News

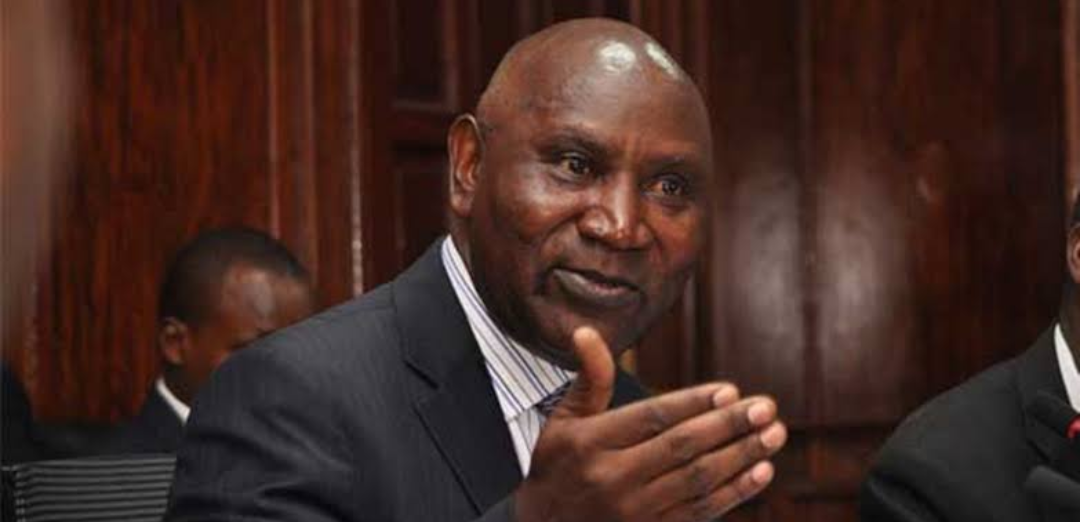

Auditor General Edward Ouko Reveals How Corrupt State Corporations Looted 823.7 Billions.

Auditor General Edward Ouko, has once again unearthed a multimillion State corporations fraud.

According to Auditor general, the government risks losing Sh823.7 billion worth of outstanding loans advanced to 72 State corporations.

From the documents seen by this site, Sh47.52 billion of these loans are dormant and have fallen due on various dates over the years.

Auditor-General Edward Ouko’s Annual National Treasury report on government investment and public enterprises

{outstanding loans} reveals that most of the loans were issued out by the National Treasury without the required procedure and documentation.

“Failure to redeem the loans precipitate a high likelihood of defaulting and eventual loss of public funds because of continued write-offs of bad debts,” reads part of Auditor general’s report.

The National Assembly has said that the management of the state corporations did not forward over their respective annual work plans, cashbooks, ledgers, quarterly reports, monitoring and evaluation reports for the loans.

And just like any other State masterminded fraud, the loans did not have documentation determining the beneficiaries, terms of the loans and the authorisation of the disbursements.

“This determination appears to be outside the department’s control, thus the department implements decisions that are made elsewhere. This is exhibited by the continued growth of the outstanding loans,” reads part of Ouko’s report.

The National Assembly’s Public Accounts Committee (PAC) chaired by Ugunja MP Opiyo Wandayi is set to review Auditor Generals report and table their recommendations to the House.

Another revelation in Ouko’s report is how the already defaulting institutions continue to receive funding from The National Treasury.

This casts doubts on the backdoor criteria is being used by the Treasury to advance new loans to the Institutions.

The heads of the 72 States have hidden their budgets, annual plans and, are also sitting on assessment, evaluation and performance reports of the loaning portfolios.

This is how public funds are swindled by corrupt public servants.

According to Ouko, without those budgets, annual plans and, assessment, evaluation and performance reports it’s difficult to determine whether public funds had been used properly.

Here are some of the notorious parastatals with dormant loans in billions of shillings:

Rural Electrification Authority 13.65 Million, Coast Water Service Board 7 million, Northern Water Services Board 5.39 million and Tanathi Water Services Board has Sh4.4 million.

Also on the list of shame is Lake Victoria South Water Services Board with 3 million, Lake Victoria North Water Services Board 2.8million, the collapsing Mumias Sugar Company has 2.5 Billion, the National Water Conservation and Pipeline Corporation 2.46million.

According Auditor general’s report, SONY Sugar Company limited books indicated that they have a loan of Sh770.28 million but Treasury says the have outstanding loans of Sh199.02 million.

The already crippled Mumias Sugar Company limited has Sh3 billion as per its financial records but Treasury records have Sh2.5 billion.

Also, Agro Chemicals owes the public Sh9.07 billion but National Treasury records only captured Sh1.11 billion.

Tanathi Water Services Board has Sh5.20 billion in debt but Treasury records have 5.05 billion.

Another swindle according to Ouko’s report is where Moi University owes the coffers 257.77 million but the Treasury has only listed 31.25 million.

Kenya Meat Commission has 300million but Treasury has 90.24 million in its records.

Utalii College has pending debts of 140.13 million but Treasury lists zero balance.

Faulu Kenya owes the public 176.68 million but Treasury records shows 141.31 million only.

IDB Capital limited alleges to have zero balance but Treasury records indicate they still owe the public 1.56 billion.

Coffee Board of Kenya owes the public 976 million.

Pyrethrum Board of Kenya 863 million, Kenya Industrial Estates 758 million.

Funny enough, Co-operative Bank of Kenya also owes the government Sh476 million despite making billions of shillings in profit every year.

These agencies managements do not pay the loans intentionally so that the government ends up writing off their debts.

This is how government is splashing public money on the tables of greedy parastatals heads.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News1 week ago

News1 week agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations1 week ago

Investigations1 week agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy1 week ago

Economy1 week agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa2 weeks ago

Africa2 weeks agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Grapevine5 days ago

Grapevine5 days agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Politics2 weeks ago

Politics2 weeks agoSifuna, Babu Owino Are Uhuru’s Project, Orengo Is Opportunist, Inconsequential in Kenyan Politics, Miguna Says