Business

Stanbic CEO Joshua Oigara Escapes Arrest Over Deposit Row With Airline Company

The lender moved to court last month to stop the banking fraud unit (BFIU) at the Directorate of Criminal Investigations (DCI) and Mr Ingonga from instituting charges against Mr Oigara, its directors or staff in a dispute with Air Afrik Aviation Ltd.

The Banking Fraud Investigations Unit has been blocked from questioning Stanbic chief executive officer Joshua Oigara or any of the lender’s employees, over millions of shillings deposited into an airline’s account and later reversed, pending the determination of a petition by the bank.

High Court judge Bahati Mwamuye also restrined the Director of Public Prosecutions (DPP) Renson Ingonga from instituting criminal charges against Mr Oigara or any directors, staff or employees of Stanbic, pending the hearing of the case.

The lender moved to court last month to stop the banking fraud unit (BFIU) at the Directorate of Criminal Investigations (DCI) and Mr Ingonga from instituting charges against Mr Oigara, its directors or staff in a dispute with Air Afrik Aviation Ltd.

The bank argued that the DCI was seeking to investigate a matter that is pending before the High Court.

The lender’s lawyer, Hiram Nyabui, informed the court that police officers had camped at the bank’s offices seeking to arrest the officials, a move that would render the petition useless.

The judge said the DPP can make an application for the discharge of the orders.

“That this honourable court be pleased to issue conservatory order staying the execution or implementation or the requisition to compel attendance addressed to the 2nd petitioner (Mr Oigara) by the Banking Fraud Investigations Unit of the 1st respondent (DCI), pending the inter-partes hearing and determination of this application,” the lender said.

The bank said BFIU issued the summons for Mr Oigara to appear for questioning and statement taking on October 17.

However, the lender said it found the timing suspicious, coming a week after Stanbic opened its defence in the matter pending before the High Court.

Further, the lender said that the matter had been investigated by the Central Bank of Kenya in 2016 following a complaint by the airline and the parties were allegedly advised to resolve the matter amicably or pursue a civil case.

He said Mr Oigara failed to appear as directed by the DCI and the police issued a fresh summons.

“The subject matter of the requisition pertains to the very matters that were the subject of the investigations that were concluded on December 6, 2016, more than eight years ago as well as the civil suit that is currently part-heard before the High Court,” the bank said.

The lender said the purported statement taking is intended to harass and intimidate Stanbic and interfere with its ability to defend the proceedings pending before court.

Further, that is also intended for ulterior purposes of embarrassing the bank and coerce it to abandon the defence of the civil suit or settle the matter, the lender added.

“The intended parallel criminal proceedings are calculated to embarrass, humiliate, vex and eventually force the petitioners to concede to the interested party’s claims in the civil suit,” Janet Wanjohi, the bank’s head of legal said in an affidavit filed in court.

Ms Wanjohi added that the move amounts to impunity on the part of the police and prosecution.

The managing director of Air Afrik, Eric Lugalia, said in response to the petition that the police should be allowed to do their job.

“That it is only in the interest of justice that if the petitioners/applicants do not have anything to hide, let them answer the issued summons thereof,” said Mr Lugalia.

The airline was a customer of the bank and operated an account at its branch in Juba, South Sudan.

On February 5, 2016, the bank received a credit note from Bank of South Sudan (BoSS), advising it that the airline’s clearing and settlement account at BoSS had been credited with $7.22 million (about Sh931 million).

The lender then credited Air Afrik’s bank account with the amount.

Stanbic said the airline allegedly carried out large value transactions on its account and withdrew a total of $1.1 million (Sh141 million).

The lender said it later realised that no actual funds had been remitted by BoSS as alleged and reversed the funds to prevent further withdrawals as the funds ‘were paid in error”.

The airline sought damages for losses it suffered after a plane leasing contract of $20 million with South Sudan government was terminated after the funds were withheld.

The parties then tried unsuccessfully to resolve the dispute before Air Afrik lodged the complaint with the CBK.

Justice Mwamuye directed the matter to be mentioned on December 10, for further directions.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations1 day ago

Investigations1 day agoSOLD TO THE BULLET: How the Bodyguard Handed MP Ong’ondo Were to His Killers

-

Investigations1 week ago

Investigations1 week agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations2 weeks ago

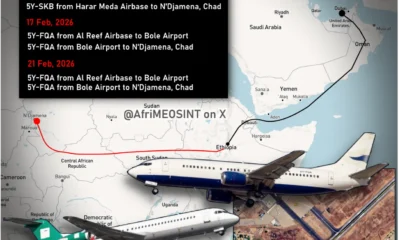

Investigations2 weeks agoTracker Identifies Kenyan-Registered Flights Allegedly Running Errands for RSF