News

Sakaja’s Mystery Loan Sparks Storm as County Billions Flow to Ruto-Linked Sidian Bank

Nairobi County Secretary Godfrey Akumali directed all Level 4 and 5 hospitals to cease transactions with Co-operative Bank and open new accounts with Sidian Bank.

Nairobi County Assembly descended into chaos Wednesday when Governor Johnson Sakaja requested approval to borrow an unspecified loan amount without disclosing basic details including the loan size, source, or repayment terms, triggering a political firestorm that has exposed what critics are calling the most brazen financial manipulation in the capital’s history.

The explosive controversy has deepened after revelations that City Hall abruptly shifted its primary banking accounts to Sidian Bank, a smaller Tier 3 financial institution with alleged ties to President William Ruto, abandoning the long-standing relationship with Co-operative Bank, a reputable Tier 1 institution.

During a heated plenary session, Majority Leader Peter Imwatok failed to explain even the most basic details when pressed by MCAs about the loan request to settle salary and salary-related expenditure. The special motion left ward representatives from both sides of the political divide stunned by its audacity.

“We don’t have the content in the statement. What are we passing? What is the exact amount that they want to borrow? What are the terms? We do not want to be reduced to conveyor belts,” Ngara Ward MCA Chege Mwaura demanded during the session.

Minority Leader Anthony Kiragu cautioned the City County Assembly against being used by the Executive to achieve its agenda without asking important questions. “I request that you protect this House from bombardment with useless papers that do not follow the law. It is important that Finance Executive Charles Kerich attach it with a nexus before bringing it to this House,” Kiragu said.

The timing couldn’t be more suspicious.

The loan request comes as county government workers have experienced repeated salary delays, with the October salary only received on November 18, despite Sakaja’s campaign promise that workers would never face such delays under his watch.

There are also concerns from the County Government Workers Union about repeated delays to salaries and statutory deductions, which they say have caused them distress.

On November 5, following a County Executive Committee resolution from October 28, Nairobi County Secretary Godfrey Akumali directed all Level 4 and 5 hospitals to cease transactions with Co-operative Bank and open new accounts with Sidian Bank.

No public explanation was provided for this abrupt change at the time.

The switch has triggered outrage from political leaders and civil society.

Nairobi Senator Edwin Sifuna condemned the move as suspicious and potentially corrupt, stating, “How you wake up one day and direct all of them to move to a tier three bank cannot be explained any other way than that corruption is at play.”

But the controversy runs deeper.

Former Deputy President Rigathi Gachagua alleged in a recent interview that a senior official in President Ruto’s administration acquired a local bank through proxies shortly after the 2022 elections, with multiple sources pointing to Sidian Bank as the institution in question.

In September 2023, Sidian Bank’s shareholders approved the acquisition of a 38.91 percent stake by three entities.

Pioneer General Insurance Limited acquired 20 percent, Wizpro Enterprises Limited secured 15 percent, and Afram Limited obtained 3.91 percent. While official ownership remains opaque, public sentiment has fueled speculation about connections to prominent Kenyan figures, including claims of indirect ownership by President Ruto.

The loan request has exposed the dire state of Nairobi County’s finances.

As of June 2024, the county’s pending bills had ballooned to Sh118.3 billion, an increase of Sh11 billion from the previous year, equivalent to 86 percent of the county’s entire annual revenue.

Former planning PS Irungu Nyakera revealed that Nairobi’s wage bill has exploded from Sh6 billion with 5,777 employees in June 2022 to Sh17.3 billion with 16,321 staff by June 2024, while revenue barely moved from Sh12.1 billion to Sh13.8 billion.

“The governor was asking for a blank cheque. This is how Nairobi has been piling up debts and pending bills. Zero governance, zero oversight and a system that keeps enabling reckless decisions at the expense of Nairobians,” Nyakera warned.

Civil rights group Bunge La Mwananchi has moved to the High Court to contest the Sidian Bank directive, claiming it is unconstitutional and undermines transparency and accountability principles.

The petitioners argue that the directive violates multiple constitutional provisions and could indicate irregular financial arrangements.

The activists have named the Nairobi City County Government, the County Executive Committee Member for Finance, and the Attorney-General as respondents, seeking to suspend the directive until the matter is heard.

Appearing before the Senate Committee on Devolution and Intergovernmental Relations, Sakaja defended the county’s decision to move hospital deposit accounts to Sidian Bank, saying the shift was informed by administrative and financial considerations.

He said the previous bank had caused delays in processing salaries, making it difficult for the county to pay health workers on time, especially when the national government delayed reimbursing county funds.

He added that the law was fully followed, noting that the Public Finance Management Act does not restrict counties to opening accounts in specific banks.

He also said the interest rates offered by the previous bank were unfavorable, prompting the county to look for a better option.

“Sidian had a cheaper interest rate and gave us a better offer. It is a good deal. We invited many banks, and Sidian presented the best package. As for ownership, every bank has owners, but what matters is good service,” Sakaja told the committee.

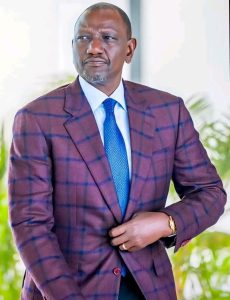

Nairobi Governor Sakaja Johnson, when he appeared before Senate Committee on Devolution and Intergovernmental Relations/HANDOUT

He emphasised that no law was broken and that the move was made in the best interest of the county to address salary delays, given that Sidian Bank provided the most favourable terms.

“It was an administrative issue. The main challenge we had was management; there were cheque delays, and we struggled to pay workers. The interest rates from the previous bank were also very high, so we decided to move to Sidian Bank after they gave us a better offer,” Sakaja told the committee.

However, the governor’s explanations have done little to quell suspicions among MCAs and civil society activists who point to the opacity of the loan request as evidence of deeper financial irregularities.

Critics note that if the banking switch was motivated by efficiency concerns as Sakaja claims, why did he fail to provide similar transparency when requesting the mystery loan from the County Assembly.

This latest scandal adds to mounting pressure on Governor Sakaja, who narrowly survived an impeachment attempt in September after interventions by President Ruto and ODM leader Raila Odinga.

MCAs accused him of delays in bursary disbursement, corruption cases, stalled ward projects, failure to release ward development funds, dilapidated roads, uncollected garbage, and misappropriation of public funds.

Assembly Speaker Kennedy Ng’ondi, quelling the members during the chaotic session, said the papers had been laid and stand committed to the Budget and Appropriation Committee to do a report on behalf of the House members.

“We expect nothing short of a comprehensive interrogation of the requirement in line with the status and articles of the constitution,” Ng’ondi said.

As MCAs demand answers and civil society prepares for legal battle, one question looms large over Kenya’s capital. Is this a routine administrative change, or the latest chapter in a systematic capture of public resources.

The County Assembly’s Budget and Appropriation Committee is expected to conduct a comprehensive interrogation of the loan request.

But with the governor’s track record of opacity and the suspicious timing of the banking switch, many Nairobians are bracing for more revelations in what could become one of the city’s most significant financial scandals.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News1 week ago

News1 week agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations1 week ago

Investigations1 week agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy1 week ago

Economy1 week agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa2 weeks ago

Africa2 weeks agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Grapevine5 days ago

Grapevine5 days agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Politics2 weeks ago

Politics2 weeks agoSifuna, Babu Owino Are Uhuru’s Project, Orengo Is Opportunist, Inconsequential in Kenyan Politics, Miguna Says