale was not done by MOFED but by ex-Minister Bhadain and his team at the price of MUR2.4bn, without record and behind the back of the nation.

The Minister of Finance had exited the scene by the beginning of February 2016. Thereafter, it was Minister of Financial Services Good Governnace and Institutional Reforms who was given and took over the responsibility. Mr Peter Munga had already had an eye on the Britam shares. He had discussed the matter with Dawood Rawat before the death knell many in April 2015. He knew how to handle both the Kenyan as well as the Mauritian top brass.

The Commission was aghast at the extent to which the Mauritian side – the MFSGG&IR, FSC, NPFL and BDO as well as the Mauritian professionals involved – all put together gave in to Peter Munga and have kept conning others to this day on the sale of Britam shares. Mr Peter Munga represented to them and the world at large that he was doing Mauritius a favour. He had perfected his art of buying gold for the price of chaff.

Who got it wrong? In sum, can ex-Minster Bhadain be believed that he was not involved at all, a position he insisted upon even after he was served with a Salmon Notice. The 15 facts he advanced to say it was not he but MOFED were carefully selected to pass the buck on MOFED. He did not submit materials which he had and which compromised him.

It all went wrong in all aspects because all was done in the dark. If it came out of the horse’s mouth, the single buyer, Mr Peter Munga, that it was a Manowari Project, who is anybody to conclude the contrary?

The MFSGG&IR was, admittedly, a hyper dynamic Ministry, the type many applaud. But it only shows how many things can go wrong in the State, whether in open or subtle forms, and at what cost to the nation when high octane dynamics are misdirected through lack of wisdom in statesmanship.

When Ministers ignoring professionals and public officers take the wrong road, some professionals and public officers like to keep a discreet distance and some adopt an attitude of resignation and some are just happy to be absent.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

📩 Got a Tip, Story, or Inquiry? We’re always listening. Whether you have a news tip, press release, advertising inquiry, or you’re interested in sponsored content, reach out to us! 📬 Email us at: [email protected] Your story could be the next big headline.

Fact-Check: MP Ndindi Nyoro Wrong on ‘Secret’ Govt Borrowing Against Fuel Levies

KUCCPS Reopens Applications For September 2025 TVET Intake

“Mimi Ni Mwizi Wa Mabwana. Mimi Ni Mwizi Wa Mabwana” My Cousin Shouted After Doing a Spell to Recover My Husband

Any Civil Servant Who Absconds Duty Or Reports Late Will Be Treated As A Ghost Worker – CS Ruku

Inside The London Clinic: Where Nigeria’s Former President Buhari Spent His Final Days

Court Orders Senator Orwoba to Pay Sh 10.5 Million for Defamation

Wanyonyi Entrance to Bungoma Gubernatorial Race Spells Doom For Didmus Barasa

SHA is Not Working: Meru Politician Makarina Calls Out Government as Ex-DCI Kinoti Offsets His Hospital Bill

Exodus: 3 Million Kenyans Flee Safaricom for Airtel in Just 3 Months Over Govt Spying Fears

WHO Approves Kenya To Roll Out Twice-yearly Lenacapavir Injectable HIV Preventive Drug Starting January 2026

From Billionaire to Broke: The Fall of Humphrey Kariuki’s Empire

How NCBA Software Engineer Opened Floodgates For Mobile Banking System Fraud

Investigation Exposes Alleged Sex Crimes at Alliance Girls High School Amid Institutional Cover-Up

EXCLUSIVE: How Corruption and Mismanagement Have Brought Kenyatta National Hospital to Its Knees

Housing PS Charles Hinga Entangled in Sh 2B Tender Scam

Inside the Kibaki Estate Dispute: Power, Bloodlines & the Unfolding Legal Drama

Former PS Warns of Hidden Hand Behind Mwaura’s Sh1.6B HF Group Acquisition, Predicts Delisting

Inside Equity Bank’s Sh1.5 Billion Heist: A Web of Deception and Cover-Up

Police Officer Who Shot Mask Hawker During Protests Arrested

How Deep is DIG Lagat in The Kenyan Deep State?

Most Popular

-

Investigations2 weeks ago

Investigations2 weeks agoInvestigation Exposes Alleged Sex Crimes at Alliance Girls High School Amid Institutional Cover-Up

-

Business2 days ago

Business2 days agoInside Equity Bank’s Sh1.5 Billion Heist: A Web of Deception and Cover-Up

-

Business1 week ago

Business1 week agoCourt Freezes Kenya’s Afriswiss Commodities Bank Account in Alleged Gold Fraud

-

Americas2 weeks ago

Americas2 weeks agoHow A Nigerian Yahoo Boy’s Elaborate Plan to Scam Trump Backfired As FBI Goes After Him

-

News2 weeks ago

News2 weeks agoIrony of Lydia Mathia Seeking Court Interventions Months After Calling Court Orders ‘Mere Papers’ While Spearheading Evictions

-

Politics1 week ago

Politics1 week agoMoses Kuria Resigns from Kenya Kwanza Government

-

Business2 days ago

Business2 days agoThe ‘Untouchable’ Ruth Muthoni Kamau: Inside Kenya’s Sh1.5 Billion Bank Heist

-

Business1 week ago

Business1 week agoProf. Herman Manyora Appointed as The Nairobi Hospital Chair