Business

Ruthless and Merciless Kenya Women Microfinance Bank (KWFT) on Loan defaulters.

The Kenya Women Microfinance Bank, formerly known as Kenya Women Finance Trust, was founded in 1981 to address the financial needs of women.

Unfortunately, through KWFT, clients have been left poorer than they were before they joined the bank against their (KWFT) vision, “To be the Women Financial Solutions Provider with a Difference.” KWFT, is a top tier Microfinance bank in Kenya with 45 branches out of 47 counties. KWFT boasts to be serving over 800,000 clients across the country with over 2800 dedicated employees.

KWFT styles itself as an unregulated bank, insurer and acts illegally as a Kangaroo court and a ruthless auctioneer. Unsuspecting poor women are induced to take loans with strange terms and sweet deals which often end in premium tears, depression and poverty.

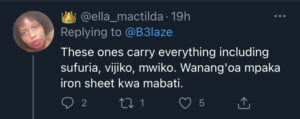

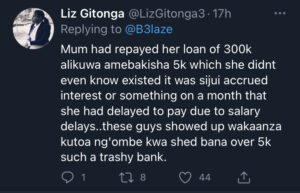

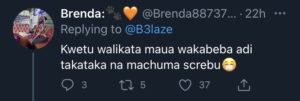

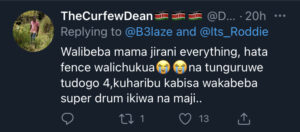

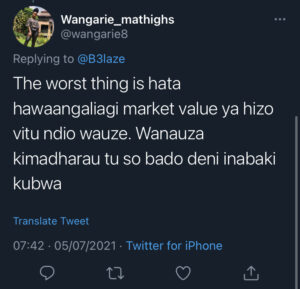

KWFT mercy on assets recovery is none of their business – none of their language eithee. They sweep clean properties of loan defaulters without within a twinkle of an eye and without a blink and are always on time that immediately when 00:01hrs ticks, they’ll be right on your doorstep or homestead to sweep clean any valuable and invaluable assets even if grass is an asset to them. In a gated property, they demolish and carry it along even if it exceeds their aimed value. They’re considered thorough and a no go zone to those considering to acquire loans from them if there’s a possibility of defaulting.

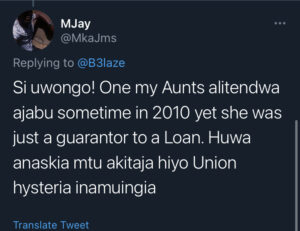

They’ve no grace period. No remorse. Inconsiderate. With 80% of the clients in rural settlement, KWFT has deliberately trapped poor souls in rat race.

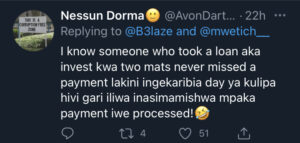

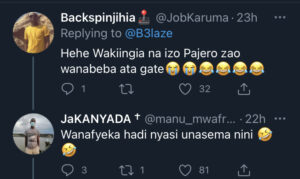

Victims of their wrath took to social media in a heated discussion and engagement expressing their experience, displeasures that isolates the bank from other banks on how they handle loan defaulters.

KWFT asset recovery actions discourages potential customers and as it stands now, interested clients should beware and reconsider other avenues, other banks since KWFT is a no go zone especially during this covid19 period where SMEs, people are struggling in a recovering economy, there’re lots of defaults in loan repayment but KWFT seems not to understand this language.

Avoid KWFT, if you want avoid drama.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations1 week ago

Investigations1 week agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations1 day ago

Investigations1 day agoSOLD TO THE BULLET: How the Bodyguard Handed MP Ong’ondo Were to His Killers