Business

CMA Fines Micro-Lender Directors Over Money Laundering

The Capital Markets Authority (CMA) has fined four former directors of microlender Real People a combined Sh15 million for their roles in diverting proceeds of a Sh1.3 billion bond to South Africa.

The lender raised Sh1.3 billion in 2015 from Kenyan investors to issue loans to local customers but the bulk of the money was wired to its parent company in South Africa to pay an internal loan.

This landed nine former bosses and directors – four Kenyans and five South Africans, in trouble with the regulator who ordered an inquiry into the company.

Five of the nine executives have opposed the regulatory action at the CMA tribunal, while the four have been fined between Sh2.5 million and Sh5 million.

“CMA initiated an investigation into the matter and noted that there appeared to have been a plan involving RPKL (Real People Kenya Limited) and RPIHL (Real People Holding International Limited), South Africa to use the medium-term note proceeds to settle an intercompany loan even before the application, approval, and issue of the medium-term note,” CMA said.

The Kenyan unit of Real People is fully owned by South Africa firm—Real People International Holding.

Real People Kenya former board chairman Robert Arthur, and Neil Grobbelaar, the South African CEO and a board member for the Kenyan unit, were fined Sh5 million each and barred from being directors at firms licensed by the CMA until the bond money is recovered.

Arumugam Padachie and Bruce Schenk, who served on Real People board, were fined Sh2.5 million each and also barred from holding top positions in licensed firms.

Other directors, Charl Kocks, Nthenya Muli, Daniel Ohonde, Yvonne Godo and Norman Ambunya, will know their fate once their case is resolved at the tribunal.

Real People experienced financial problems immediately after raising the funds and has failed to repay the bondholders, prompting CMA to investigate how the Sh1.3 billion was used.

CMA says the money was diverted to pay an internal loan to Real people South Africa instead of being lent to customers in Kenya.

James Mbui, former RPKL Chief Information Officer, Bruce Evans, former RPIHL Group Head of Corporate Finance, and Werner Nel, former RPHIL Group Head of Treasury got off the hook.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations1 day ago

Investigations1 day agoSOLD TO THE BULLET: How the Bodyguard Handed MP Ong’ondo Were to His Killers

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations1 week ago

Investigations1 week agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations2 weeks ago

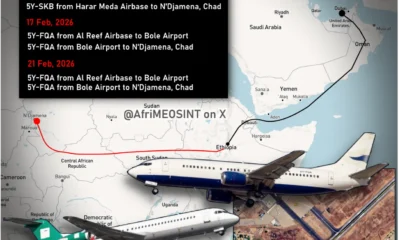

Investigations2 weeks agoTracker Identifies Kenyan-Registered Flights Allegedly Running Errands for RSF