News

Kenya’s Economic Recap 2019

There was slow global economic growth in 2019, Kenya experienced the same with hope for 2020 as the repeal of interest cap law and tough macro and micro-economic prospects give Kenyans optimism.

Corruption, soaring debt levels, missed revenue targets coupled with a destructive rainy season wore down the economy heavily in 2019, the tough economic year for the country was worsened by high pending bills by both the government and private sector, denting money supply to suppliers. In the year 2019, Kenya’s debt levels spiralled to almost 60 pc of the GDP, leaving the country with no headroom to borrow more funds. Public debt to GDP currently stands at 59pc, this is 9.9pc above the 50% threshold which had been approved by the National Assembly.

The country is already spending more than 40 per cent of total revenue to service outstanding debts.The International Monetary Fund recommends a threshold of 30 per cent for emerging economies.

The Kenya Revenue Authority under the tutelage of the new Commissioner General, has become more aggressive in pursuing tax defaulters and widening the tax base more often than not frustrating honest businesses like Sportpesa and the likes leaving the country suffering. In the financial year 2019/20 the taxman increased collection by 100.1 billion to Sh1.44 trillion, though the collection fell short of the Treasury-set target by Sh72.7 billion.

In the nine months to September this year, KRA is behind collection target by close to 80 billion shillings, exerting more pressure on the country’s fiscal space.

Due to rampant theft and corruption in government and money laundering, CBK announced the introduction of new notes in June, giving the 1000 old notes up to September before they were rendered worthless.

There was unrest in the National Treasury after the arrest of Cabinet Secretary Henry Rotich, Principal Secretary Kamau Thugge and other high-ranking treasury officials for embezzlement of public funds, corruption among other economic crimes.

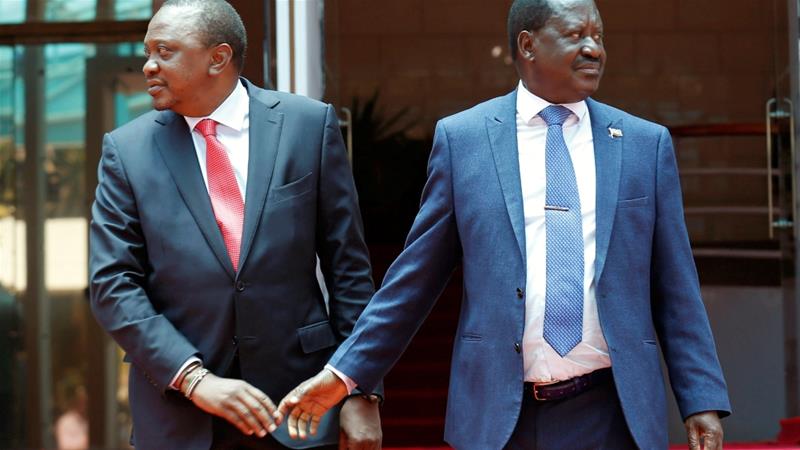

President Uhuru Kenyatta repealed the controversial interest rate cap in the Finance Act 2019. the controversy surrounding the law had led to decreased credit flow to the private sector.

Crazy surplus investment in the real estate sector saw Kenyans incur losses, Billions of money were poured out to increase investments in infrastructure in the country, however, it still faces the challenges of inadequate infrastructure.

Kenya was riddled with disparity in income, poverty levels spiked due to the high level of unemployment in the country, companies reported redundancies throughout the year as the cost living increased exponentially.

Insecurity and political instability was also a key factor to the slow growth.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations7 days ago

Investigations7 days agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations2 weeks ago

Investigations2 weeks agoBaraton College Russia Labour Programme Accused of Recruiting Kenyans into Ukraine War