Development

Ruto Administration Borrowing Sh1 Trillion Every Year, CBK Data Shows

The data shows that Kenya now owes Sh6.33 trillion to domestic creditors and Sh5.5 trillion to external lenders.

Kenya’s public debt has risen sharply under President William Ruto’s administration, with new data from the Central Bank of Kenya indicating that the government has taken on an average of Sh1 trillion in fresh loans every year since 2022.

The figures, presented to the Public Debt and Privatisation Committee of the National Assembly, show that the country’s debt stock has grown by about Sh3 trillion in just three years.

According to the CBK, Kenya’s total public debt stood at Sh8.7 trillion in the 2021/22 financial year when President Ruto assumed office. By June 30, 2025, the amount had climbed to Sh11.81 trillion.

This represents a 17 percent increase and reflects a heavy dependence on domestic borrowing, which has intensified pressure on the country’s fiscal sustainability.

The data shows that Kenya now owes Sh6.33 trillion to domestic creditors and Sh5.5 trillion to external lenders.

The shift towards local borrowing has been driven by the government’s rising budget needs and the limited availability of affordable foreign loans.

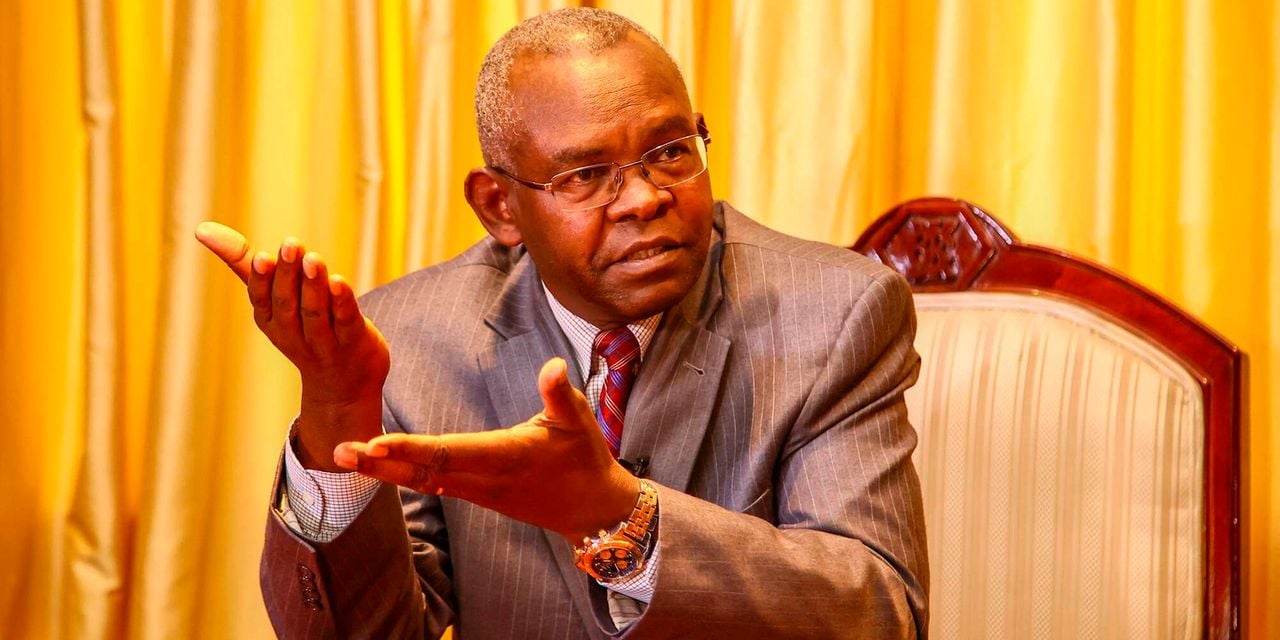

In a presentation to lawmakers, CBK Governor Kamau Thugge said recent borrowing targets have been more aggressive as the domestic market continues to absorb the growing financing requirements.

Despite the surge, the CBK document does not specify which projects were funded by the Sh3 trillion borrowed in the first three years of the Kenya Kwanza government, a gap that has drawn concern from legislators and economic analysts.

President Ruto took office in September 2022 promising to implement strong fiscal consolidation measures to stabilise the economy, which was facing the effects of drought, post-pandemic shocks and rising global interest rates.

However, Treasury data shows that the pace of borrowing has continued to accelerate, pushing the debt-to-GDP ratio to nearly 69 percent.

Interest payments have also grown significantly and now account for one of the largest components of government expenditure.

Domestic interest alone has risen from Sh388.8 billion in the 2020/21 financial year to Sh776.3 billion in 2024/25.

The rapid growth reflects higher obligations tied to Treasury bonds and the expanding share of domestic debt.

Dr Thugge told MPs that although Kenya’s public debt remains within sustainable thresholds, the country faces a high risk of debt distress.

The concern is linked to missed revenue targets and the government’s increasing reliance on short-term domestic instruments, which attract higher interest rates and carry frequent refinancing risks.

The CBK report notes that domestic interest payments now consume a larger share of ordinary revenue and recurrent expenditure, underscoring the growing strain on fiscal stability.

Economists warn that this trend has crowded out the private sector, especially small and medium-sized enterprises, by limiting the availability of affordable credit.

To reduce vulnerability, the government has begun implementing a series of reforms aimed at strengthening the domestic debt market.

These include broadening the investor base, diversifying debt instruments and improving efficiency in the government securities market.

Officials hope these measures will improve liquidity, reduce concentration risks and ease the cost of future borrowing.

Kenya’s rapid debt growth remains a central issue in the national debate over economic direction.

As the government enters its fourth year in office, attention is now shifting to whether the administration can curb its appetite for borrowing and free up resources for development, or whether rising interest costs will continue to overshadow critical spending priorities.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations2 weeks ago

Investigations2 weeks agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations7 days ago

Investigations7 days agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners