Economy

Running on Empty: South Sudan Is Out of Foreign Exchange Reserves

South Sudan, battered by years of conflict and corruption, has run out of foreign exchange reserves and cannot stop the pound’s depreciation, a senior central bank official in the oil-producing nation said on Wednesday.

South Sudan gets almost all of its revenue from crude oil, but current output, at about 180,000 barrels per day (bpd), has plummeted from a peak of 250,000 bpd before the outbreak of conflict in 2013, according to official figures.

“It is difficult for us at the moment to stop this rapidly increasing exchange rate, because we do not have resources, we do not have reserves,” Daniel Kech Pouch, the bank’s second deputy governor, told a news conference.

South Sudan has three exchange rates – one from the central bank, from commercial banks, and from the unofficial market. Pouch said the rate for the pound from the central bank is 165 a dollar, from commercial banks about 190, and 400 from the parallel market.

In addition to lower oil production, corruption is also driving the crisis, said Brian Adeba, the deputy director of policy at United States-based watchdog The Sentry, which has released several reports documenting high-level corruption. The government has denied the findings.

“For a long time, egregious corruption and the deliberate destruction of institutional mechanisms for checks and balances have resulted in officials using the central bank as their personal ATM, so this [running out of foreign exchange] is not surprising,” Adeba told the Reuters news agency.

South Sudan ended five years of civil war in 2018 but disagreements between President Salva Kiir and First Vice President Riek Machar, who led the main rebel group, have stalled the conclusion of the peace process.

The war – marked by ethnic cleansing, extreme sexual violence and pockets of famine – displaced around a third of the population from their homes. The conflict killed an estimated 400,000 people and created Africa’s biggest refugee crisis since the 1994 genocide in Rwanda.

“The Bank of South Sudan and ministry of finance have created serious economic blunder by taking out the SSP reserve from the treasury and giving it to businessman … This is dangerous for the peace agreement because it will create fear,” said James Okuk, researcher at the Juba-based Center for Strategic and Policy Studies.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations1 day ago

Investigations1 day agoSOLD TO THE BULLET: How the Bodyguard Handed MP Ong’ondo Were to His Killers

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations1 week ago

Investigations1 week agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations2 weeks ago

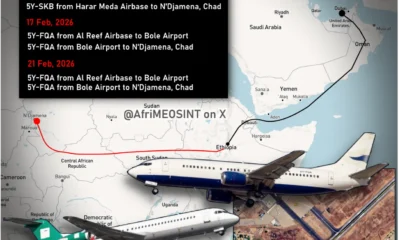

Investigations2 weeks agoTracker Identifies Kenyan-Registered Flights Allegedly Running Errands for RSF