News

MP Joseph Hamisi Dena Implicated in Multi-Million Corruption Scandal

A nominated Member of Parliament from the Amani National Congress (ANC) party, Joseph Hamisi Dena, faces potential imprisonment following allegations of involvement in an extensive money laundering scheme that has siphoned millions of shillings from taxpayers.

The Ethics and Anti-Corruption Commission (EACC) has launched a comprehensive investigation into Dena and several associates for allegedly using multiple companies as vehicles for money laundering activities involving government agencies.

The probe centers around suspected collusion between the MP and Antony Muhanji, a former senior officer at a prominent government parastatal based in Kenya’s Coast region.

The investigation encompasses allegations of money laundering, abuse of office, and conflict of interest.

In a letter dated July 4, 2024, the EACC summoned Dena and two other directors, Mercy Mterere and Joseph Kingwangu Safarry, regarding allegations of conflict of interest and abuse of office.

The companies under scrutiny include Stone Contractor, Escalate Group C, Harbour Contractors (K) Limited, Kitengela Aqua Fish Farm Limited, Citiport Engineering (K) Limited, and Idealyic Company Limited.

Financial records reveal suspicious transactions involving substantial sums. m

An Equity Bank account associated with one of these companies received Ksh 66,820,174 between February and October 2021. m

Similarly, a Cooperative Bank account received Ksh 42,737,504 between January 2018 and 2019.

The investigation has extended to include some of Dena’s relatives, specifically Gliny Joseph Dena and George Shuma Dena, who have been linked to the scheme.

According to intelligence reports, these companies, through their directors and proxies, are suspected of engaging in money laundering and tax evasion in their dealings with government agencies.

In a particularly suspicious arrangement, one company received 99 percent of its deposits from a single government agency—its only customer.

Financial analysis indicates significant tax irregularities.

A comparison between bank deposits and declared income revealed that one of the companies understated its income in 2021 by Ksh 58,817,755. The EACC estimates that approximately Ksh 17,645,326 in income tax and Ksh 9,410,841 in VAT remain unpaid.

This is not the first time these individuals have faced legal scrutiny.

In 2022, the EACC sued Muhanji in an effort to recover over Ksh 78 million, a case in which Dena was also implicated.

Court documents alleged that Muhanji, while serving as a project manager, awarded a contract for excavation and concrete work to his own company without disclosing his directorship.

Sources familiar with the investigation indicate that Dena has recently moved funds in an apparent attempt to evade authorities.

Documents also suggest that the MP has leveraged his influence to gain unauthorized access to bank accounts where he is not officially registered as a signatory.

The EACC’s investigation is ongoing, with particular focus on potential tax evasion as the commission works with the Kenya Revenue Authority to examine financial records associated with Dena and his business associates.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations1 week ago

Investigations1 week agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations1 day ago

Investigations1 day agoSOLD TO THE BULLET: How the Bodyguard Handed MP Ong’ondo Were to His Killers

-

Investigations2 weeks ago

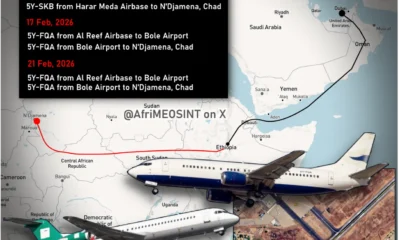

Investigations2 weeks agoTracker Identifies Kenyan-Registered Flights Allegedly Running Errands for RSF