While companies negotiate sumptuous contracts for services, they pay employees beggar salaries and evade taxes through under-declaration of income and overstating deductions.

Major private security companies are now on the spot over tax evasion, denying the government KES14.6 billion in the last eight years, according to the Kenya Revenue Authority (KRA).

Despite security firms charging clients substantial amounts, up to KES 50,000 per guard, many security guards are reportedly being cheated out of millions of shillings monthly by their employers through income under-declaration. Guards allegedly receive only KES 6,000 to KES 10,000 in monthly salary.

Reports from the Intelligence and Strategic Operations Department of Kenya Revenue Authority (KRA) between 2021 and May of the previous year alleged that several firms engaged in tax evasion practices, including under-declaration or non-declaration of income, tax fraud, dishonest tax reporting, understating employee numbers, and overstating deductions.

These findings emerge amid a conflict between private security firms and the Private Security Regulatory Authority (PSRA) regarding the enhancement of working conditions for security guards.

According to the PSRA, the total minimum pay should be Sh30,000, while the statutory deductions are to be National Social Security Fund (NSSF) of KES 1,080, Social Health Insurance Fund (SHIF) of KES 825, Pay as You Earn KES 1,229.75. However, some firms do not remit some of these statutory deductions, further exposing the guards.

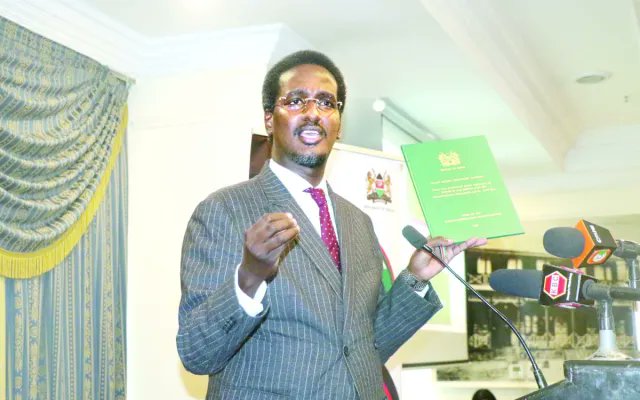

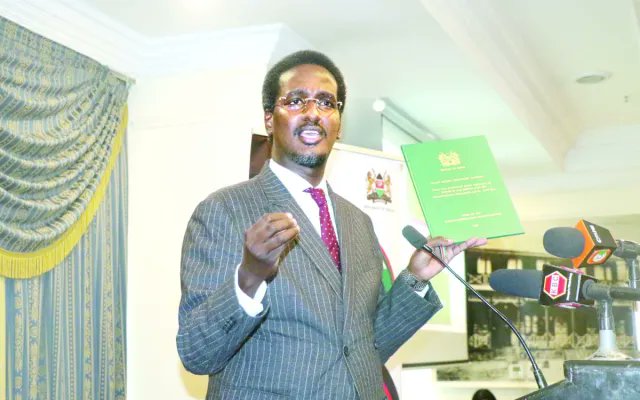

For this reason the Chief Executive of the Private Security Regulatory Authority (PRSA), Mahamud Fazul, introduced new guidelines, including a mandated minimum monthly salary ranging from KES 27,000 to KES 30,000, which security firms are required to adhere to.

Fazul emphasized that only private security firms complying with these regulations would be permitted to continue their operations.

On fictitious VAT claims, KRA revealed that some of the firms fraudulently claimed more purchases on VAT3 than the corresponding sales declared by suppliers. “The taxpayers claimed fictitious purchases and the VAT attributable to the purchases amounting to the fictitious VAT claimed ought to be disallowed,” one of the reports read.

Among the companies included in the reports are Kenya Kazi Linited, Lavington Securities Ltd, Securex Agencies Kenya Limited, Wells Fargo Ltd, BABS Security Limited and Delta Guards Ltd. Others are Gyto Success Company Ltd, Riley Falcon Security Services Ltd, Total Securities Surveillance Ltd, and Wins Guards Ltd.

Regarding one of the companies, the KRA report highlighted: “Upon examination of the taxpayer’s claimed purchases on VAT3 returns from various suppliers, it was discovered that the taxpayer deceitfully asserted more purchases on VAT3 than the sales declared by suppliers, amounting to KES 7,454,870 for the period between 2016 and 2021. Input VAT totalling KES 1,005,726 should be rejected.”

The report also indicates that examinations of the firms’ bank accounts exposed instances where they understated income tax and VAT turnovers. Additionally, some companies were identified for not accurately reporting the total number of their employees, as per the intelligence report.

Another company is accused of investing in a subsidiary company in Mauritius, a country traditionally considered to be a corporate tax haven.

An analysis done on nine of the company’s 16 bank accounts revealed under-declared income tax turnover of KES 562.6 million for the years 2018, 2019 and 2020.

In response, the firms have dismissed a directive to increase their guards’ salaries. In a joint press statement, the Kenya Security Industry Association and Protective and Safety Association of Kenya said the directive was illegal. They said the directive ought to have been gazetted by Labour Cabinet Secretary Florence Bore, before it is enforced.

Private Security Regulatory Authority directorgeneral Fazul Mahamed

Suspensions

Meanwhile, operating licences of nine major security companies have been cancelled for violation of various regulations. The Private Security Regulatory Authority yesterday gazetted the names of the companies, highlighting their failures in a notice.

This move is likely to jeopardise the operations of the affected firms that have employed many Kenyans as security guards, and in other areas of their operations.

“Take notice: The Authority shall be conducting periodic reviews of the compliance status of Private Security Companies with the provisions of the Act, consequently, the lists of registered private security service providers and those whose registration certificates have been cancelled shall be regularly updated,” PSRA Director General Fazul Mahamed said in the notice.

This comes as a seven-day notice to the firms to comply with a directive to increase the guards’ salary to at least Sh30,000 lapses today (Tuesday, February 6.

The grounds listed as being behind the move include claims they have breached the provisions of the Private Security Regulation Act No 13 of 2016, they violated the terms and conditions attached to their certificates of registration as corporate private security service providers and failed, declined and/or refused to comply with minimum wage regulations.

They also contravened Section 33 of the Act having employed and/or engaged Private

Security Officers who are not in possession of Guard Force Numbers as proof of registration by the Authority in accordance with the provisions of the Act.

The affected firms include Victory Protective Services Africa Limited, Victory Consultants Limited, Bedrock Security Services Limited and Bedrock Security Alarms Systems and Product Limited.

Others are Senaca East Africa Limited, Hipora Security Solutions Limited, Salama Fikira International (Kenya) Limited, Marco Security Limited and Superb Marketing Solutions Limited.

Mahamed said the law says anyone who hires, employs or otherwise engages the services of any unlicenced private security firm commits an offense and shall be liable to a fine or to both such fine and imprisonment in the case of a natural person and Sh2 million in the case of a corporate.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

Investigations1 week ago

Investigations1 week ago

Grapevine2 weeks ago

Grapevine2 weeks ago

News2 weeks ago

News2 weeks ago

Opinion2 weeks ago

Opinion2 weeks ago

Americas1 week ago

Americas1 week ago

News1 week ago

News1 week ago

Politics5 days ago

Politics5 days ago

News2 weeks ago

News2 weeks ago