Economy

Treasury Avoids Tax Hikes in New Finance Bill Following Last Year’s Protests

Instead of introducing new taxes, the William Ruto administration is targeting tax expenditures by changing the VAT status of various manufacturing inputs from zero-rated to exempt.

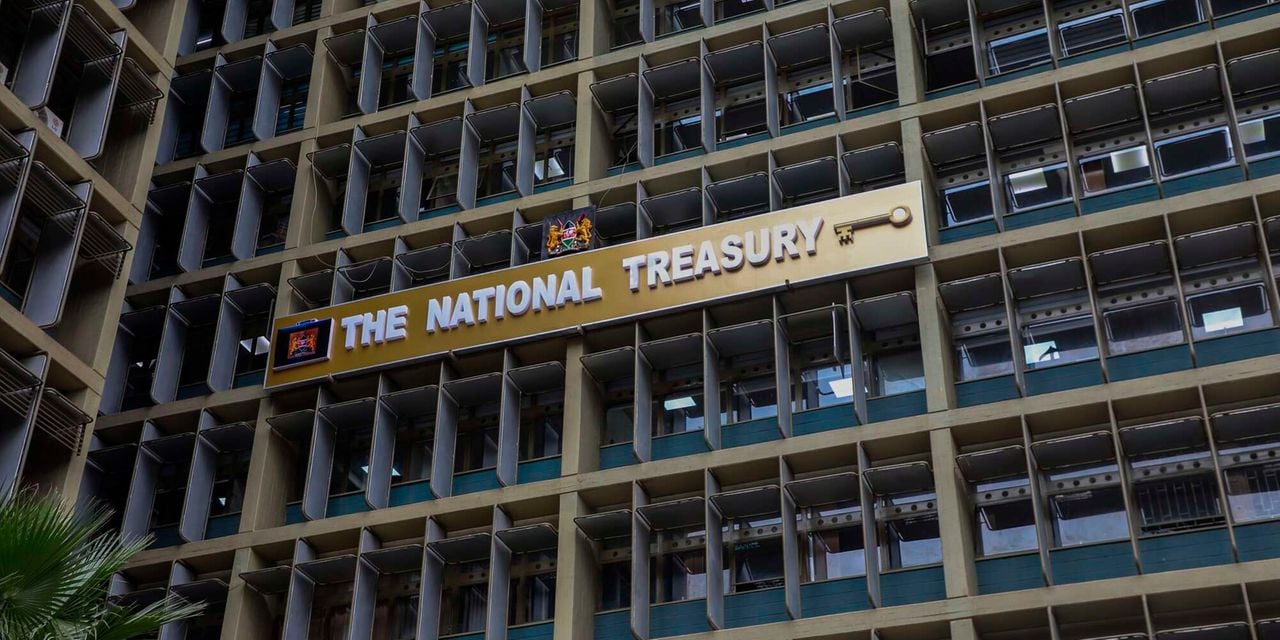

In a significant policy shift that appears to acknowledge last year’s widespread youth-led protests, the government has steered clear of aggressive tax increases in the Finance Bill 2025, opting instead to focus on closing revenue leakages and enhancing tax administration efficiency.

The draft bill, tabled in Parliament on Wednesday, marks a notable departure from previous years’ approaches that typically included higher excise duties on common consumer goods such as alcohol, cigarettes, and imported products.

“The government has clearly learned its lesson from the June 2024 protests that forced the withdrawal of last year’s Finance Bill,” said economic analyst Maria Kamau. “They’re now taking a more cautious approach to avoid triggering similar public outrage.”

Instead of introducing new taxes, the William Ruto administration is targeting tax expenditures by changing the VAT status of various manufacturing inputs from zero-rated to exempt.

This technical adjustment means manufacturers will no longer be able to claim VAT refunds on these inputs, with the cost likely being passed to consumers.

Products affected by this change include locally assembled mobile phones, animal feed, raw materials for pharmaceutical products, solar and lithium batteries, and electric bicycles.

According to a Cabinet brief released ahead of the bill’s tabling, the focus is on “closing loopholes and enhancing efficiency, including addressing loopholes related to tax expenditures that have historically been exploited to siphon funds from public coffers, such as through inflated tax refund claims.”

The Treasury has also proposed amendments to the Tax Procedures Act that would remove barriers preventing the Kenya Revenue Authority (KRA) from integrating its systems with those of businesses.

This would effectively give the tax authority direct access to payment data, strengthening its ability to identify tax evasion.

Additionally, the KRA is working to integrate its iTax system with government payment platforms including the Integrated Financial Management System (Ifmis), Government Human Resource Management Information System (GHRIS), and the Central Bank System to better track tax compliance among public sector suppliers and government employees.

Molo MP Kuria Kimani, who chairs the National Assembly’s Finance and National Planning Committee, cautioned that the bill is still subject to changes.

“It is a draft document that was released by the National Treasury. It is undergoing review and some of the proposals in it will be in the final document that will be published by next week,” he said.

The government’s cautious approach comes after the dramatic events of June 2024, when protestors stormed Parliament shortly after MPs passed last year’s Finance Bill.

That bill had sought to raise more than Sh360 billion in additional revenue but was withdrawn following days of nationwide demonstrations.

Some withdrawn provisions were later reintroduced through the Tax Laws (Amendment) Act 2024 in December, as the government attempted to meet revenue targets required under its funding agreements with the International Monetary Fund and World Bank.

The government has increasingly turned to alternative revenue sources, including raising levies on fuel and government services.

Last July, the Road Maintenance Levy was increased from Sh18 to Sh25 per liter, aiming to generate an additional Sh30 billion annually for road contractors’ pending bills and maintenance of the expanded road network.

Other recent revenue measures include the Housing Levy (1.5 percent of gross pay, matched by employers) and enhanced contributions to the Social Health Insurance Fund (2.75 percent of earnings, previously capped at Sh1,700 monthly).

While the draft bill doesn’t specify how much additional revenue these measures are expected to generate, analysts suggest the government is walking a tightrope between meeting its fiscal targets and avoiding another wave of public protests that could destabilize the administration.

The Finance Bill 2025 is expected to be finalized next week, with Parliament set to debate its provisions before the June 30th deadline for the approval of the budget for the 2025/26 fiscal year.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business4 days ago

Business4 days agoCooking Fuel Firm Koko Collapses After Govt Blocks Sh23bn Carbon Deal

-

Business3 days ago

Business3 days agoABSA BANK IN CRISIS: How Internal Rot and Client Betrayals Have Exposed Kenya’s Banking Giant

-

Politics2 weeks ago

Politics2 weeks agoYour Excellency! How Ida’s New Job Title From Ruto’s Envoy Job Is Likely to Impact Luo Politics Post Raila

-

Business2 weeks ago

Business2 weeks agoMinnesota Fraud, Rice Saga, Medical Equipment Deal: Why BBS Mall Owner Abdiweli Hassan is Becoming The Face of Controversial Somali Businessman in Nairobi

-

Americas3 days ago

Americas3 days agoEpstein Files: Bill Clinton and George Bush Accused Of Raping A Boy In A Yacht Of ‘Ritualistic Sacrifice’

-

News2 weeks ago

News2 weeks agoKenya Stares At Health Catastrophe As US Abandons WHO, Threatens Billions In Disease Fighting Programmes

-

News2 weeks ago

News2 weeks agoDCI Probes Meridian Equator Hospital After Botched Procedure That Killed a Lawyer

-

Investigations1 week ago

Investigations1 week agoPaul Ndung’u Sues SportPesa for Sh348 Million in UK Court, Accuses Safaricom Boss of Sh2.3 Billion Conspiracy