Business

Boardroom Blowout: Sh500M Shareholder Feud Threatens Kenya’s Newest PSV Insurer Definite Assurance

The escalating conflict, pitting prominent businessmen Ronald Karauri and Peter Mbugua against each other, threatens to destabilize the fledgling insurer and expose the murky dealings behind its inception.

A fierce boardroom and shareholder battle is rocking Definite Assurance Company Limited, Kenya’s newest insurance firm targeting the lucrative public service vehicle (PSV) sector, barely two months after it received its operating licence from the Insurance Regulatory Authority (IRA) on December 11, 2024.

The escalating conflict, pitting prominent businessmen Ronald Karauri and Peter Mbugua against each other, threatens to destabilize the fledgling insurer and expose the murky dealings behind its inception.

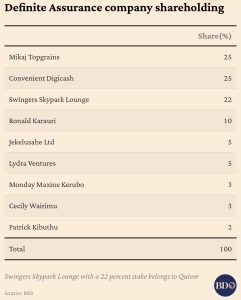

At the heart of the dispute is Peter Mbugua, the Quiver Lounge & Grill owner, whose former allies in the company—including SportPesa CEO and Kasarani MP Ronald Karauri—are pushing for his exit. The fallout has spiraled into a high-stakes valuation war, with Mbugua demanding Sh500 million for his 22 percent stake, a figure his partners dismiss as outrageous, offering him Sh195 million instead—a sum they claim he had previously agreed to accept.

The rift began brewing in early November 2024, when delays in securing the IRA licence left Mbugua disillusioned. Citing the prolonged uncertainty, he sought to cash out his initial Sh175 million investment, which included Sh75 million for setup costs and Sh100 million toward the firm’s capital.

At the time, he requested an additional Sh20 million as a premium, notifying IRA Commissioner Godfrey Kiptum of his intent to withdraw on November 13. Karauri, holding a 10 percent stake and having injected Sh500 million into the firm, initially agreed to buy Mbugua’s shares, a move that would have elevated his ownership to 32 percent.

But the deal unraveled when the IRA licence was finally granted in December. Emboldened by the firm’s newfound regulatory approval, Mbugua reversed course, hiking his asking price to Sh500 million.

“How does he expect the value of my shares to be the same before and after the licence?” Mbugua said, “It’s like agreeing to sell a Range Rover without an engine, tyres, and gearbox for Sh1 million, then the buyer disappears for a month, resurfaces when I’ve installed everything, and still wants to pay the same amount.”

Mbugua accuses Karauri and other shareholders, including businessman Kushian Muchiri—who holds a 30 percent stake—of sidelining him and running the company without his input. “I put in Sh175 million as seed capital, but I’ve been kept in the dark about operations,” he lamented, pointing fingers at Karauri as the mastermind behind his exclusion.

Muchiri, however, paints a different picture, asserting that Mbugua voluntarily resigned and signed off on the sale of his shares for Sh195 million.

“He resigned, signed shareholder and board resolutions, and share transfer forms,” Muchiri said. “The shares were sold to raise his requested settlement. The money is ready whenever he wants it.” Official records from the Business Registration Service (BRS) still list Mbugua’s Swingers Skypark as the holder of the 22 percent stake, adding fuel to the ownership dispute.

The turmoil marks a shaky start for Definite Assurance, which aimed to disrupt the PSV insurance market—a Sh5.5 billion-a-year segment plagued by losses and the collapse of players like Invesco Assurance and Xplico.

The firm had hoped to capitalize on Muchiri’s expertise in the matatu industry, gained from managing Kenya Mpya buses, and the financial muscle of Karauri, a betting mogul who reaped billions from SportPesa, and Mbugua, whose Quiver Lounge chain has become a nightlife staple in Nairobi.

The partnership, once a promising blend of wealth and ambition, has soured into a bitter feud. Mbugua, who claims to have built his fortune from humble beginnings in the alcohol trade, alleges that his partners are manipulating the company’s directorship behind his back.

Through his lawyer, Dunstan Omari, he has threatened legal action, warning that “additional persons/directors” unknown to him have been introduced into the firm. “We shall move to protect our client’s interest by instituting legal proceedings,” Omari’s letter to the company stated.

Karauri, faces mounting pressure as the public face of the insurer. His Sh500 million investment was pivotal in meeting the Sh600 million minimum capital requirement for a general insurance company in Kenya, but the ongoing spat risks undermining Definite Assurance’s credibility before it can even establish a foothold.

As the boardroom war intensifies, industry watchers warn that the fallout could jeopardize the company’s mission to revolutionize matatu insurance.

With rival Directline Assurance, the market leader owned by media tycoon SK Macharia, already grappling with its own shareholder and regulatory woes, Definite Assurance’s internal chaos may leave the PSV insurance segment vulnerable at a critical juncture.

For now, the firm’s future hangs in the balance as its founders battle over money, power, and control.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations2 weeks ago

Investigations2 weeks agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations7 days ago

Investigations7 days agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners