Business

Kingdom Bank Aided Fraud, Court Makes A Landmark Ruling That Will Open Floodgates For Lawsuits

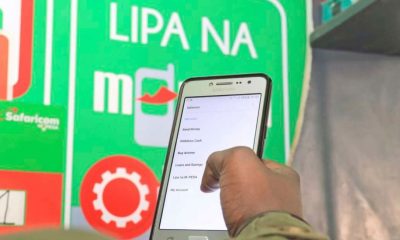

In a landmark ruling that is expected to disrupt the peace of many banks in Kenya, the High Court on March 15, 2024 upheld the decision of the Small Claims court in which a customer successfully sued Kingdom Bank a subsidiary of Co-operative bank after losing Sh50,600 he erroneously credited to an M-Pesa till number that terminated in an account domiciled at the bank. The court held that the bank was liable for the loss.

The High Court judge ruled that despite Kingdom Bank having demonstrated that money was withdrawn before the affected customer reported the erroneous transaction, it failed to show that it tried following up with the customer who withdrew the money to stop the fraud.

“The bank was under a duty to demonstrate that it took the necessary steps in recalling the money. However, all that the bank did was to file statements to show how the transaction was undertaken or how the money was withdrawn. There was nothing to show that the bank called for the money from its customer. No evidence of its intention to aid the recovery of the money,” said Justice Mabeya, the presiding judge of the Milimani High Court Commercial and Tax Division.

“While I admit that the bank has a duty to protect its customer’s interests, in this case, the customer fraudulently withdrew money that did not belong to it. The bank had a duty to ensure that it did not aid a fraud and it is not enough to state that the account did not have sufficient funds.”

The case of Kingdom Bank and Alice Wanja Wanjohi

In court papers seen by Kenya Insights, Ms Wanja erroneously sent a total some Ksh50,600 to the Kingdom-linked MPESA till.

She reached out to Safaricom upon realizing the mistake informing them of the erroneous transaction but was instead instructed to reach out to the Bank for assistance.

“On 16/8/2022, a day after the transaction, Safaricom informed the respondent that the reversal request had been transferred to the appellant for resolution,” read the court papers.

On reaching out to the Bank, Wanja was informed the money had already been withdrawn by the receiving customer and could not be recovered.

The Bank produced a bank statement showing that its customer withdrew the funds on the same day the amount landed in the account.

Dejected, Wanja went on to sue the Kingdom Bank at the Milimani Small Claims Court, arguing that the lender acted in breach of care.

She pointed out that the Bank failed to stop a fraudulent transaction and in turn shielded its customer.

The High Court finding now raises the bar of the responsibility of banks in protecting the interests of customers who are not even their own.

Banks will be held responsible for loss of cash erroneously sent by clients to unintended Safaricom M-Pesa tills numbers, which terminate into accounts held by the lenders.

The High Court has held that banks will have to demonstrate that they took all the “necessary steps in recalling the money” to stop their clients from illegally profiting from such erroneous transactions or be held liable for the losses suffered by affected M-Pesa users.

This could open up banks to thousands of lawsuits involving M-Pesa customers who accidentally send money to the wrong till numbers terminating in banks and end up losing the money amid the tedious process involved in requesting for reversals.

Safaricom has over 606,000 enterprises using its payment service, Lipa na M-Pesa, to accept payments for goods and services, pointing to the popularity of the service that transacted Sh1.63 trillion in the financial year ending March 2023.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations1 week ago

Investigations1 week agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations1 day ago

Investigations1 day agoSOLD TO THE BULLET: How the Bodyguard Handed MP Ong’ondo Were to His Killers