Business

Deep-Running Syndicate: Fraud Scandal Rocks Stima DT Sacco Ahead of 51st AGM Amid KUSCCO Crisis

Suspicion of a cover-up at Stima Sacco intensifies the narrative. Whispers in Nairobi’s financial circles point to a faction of the board—meant to protect members’ interests—as potential architects of a cleanup effort gone awry.

Stima DT Sacco Society Limited, a financial titan serving over 211,000 members from Kenya’s energy sector, is teetering on the edge of collapse as a multi-million-shilling fraud scandal threatens its 50-year legacy.

With its 51st Annual General Meeting (AGM) slated for tomorrow, February 28, 2025, at the College of Insurance Auditorium in Nairobi’s South C, the Sacco—once a symbol of cooperative triumph—faces allegations of a sophisticated loan racket, a high-level cover-up, and ties to a broader crisis engulfing the Sacco sector.

As assets stand at Ksh 61 billion and a 2023 pre-tax profit of Ksh 1.4 billion masks a deepening rot, the fallout could ripple through energy parastatals like Kenya Power and Lighting Company (KPLC), Kenya Electricity Generating Company (KenGen), and the Rural Electrification and Renewable Energy Corporation (Rerec), destabilizing thousands of civil servants who rely on its services.

A Syndicate of Deceit: Forged Payslips and Ghost Shares

The scandal at Stima Sacco centers on a well-orchestrated loan racket fueled by forged payslips, allegedly perpetrated by a coalition of rogue members, current employees, and former staff turned external “fixers.”

Insiders estimate losses could range from tens to hundreds of millions of shillings, with funds meant for hardworking Kenyans siphoned into the pockets of a well-connected few.

The scheme exploits the Sacco’s loan eligibility rules—capped at four times a member’s deposits and adhering to the one-third salary deduction limit under the check-off system, as outlined by Anne Kago, SASRA’s Manager of Market Conduct. Rogue players inflate loan limits by submitting falsified payslips, often co-guaranteeing each other to deepen the deception.

But Stima Sacco’s woes echo a disturbing pattern across the sector.

A forensic report by Reuben Gitahi & Associates, presented in court, revealed that staff at Energy Sacco—another entity tied to the Ministry of Energy—colluded with members to siphon Sh82.36 million between 2016 and 2021 through ghost shareholding.

The report, part of a legal battle over unpaid fees, exposed how fictitious shares were created to secure loans and dividends, with staff manipulating records to mask defaults.

At Energy Sacco, 38 of 44 investigated members tapped Sh80.77 million in mobile loans—far exceeding the Sh20,000 limit—while pocketing Sh1.58 million in unearned payouts. Suspicious transactions, like Sh5.1 million paid to a single account but recorded under 11 names, underscored the depth of the fraud.

At Stima Sacco, parallels are striking. Sources allege a “deep-running syndicate” involving former employees like Erastus Mutwiri, whose departure a decade ago was only publicly disavowed on February 18, 2025, via a Daily Nation notice.

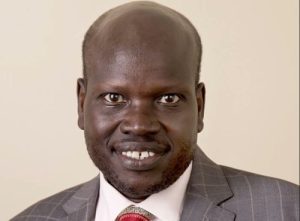

The Sacco distanced itself from Mutwiri, claiming he misrepresented himself to deceive others, yet neither National Chairperson Joseph Siror (also KPLC’s Managing Director) nor CEO Gamaliel Hassan explained the decade-long delay.

Communications Officer Jack Kulova dismissed broader fraud claims as “frivolous” but conceded forged payslips had been used illegally—a tacit admission of vulnerabilities mirroring Energy Sacco’s ghost share racket.

Cover-Up or Collapse? Leadership Under Fire

Suspicion of a cover-up at Stima Sacco intensifies the narrative. Whispers in Nairobi’s financial circles point to a faction of the board—meant to protect members’ interests—as potential architects of a cleanup effort gone awry.

Rather than rooting out culprits, some implicated staff have reportedly been shuffled to other branches among the Sacco’s 12 nationwide outlets.

This reluctance to act decisively has sparked theories of a power play by insiders, possibly to shield the Sacco’s image ahead of tomorrow’s AGM, where financial reports, policy amendments, and elections are on the table.

The timing raises eyebrows. With revenues up 21% to Ksh 8.96 billion in 2023 and dividends at Ksh 1.44 billion, Stima Sacco’s success has been a point of pride.

Yet, insiders warn of a “financial house of cards,” with ghost members, inflated financials, or kickbacks to boardroom figures potentially lurking beneath the surface.

Siror’s dual role as KPLC MD and Sacco chair only deepens the intrigue—his silence amid mounting allegations suggests either complicity or a scramble to contain the damage.

