News

Second Suspect, A Regional Tecno Distributor, Nabbed In Sh28 Million Gold Scam Targeting American Investor, Rogue Lawyer Michael Owano On The Run

Owano, the advocate behind MOAC Advocates, has found himself cast not as a professional servant of the law but as the alleged operational linchpin of a criminal enterprise targeting foreigners.

NAIROBI, Kenya — The walls are closing in.

Barely a week after the first arrest in a brazen gold scam that robbed an American businessman of USD 217,900, detectives from the Directorate of Criminal Investigations have hauled in a second suspect whose role in the scheme is as audacious as it is damning. Mohammed Noor Muhyadhin Mohammed, a Nairobi-based mobile phone trader with business tentacles stretching all the way to Hong Kong, was this week arrested by sleuths from the Operations Support Unit (OSU) for his alleged role in laundering millions of shillings that passed through his hands like sand through a sieve.

What makes this arrest remarkable is not just the scale of the fraud, now one of the most investigated gold scam networks in recent Nairobi history, but the identity of the man caught in the crosshairs. Mohammed is the sole proprietor of Mohazcom Trading, a registered Kenyan business that sources mobile phones primarily from Tecno Mobile Limited, one of the most recognised handset brands in East and Central Africa.

The revelation that a legitimate electronics distribution business allegedly served as a conduit for criminal proceeds has sent shockwaves through Nairobi’s trading corridors.

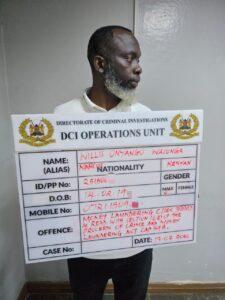

His arrest follows the February 16 arraignment of Willis Onyango Wasonga, known in shadier circles by the street alias “Marcus,” who now faces a thunderclap of charges at Milimani Law Courts: conspiracy to defraud contrary to Section 317 of the Penal Code; obtaining money by false pretences contrary to Section 313; and three counts under the Proceeds of Crime and Anti-Money Laundering Act (POCAMLA No. 9 of 2009), covering acquisition, possession, and use of proceeds of crime.

Wasonga pleaded not guilty and was released on a bond of Ksh 1 million, with the case returning for mention on March 3, 2026. The bond, critics say, was a bargain price for a man accused of engineering a multi-million shilling con.

The scheme itself reads like a crime thriller.

An American businessman, John Sodipo, and his Russian associate, Gershonov Oleg, were wooed into a deal for the purchase and chartered export of 495 kilograms of gold to Dubai.

The promise was glitter. The delivery was dust. Sodipo deposited funds into what he was assured was a legitimate escrow arrangement handled by MOAC Advocates, the law firm of one Michael Otieno Owano, a Nairobi advocate who has now earned the unenviable distinction of appearing at the centre of three separate fraud investigations targeting foreign investors.

That is where Mohammed enters the picture, and where the story darkens further.

Investigators have established that on February 3, 2026, USD 217,900 was transferred in a swift transaction from MOAC Advocates’ account at the National Bank of Kenya directly into Mohammed’s company account at the same institution.

The speed and precision of the transfer raised immediate red flags.

Within the same breath, Mohammed wired the entire amount overseas to accounts held by Tecno Mobile Limited at Citibank in Hong Kong, purportedly to finance a new shipment of mobile phones that, investigators note pointedly, has yet to set foot on Kenyan soil.

In a city where Nairobi’s murky gold underworld is estimated to be worth USD 28 billion, making it larger than the country’s entire national budget, the mechanics of laundering criminal proceeds through legitimate-seeming businesses is nothing new.

What separates this case is the sophistication of the paper trail assembled to cover the crime.

MOAC Advocates presented detectives with a debt settlement agreement allegedly signed by Mohammed and a second suspect still at large, a document investigators have now dismissed as what they describe as a mere smokescreen, a paper shield crafted to sanitise what was in reality a straightforward money laundering operation.

The threads connecting Mohammed to the broader syndicate do not end with a single suspicious transfer.

Investigators have dug deeper and established that he has maintained a decade-long business relationship with a forex bureau operating along Standard Street in the heart of Nairobi’s central business district.

