The Performance of the country’s economy and the challenges it is currently facing calls for urgent intervention to turn around the economy.

The Treasury and Planning Cabinet Secretary (CS), Amb. Ukur Yatani said that the total revenue as a share of GDP has averaged at 18.6 pc in the post devolution era down from 22 pc in the pre-devolution.

Speaking last week during a Workshop on Prudent Financial Management for Public Finance Management officials at the KICC, the CS said the rising public debt, high levels of unemployment and immense challenges associated with the prevailing socio-economic conditions calls for immediate action.

Yatani noted that all financial officers that are serving in ministries have the responsibility of prudently managing resources and making sure those payments and financial transactions are paid within the required time. “Some ministries are collecting revenues on behalf of Treasury and are supposed to deposit the money into the consolidated fund but are not following the required procedure and timelines,” he said.

The CS directed that all accounting officers dealing with the issues of finance to strictly follow the right procedure when it comes to payments and spending and cautioned that this time round failure to enforce will see them being individually responsible for flouting and will be charged even in court as individuals

Yatani noted that the government wants strict compliance of budgeting implementation without option, saying the issue of pending bills will soon be a thing of the past as the same will and not be carried forward beyond financial years.

Although in the last few months, the CS said, measures have been put in place and most of the pending bills at both the ministry and also county levels have been paid, a prudent and responsible management of public resources is fundamental in making sure all pending bills are paid in time.

“The measures put in place in the last two months has seen some positive outcomes and out of sh.14 billion pending bills owed to some suppliers, Sh13 billion has been paid and only Sh1.8 billion remains and narrowing to only a few ministries that had challenges such as inadequate budgets,” the CS said.

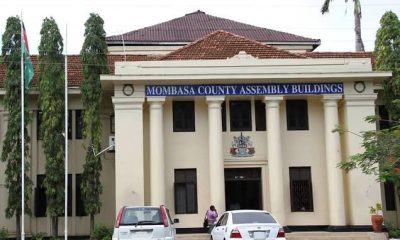

At County Level, he explained that out of Sh.55 billion pending bill, sh.36 billion has already been paid leaving a pending bill of around sh.19 billion which is a good progress.

“We have entered into an agreement with all the Counties that between now and June we will have cleared the pending bills. We do not want to cross the next financial year with any pending bills, and although there are some that are resisting, they do not have an option, what belongs to the people must be paid in good time,” Yatani emphasized.

He assured that in the next financial year, there will be no discussion on any pending bills, expenditure beyond budgetary allocations or spending of what is required. “We will not go that route again, spend only what you have in the budget “.

On issues of expenditure, Amb. Yatani said that the government has been spending more than what is allocated in the budget which is a challenge saying that during the next financial year, they are coming up with a project implementation unit where ministries proposals on projects will also be seeing an independent team that will do the costing in order to counter inbreeding.

“Projects have been identified, contextualized costed and implemented by one ministry but this will not work since an independent unit will be able to come and cost the project with the right amount allocated and is at acceptable standard,” he said.

On borrowing, the CS also noted that the governments wants in the next financial year to reduce uptake of borrowing by Sh. 100 billion both in foreign and domestic borrowing.

On Domestic borrowing, he explained that the government wants to free as much resource for private sector especially for SME while on foreign borrowing they reduce to a bare minimum because the Country is already constrained and Fiscal space lacking.

“We cannot continue borrowing commercials loans, and if we do we will only go for concessional loans that will be given to us at either one percent and 40 year repayment period and either between 5 and 10 grace period so that it does not constrain us,” he said

The issue of donor projects, Amb. Yatani further said is another constraint where donor projects are not implemented in a record time thus forcing the government to pay commitment fee for nothing.

During the meeting, Dr. Haron Sirima, the Director-General, Public Debt Management Office at the National Treasury said there has been low absorption of donor fund with the government’s ability or inability to utilize the resources given.

“Donors have made a budget of Sh.2.23 trillion shillings but only Sh.1.1 trillion has been utilized which is a half of what has been allocated and this is forcing the government to pay commitment fee of Sh 2.6 billion which is tax payers money,” he said .

The delays on project implementation of donor funding, Dr. Sirima explained escalates budget deficit and also increases pressure for additional borrowing.

The Director General Accounting Services and Quality Assurance at the Treasury, Bernard Ndung’u said Ministries should strive to pay their bills and put on the spot Ministry of Sports which has until now not paid any pending bills.

Other Ministries and state departments named over pending bills were Immigration department, Judiciary, Interior, IEBC, Broadcasting and Communication, Fisheries, Salary and Remuneration Commission (SRC), Kenya National Human Rights and Kenya National Police Service among others.

Revenue shortfalls amidst rising expenditure pressures have led to elevated fiscal deficits and rising public debt with key areas of concern being revenue mobilization, rising expenditure pressures, pending bills and public debt.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Opinion2 weeks ago

Opinion2 weeks ago

News2 weeks ago

News2 weeks ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago