Business

Why Sameer Africa Shareholders Should Be Worried As Company’s Reserves Drops To Sh265M

Sameer Africa has now depleted reserves significantly as shown in the just released HY June 2019.

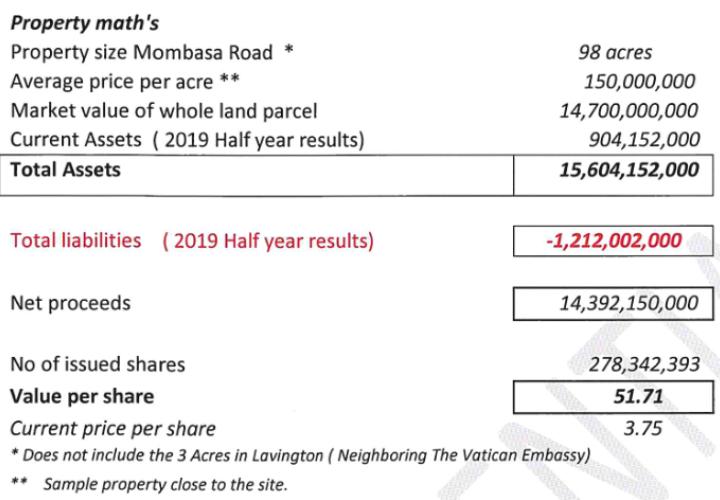

The reserves which stood at Ksh1.3 billion in 2013 now stand at only Ksh265 Million. With the current trend shareholders book value currently at Sh52 as analysed below will only continue to be depleted.

Sameer Investment LTD controlling party owns 72.15 pc of the shares worth Ksh10 Billion while the rest of the 27.85% worth Ksh4 Billion are owned by minority shareholders.

Just recently at the centre of huge losses, Simon Gachomo resigned after serving as Managing director since October 2018 to “Pursue personal interests.” During his tenor, the company saw it’s losses rising 15.8 times higher to Ksh 182 million for the first 6 months of 2019.

Group revenue also dropped by 20 pc to Ksh930.2 million as its best selling tyre remained unavailable throughout the period. The company which imports tyres from China and India under contract manufacturing claims it has faced stock shortages and counterfeits which have hugely undermined the its performance.

The company was forced to issue a profit warning back in December 2018 stating it’s earnings would plunge by 25% due to stock shortages. Compared to a the profit os Ksh80.4 million it made in 2017 the company posted a loss of Ksh686.4 million the year ended 31st December, 2018.

The company is also struggling from a one-off Ksh877 million reorganization cost comprising of Ksh405 million it spent on impairment of raw material, Ksh179 million in fixed assets impairment and Ksh 293 million for staff redundancy.

The new MD Peter Gitonga a board member since August 28th will now be tasked to steer the company to profitability and improved share value.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News1 week ago

News1 week agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations1 week ago

Investigations1 week agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy1 week ago

Economy1 week agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa2 weeks ago

Africa2 weeks agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Grapevine5 days ago

Grapevine5 days agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

News2 weeks ago

News2 weeks agoTragedy As City Hall Hands Corrupt Ghanaian Firm Multimillion Garbage Collection Tender