This bureau, whose proprietor worked in close coordination with Mohammed, is believed to have routinely facilitated substantial cross-border transfers, including the very transaction now under scrutiny. Detectives say the bureau played a key role in the layering and concealment of criminal proceeds, the classic hallmarks of organised money laundering.

The name looming over everything, however, is that of Michael Otieno Owano.

Owano, the advocate behind MOAC Advocates, has found himself cast not as a professional servant of the law but as the alleged operational linchpin of a criminal enterprise targeting foreigners.

His firm’s accounts are now the subject of forensic investigation in connection with three separate fraud operations.

In November 2024, he was arrested following a Ksh 182 million fake tender scheme that targeted an American firm, Underground Pipeline Rehabilitation Company, with his firm receiving USD 90,000 in purported legal fees while the victim was deceived into paying over USD 1.6 million for fictitious government contracts bearing the names of the Kenya Civil Aviation Authority and the Kenya Meteorological Department.

He was released on bail while the Director of Public Prosecutions reviewed the matter.

In August 2025, Owano was arrested again in connection with a Sh79 million fake gold scheme targeting a Canadian investor, in which a proforma invoice of USD 318,400 was issued by a company called EAI Logistics, with funds wired directly into his firm’s account.

The victim was also pressured into sending USDT 300,000 in cryptocurrency. In that case, Owano was linked to a Cameroonian national, Francis Ouafo, identified as the mastermind of that operation.

Now Owano is wanted in connection with this latest case. Detectives are described as being hot on his heels, and sources indicate that three additional suspects remain at large. The rogue advocate has not been publicly apprehended as of press time, and the DCI has confirmed investigations are ongoing.

Three cases. Three sets of foreign victims. Three sets of criminal allegations. And a man who remains a licensed advocate, bound by the Law Society of Kenya to uphold ethics that, investigators allege, he has systematically trampled underfoot.

Nairobi’s reputation as a gold scam capital is not a new wound.

The DCI Director-General himself has described the problem as a huge cartel involving Kenyans, Congolese, Liberians, Nigerians, and Ghanaians, operating in a very sophisticated manner, with the upmarket Kilimani residential area specifically fingered as Africa’s fortress of gold scams.

The United Nations and international investigative agencies have documented massive discrepancies between what Kenya officially exports in gold and what the UAE alone reports importing from Kenya, suggesting a shadow economy of staggering proportions flowing beneath the surface of the country’s commercial life.

For Mohammed, the next stop is a magistrate’s court. He is currently in custody, undergoing processing for arraignment. For Wasonga, it is a court date on March 3. For Owano, it is a manhunt that detectives say is closing in by the hour.

For Kenya, it is a reckoning.

The country’s credibility as a destination for serious foreign investment depends in part on its ability to chase down and punish the conmen who have turned the promise of gold into a weapon against the very investors the country needs.

Every shilling stolen from a foreign businessman is not just a personal loss. It is a message broadcast to boardrooms in New York, Toronto, and beyond: that Kenya’s legal system, its licensed professionals, and its registered businesses can be instruments of fraud.

Whether the courts will deliver that reckoning remains to be seen. What is no longer in doubt is that the DCI is now pulling hard on threads that lead, investigators believe, to a syndicate far larger than the two men so far arraigned.

The gold was never real. The lawyers may have been. The reckoning is coming regardless.

The case returns for mention on March 3, 2026.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine1 week ago

Grapevine1 week agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Grapevine4 days ago

Grapevine4 days agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein Files: Sultan bin Sulayem Bragged on His Closeness to President Uhuru Then His Firm DP World Controversially Won Port Construction in Kenya, Tanzania

-

Investigations1 day ago

Investigations1 day agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Investigations1 week ago

Investigations1 week agoEpstein’s Girlfriend Ghislaine Maxwell Frequently Visited Kenya As Files Reveal Local Secret Links With The Underage Sex Trafficking Ring

-

News2 weeks ago

News2 weeks agoState Agency Exposes Five Top Names Linked To Poor Building Approvals In Nairobi, Recommends Dismissal After City Hall Probe

-

Business1 week ago

Business1 week agoM-Gas Pursues Carbon Credit Billions as Koko Networks Wreckage Exposes Market’s Dark Underbelly