Business

Stima Sacco Management Faces Storm of Fraud Allegations Ahead of AGM

Nairobi’s Stima DT Sacco Society Limited, a financial powerhouse serving over 211,000 members from Kenya’s energy sector, is embroiled in a scandal that threatens to dismantle its half-century legacy.

Whispers of multi-million-shilling fraud and a high-level cover-up are circulating, putting the society in jeopardy.

Just days before its 51st Annual General Meeting (AGM) on Friday, February 28, the Sacco—once a poster child for cooperative success—finds itself staring down a barrel of allegations that could shake its foundations and ripple through the government parastatals it serves.

A tangled web of deceit at Stima Sacco has been established, where employees, rogue members, and shadowy external players are allegedly running a loan racket fueled by forged payslips.

Sources close to the company suggest the scam could involve tens—if not hundreds—of millions of shillings, siphoning funds meant for hardworking civil servants into the pockets of a well-connected few.

The Sacco, which draws its membership from heavyweights like Kenya Power and Lighting Company (KPLC), Kenya Electricity Generating Company (KenGen), and the Rural Electrification and Renewable Energy Corporation (Rerec), reported a pre-tax profit of Ksh 1.4 billion in 2023, with assets ballooning to Ksh 61 billion last year.

But behind those glossy numbers, insiders hint at a financial house of cards waiting to collapse.

What’s raising eyebrows isn’t just the fraud—it’s who might be protecting it.

Rumors swirling through Nairobi’s financial circles point to a faction of Stima Sacco’s board, a group meant to safeguard members’ interests, as potential architects of a cover-up.

Instead of cracking down on the culprits, some board members are said to have quietly shuffled implicated staff to other branches, brushing the mess under the rug while the Sacco’s 12 nationwide outlets hum along.

Could this be a desperate bid to preserve the institution’s image ahead of the AGM, where financial reports and elections are on the agenda? Or is it something more sinister—a power play by insiders with their hands in the till?

The stakes are sky-high. Stima Sacco’s membership, largely tied to the Energy Ministry’s parastatals, includes employees who’ve leaned on its loans and Ksh 1.44 billion dividend payouts to build homes, pay school fees, and weather Kenya’s economic storms.

If the fraud allegations hold water, the fallout could hit these parastatals hard—KPLC alone employs thousands who bank with Stima, and a collapse could trigger a domino effect of unpaid loans and frozen savings.

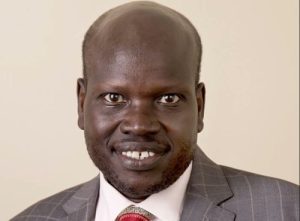

Speculation is rife that the Sacco’s leadership, including National Chairperson Joseph Siror (also KPLC’s Managing Director) and CEO Gamaliel Hassan, knows more than they’re letting on.

The timing of this scandal couldn’t be more explosive.

The government, led by Co-operatives and MSMEs Cabinet Secretary Wycliffe Oparanya, is in the midst of a nationwide purge of financial rot in the Sacco sector.

After a Ksh 13.3 billion scandal rocked the Kenya Union of Savings & Credit Cooperatives (KUSCCO) last year, Oparanya ordered forensic audits across all cooperatives, vowing to jail corrupt officials and empower the Sacco Societies Regulatory Authority (Sasra) to tighten the screws.

“This will no longer be tolerated,” he declared recently, a warning that now hangs over Stima Sacco like a storm cloud.

Could Siror, a dual-hatted power player in both KPLC and Stima, be sweating under the government’s glare? Or will the Sacco’s deep ties to the energy sector buy it a softer landing?

Theories abound about how deep the rot goes. Some whisper that former employees, now operating as fixers on the outside, are pulling strings in a syndicate that’s been years in the making.

Others speculate that the forged payslip scheme might be the tip of the iceberg—could there be ghost members, inflated financials, or even kickbacks to boardroom bigwigs?

With revenues soaring 21% to Ksh 8.96 billion in 2023, it’s hard to believe no one noticed the cracks.

Perhaps the AGM, set to approve the 2025/2026 budget and amend key policies, was meant to be a victory lap after Stima’s 50th anniversary bash in October 2024.

Instead, it might turn into a showdown for members to demand answers.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations2 weeks ago

Investigations2 weeks agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations7 days ago

Investigations7 days agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners