South Sudan government has agreed to allow a deal with a Dubai-based company to lend South Sudan $12.9 billion in exchange for oil over a 20-year period, according to a leaked UN report cited by Bloomberg.

The deal, negotiated on the sidelines of the COP28 climate change summit in Dubai, amounts to almost double South Sudan’s GDP and five times its current external debt of 2.5 billion US dollars. The government has earmarked 70% of the loan for infrastructure and 30% for the country’s working capital against the approved budget.

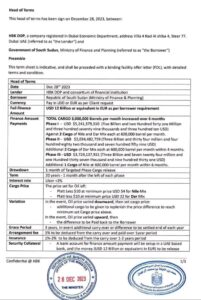

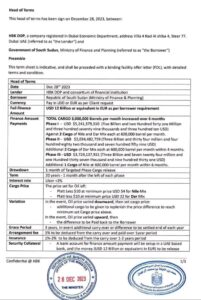

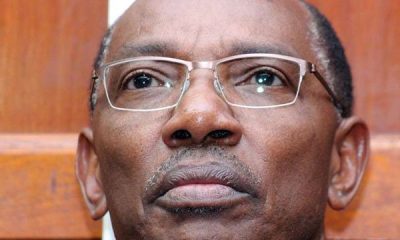

The report by a UN Security Council panel indicates that Dubai’s Hamad Bin Khalifa Department of Projects (HBK DOP) reached the agreement with South Sudan’s former finance minister, Bak Barnaba Chol, between December 2023 and February 2024.

The deal is controversial as it’s nearly twice South Sudan’s GDP. The report notes that 70% of the funds would be used for infrastructure, despite the country facing famine and conflict.

The UN panel of experts said in the unpublished report, that the loan deal will trap most of South Sudan’s oil revenues for many years.

Under the terms, South Sudan would receive $10 less than the international benchmark price per oil barrel.

Terms of the deal

The agreement obliges the South Sudan government to pump 3,000,000 barrels of oil per month to the Abu Dhabi firm with an unspecified increase in over 6 months.

In the first phase of the deal, the company will pay over 5 billion US dollars to South Sudan government after which it will receive two cargoes of Nile and Dar Mix crude oil at 600,000 barrels per month.

In Phase II, South Sudan will receive more than 3 billion dollars in exchange for two additional cargoes of Dar Mix amounting to 600,000 barrels per month within four months.

HBK DOP will further send over 3 billion South Sudanese pounds to Juba for reimbursement of one cargo of Nile at 600,000 barrels per month within six months.

It is further stipulated that if oil prices drop, South Sudan will provide additional barrels to meet the loan, whereas when oil prices rise, the number of barrels can be reduced or the difference can be paid back to suit the market.

The loan will give the UAE discounted oil for up to two decades, and under the agreement, South Sudan will receive $10 less per barrel of oil in comparison with the international benchmark, Bloomberg reported.

The UAE company further offered to provide additional funding for building the pipeline, refinery, and petrochemical complex and 1,000 megawatts of power for the project.

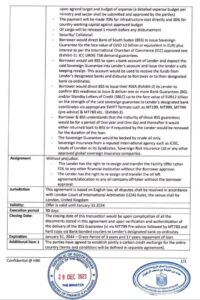

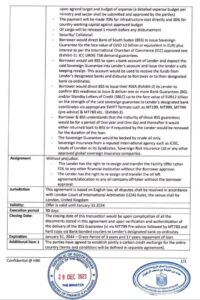

According to the terms and conditions, the government shall direct the Bank of South Sudan to open a lender bank account and deposit of sovereign guarantee backed “by crude oil only” to receive funds from the company’s designated bank coordinates.

The deal is based on English laws, where disputes will be resolved in accordance with the London Court of International Arbitration.

South Sudan is heavily dependent on oil, with the commodity being responsible for 90% of the country’s revenue and nearly all of its exports, according to the World Bank.

Former finance minister, Agak Acuil said in May 2022, that the government had been struggling to pay civil servants because the country’s oil proceeds have been sold in advance up to 2027.

HBK DOP was founded by Sheikh Hamad Bin Khalifa Al Nahyan, a distant relative of Abu Dhabi’s royal family. It’s unclear if South Sudan has yet received an initial $5 billion installment from the deal.

The UAE has pledged over $97.3 billion in African investments from 2022-2023, seeking to become the continent’s largest investor.

In February 2024, Abu Dhabi’s ADQ sovereign wealth fund pledged $35 billion to develop Egypt’s Ras El Hikma peninsula.

Oil-rich nations often turn to oil-backed loans when they struggle to access conventional financing. Nigeria recently secured a $3.3 billion oil-backed loan from Afreximbank in August 2023.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Opinion2 weeks ago

Opinion2 weeks ago

News2 weeks ago

News2 weeks ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago