Amongst us walks murderers who’re either known or unknown to us, what’s however is clear is the fact that the shadow of murder never leaves those...

Bitcoin – which has more than tripled in value since the end of last year – has been powered on by well-known companies adopting it as...

Eric Omondi has officially apologized to Kenya Film Classification Board (KFCB) following his arrest by the Directorate of Criminal Investigations (DCI) on accusations of producing unauthorized...

We are all familiar with the web that Google shows us – the “visible” surface web that is indexed by search engines. When you search for...

Kenyans and entities wishing to own and operate Unmanned Aircraft Systems popularly known as drones will now pay a Ksh3,000 registration fee. This is after the...

Chief Executive Officer of Kenyan Electricity Transmission Company (Ketraco) Mr. Fernandes Barasa is a man living on the edge following suspected fraudulent deals in his tenure...

The Pan African Forum has lauded the decision taken by the Kenya government to pull out of the maritime dispute with Somalia whose proceedings are set...

Lawyer Ahmednasir Abdullahi has been ordered to release three vehicles he seized from a state-run roads agency for auction to recover Sh750,000 awarded to him after...

In yet an unprecedented move, Kenya has withdrawn from the International Court of Justice [ICJ] case ahead of a hearing scheduled to kick off on Monday...

ODM leader Raila Odinga has been released from Nairobi Hospital where he didn’t the week after being diagnosed with COVID-19. Raila is seen to be in...

Safaricom this week suffered rare defeat in the Court of Appeal after its bid to post-pone a High Court ruling ordering it to disable access to...

Nandi County government officials want to seize a billion-shilling gold-mining operation from a Zimbabwean investor and hand it to Chinese investors linked to high-ranking politicians, the...

The first positive results from interim clinical trials of the Oxford–AstraZeneca COVID-19 vaccine, codenamed AZD1222, were published back in November, giving hope to the millions. Months...

In January 2020, the headlines splashed the blogger Cyprian Nyakundi and his assistant Emmanuel Nyamweya had been arrested in Westgate in what police said was an...

A committee of attorneys representing plaintiffs suing Boeing Co. in relation to the the 2019 Ethiopian Airlines Flight 302 crash has urged an Illinois judge to...

Following the diagnosis of Raila with the COVID-19 virus, members of the Orange Democratic Movement who had accompanied the Prime Minister to Mombasa and Kilifi in...

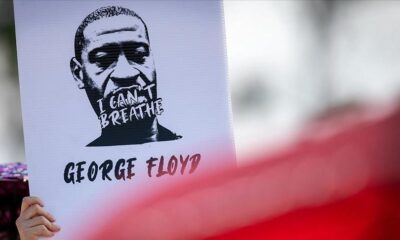

WASHINGTON The family of George Floyd and the US city of Minneapolis have agreed Friday to a $27 million settlement to end a lawsuit against the...

Netflix Inc is testing a feature that asks viewers to verify they share a household with the account holder, the company said on Thursday, a move...

President Uhuru Kenyatta has today issued two Executive Orders on the reforms in the Coffee and Tea Sub-Sectors. Executive Order No. 2 of 2021 on the...

Fellow Kenyans, Today we mark exactly one year since Kenya recorded its first case of COVID-19 on 12th March, 2020. That new global threat that was...