Energy Sacco’s experience offers a cautionary tale. Its Sh82.36 million loss remained buried until Reuben Gitahi & Associates dragged it into court, exposing a cover-up that failed to prevent legal scrutiny. Stima Sacco’s leadership may hope its energy sector clout buys a softer landing, but the parallels are undeniable: both institutions, tied to the same ministry, face staff-driven fraud threatening their stability.

The KUSCCO Fallout

Stima Sacco’s troubles unfold against a backdrop of sector-wide turmoil, headlined by the Sh13.3 billion heist at the Kenya Union of Savings & Credit Cooperatives (KUSCCO).

A PricewaterhouseCoopers (PwC) audit exposed a litany of malpractices—cooked books, executive theft, bribery, and unexplained withdrawals—leaving KUSCCO insolvent by Sh12.5 billion.

The umbrella body’s collapse imperils Sh24.8 billion in deposits from 247 Saccos, including heavyweights like Stima Sacco, which ranks second in assets at Sh59.15 billion among deposit-taking entities.

The State Department for Cooperatives has ordered these 247 Saccos to slash dividends and provision for losses tied to KUSCCO, a directive hitting members as AGMs loom. Stima Sacco’s meeting tomorrow, alongside others like Mwalimu Sacco (Saturday), Harambee Sacco (March 3), and Mhasibu Sacco (March 8), will grapple with this mandate.

Commissioner David Obonyo urged Saccos to set aside surpluses rather than disbursing full profits, warning, “Don’t declare a lot of dividends anticipating money from KUSCCO.” For Stima’s members, accustomed to robust payouts, this could compound the pain of internal fraud.

KUSCCO’s rot—executives like George Ototo and George Magutu face charges of felony, theft, and money laundering—mirrors the insider threats at Stima and Energy Saccos.

The PwC audit’s revelation of Sh9.3 billion in phantom profits and Sh206 million in stolen cash underscores how unchecked governance lapses can devastate cooperatives, a lesson Stima Sacco’s leadership cannot ignore.

High Stakes for Energy Parastatals

The stakes at Stima Sacco are colossal. Its 211,000 members, predominantly from energy parastatals, rely on its loans and dividends to weather Kenya’s economic storms—building homes, funding education, and bridging financial gaps.

KPLC, a cornerstone of its membership, employs thousands who could face frozen savings or loan defaults if the Sacco falters.

A domino effect across the Energy Ministry’s ecosystem looms, amplified by Energy Sacco’s own distress, where 2023 data showed Sh155.84 million in deposits against a 29.99% non-performing loan ratio—the fifteenth highest in the sector.

A Reckoning Looms

Co-operatives and MSMEs Cabinet Secretary Wycliffe Oparanya is spearheading a nationwide crackdown, catalyzed by KUSCCO’s implosion.

Forensic audits across all Saccos, coupled with a vow to jail corrupt officials and empower SASRA, signal a reckoning. “This will no longer be tolerated,” Oparanya declared, a storm cloud hovering over Stima Sacco as its AGM nears.

Energy Sacco’s unearthed fraud and KUSCCO’s collapse only heighten the pressure on Siror, Hassan, and their board—will their energy sector ties buy leniency, or face the full brunt of Oparanya’s purge?

The AGM Showdown

Tomorrow’s AGM was poised to crown Stima Sacco’s 50th anniversary celebrations in October 2024 with a victory lap.

Instead, it risks becoming a crucible where members demand answers amid swirling theories—of a years-long syndicate, ghost members, or broader corruption.

The State’s directive to provision for KUSCCO losses, layered atop internal fraud, could temper the Sacco’s budget and dividend plans, testing its resilience.

For now, Kulova insists the institution is sound, but the evidence paints a grimmer picture.

As Oparanya’s auditors sharpen their pencils and members brace for revelations, Stima Sacco’s legacy—and the trust of its energy sector backbone—teeters on a knife’s edge.

This report will be updated as the AGM unfolds and government investigations progress.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine1 week ago

Grapevine1 week agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Grapevine4 days ago

Grapevine4 days agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein Files: Sultan bin Sulayem Bragged on His Closeness to President Uhuru Then His Firm DP World Controversially Won Port Construction in Kenya, Tanzania

-

Business2 weeks ago

Business2 weeks agoKRA Can Now Tax Unexplained Bank Deposits

-

Investigations1 week ago

Investigations1 week agoEpstein’s Girlfriend Ghislaine Maxwell Frequently Visited Kenya As Files Reveal Local Secret Links With The Underage Sex Trafficking Ring

-

News1 week ago

News1 week agoState Agency Exposes Five Top Names Linked To Poor Building Approvals In Nairobi, Recommends Dismissal After City Hall Probe

-

Investigations1 day ago

Investigations1 day agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy