Economy

No Insurance Covers for Modified cars now.

Thousands of motorists face cancellation of insurance covers as underwriters intensify a crackdown on modifications said to be compromising the safety and performance of their vehicles.

Common alterations that may put vehicle owners in trouble include engine tuning, fitting alloy wheels, height spacers and other modifications meant to reduce the risk of theft or vandalism.

Several underwriting firms are already turning away those with modified vehicles — leaving motorists in limbo since the law prohibits them from driving uninsured cars.

UAP Insurance Company on Monday informed its customers that it would no longer insure vehicles that have been modified from using petrol or diesel to liquefied petroleum gas (LPG).

The insurer said some of the modifications have been done without authorisation from the car manufacturers, raising questions on the safety of such vehicles.

“Such modifications lower safety precaution standards and aggregate our exposure to liabilities in case of an accident,” said George Odinga, UAP Insurance general manager for underwriting and reinsurance.

“We have therefore taken a decision not to onboard or renew cover for any vehicle with such modification done without manufacturer’s approval.”

The National Transport and Safety Authority (NTSA) had in report ruled out any increased risk of fire when it licensed LPG-operated vehicles.

But UAP has instructed its valuers to be highlighting such modifications in their valuation reports so that the underwriter decides whether it is a risk worth taking.

“The modification has completely changed the risk from a standard motor vehicle risk to the level of a tanker on the road carrying LPG— highly flammable,” said Mr Odinga.

The development is a blow to several companies and hundreds of garages that have been earning revenue from modified vehicles to satisfy customers’ preferences for increased comfort, higher efficiency, and distinctiveness.

Laurence Okulo, a proprietor at Frigate Motors, said he had witnessed a rise in demand for conversion of engines and face-lifting of vehicles.

“We charge as from Sh150,000 on modifications but it could go as high as Sh500,000 or Sh1 million depending on the extent of modification as customers seek high performance and trendy look,” said Mr Okulo.

Modifications or customisations are added parts that do not come from the factory, also referred to as aftermarket.

Insurers nonetheless concede that some changes, like some engine modifications, maybe impossible for many people to detect. Some insurers in markets such as Europe require owners to apply for modified car insurance— a type of insurance that covers modifications to a vehicle.

However, many Kenyan insurers argue that modifications are making it hard to determine the risk profile of vehicles and therefore almost impossible to pick the right level of premiums.

ICEA Lion General Insurance senior motor assessor Peter Mzungu said insurers now have to insert modifications as exclusions in vehicle insurance contracts to avoid disputes with customers.

“Any kind of modification from manufacturers’ specification is prohibited unless the insurer is notified in writing so that they can weigh the risk and decide whether to take it or not,” said Mr Mzungu.

He said that manufacturers assemble features that are safe for operations but modifications such as the use of facelifts, spacers, and spoilers are interfering with this.

“A vehicle’s centre of gravity (COG) is well designed during manufacturing to ensure the safety of use. The minute you put in spacers, you increase COG and thereby make the vehicle very unstable on the road,” said Mr Mzungu.

The instabilities, he said, could mean higher chances of accidents and therefore higher claims.

Underwriting losses from insuring motor vehicles jumped by 126 percent to a record high of Sh6.86 billion in 2019, with private vehicle insurance returning losses for the eighth running year. The loss softened to Sh5.44 billion last year helped by Covid-19 travel curbs.

The loss softened to Sh5.44 billion last year, helped by Covid-19 travel curbs.

Mr Mzungu said minor changes such as replacing safety belts of one vehicle model with advanced ones meant for another could mean the belts failing to deploy correctly in case of a collision, enhancing the risk of fatalities.

Other facelifts such as putting high valued radio are also seen as increasing the total value of the vehicle and increasing the risk for theft.

“Unless there is a commensurate increase in insured value, the risk of insurers receiving fewer premiums for a high-valued vehicle is high,” said Mr Mzungu.

Insurers are also concerned that the modifications mean that manufacturers cannot take any responsibility in case it backfires, exposing the general public to risks such as an accident.

[BD]

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations1 day ago

Investigations1 day agoSOLD TO THE BULLET: How the Bodyguard Handed MP Ong’ondo Were to His Killers

-

Investigations1 week ago

Investigations1 week agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations2 weeks ago

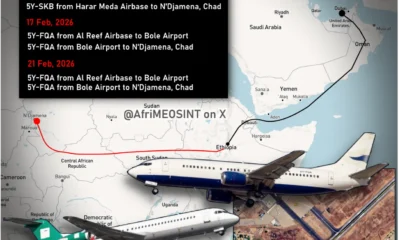

Investigations2 weeks agoTracker Identifies Kenyan-Registered Flights Allegedly Running Errands for RSF