Business

Revealed: NCBA Bank’s Hand In Fake Fertilizer Scam

Documents tabled by the prosecution in the court indicate that the firm, 51 Capital owned by controversial businessman with a criminal past Joe Kariuki used fake documents in almost all its transactions that saw it being paid Sh 206.2 million in a deal that has left farmers with heavy losses.

In what ignited the memories of NYS saga where banks were used in looting public funds, NCBA Bank finds itself in muddy grounds after being dragged the multimillion fake fertilizer saga that has caught the country in shock and left many farmers counting losses thanks to the greed of a few who conspired with crooked businessmen in the supply chain.

Documents tabled by the prosecution in the court indicate that the firm, 51 Capital owned by controversial businessman with a criminal past Joe Kariuki used fake documents in almost all its transactions that saw it being paid Sh 206.2 million in a deal that has left farmers with heavy losses.

It has emerged that he used the Kenyatta’s owned bank to defraud farmers and consequently launder money.

Details are now emerging of how National Cereals and Produce Board (NCPB) top officials conspired with a Joe Kariuki to supply farmers with an ingredient used to reduce high acidity in the soil in the disguise of providing them with fertilizer.

Reports also indicate that those behind the scheme, bought the soil conditioner, scientifically known as diatomaceous at Sh 200 per a kilogramme and sold it to NCPB at Sh1700 , making an impeccable profit.

A total of 106, 000 bags of diatomaceous 25 kg each (soil conditioner) were supplied to NCPB with 51 Capital being paid Sh 205, 222,000 through its account number 4746630018, NCBA bank, Prestige branch through Swift Code CBAFKENXXXX.

According to the documents, 51 Capital entered into a contract with NCPB on March 31, 2022 so supply to the cereals board among other items, animal supplements, GPC Guard and Diatomaceous.

Suspended NCPB Managing Director Joseph M. Kimote and Corporation Secretary J.K Ngetich signed the contract behalf of the parastatal while Josiah Kimani Kariuki, the director at 51 Capital signed on behalf of the private entity. A Mr Abraham G. Wanjiru signed the document as a witness.

Details have now emerged how 51 Capital purportedly bought the soil conditioner from African Diatomite Industries , packaged it in 25 kg bags and sold resold it to NCPB.

Although in the agreement, 51 Capital purported to have been supplying the soil conditioner together with African Diatomite Industries, investigations by the Economic and Commercial Crimes Unit of the Directorate of Criminal Investigations established otherwise.

According to ECCU, 51 Capital is said to have used fake papers to bring African Diatomite Industries into the deal without their knowledge.

Already, three top officials of NCPB have been charged before an Anti-corruption court with Sh209million fake fertiliser scandal.

They are accused that jointly with others not before court, they conspired with intent to defraud Kenyan farmers, sold a total of 139,688 bags of 25 Kgs each of soil amendment and conditioner valued at Sh209,532,000 purporting it to be a genuine fertilizer a fact they knew to be false.

Kamote was charged that being the MD at the NCPB, used his office to improperly confer a benefit to Kariuki by executing an Agency Contract between the NCPB and 51 Capital, African Diatomite Industries Limited to supply 139,688 bags of 25Kgs each of soil amendment and conditioner branded as fertiliSer within NCPB depots across the country.

Ngetich was charged separately that on March 31, 2022, at Kenya NCPB headquarters Nairobi City within Nairobi County, being the Cooperate Secretary at NCPB used his office to improperly confer a benefit to Kariuki by executing an Agency Contract between the National Cereals and Produce Board and 51 Capital, African Diatomite Industries Limited.

The third NCPB official, John Mbaya was accused that being the Chairman of Business Development and Advisory Committee at the NCPB used his office to improperly confer a benefit to Kariuki by recommending an Agency agreement between the NCPB and 51 Capital, African Diatomite Industries Limited to supply 139,688 Bags of 25 Kgs each of soil amendment and conditioner branded as fertilizer within NCPB depots across the country.

Kariuki, the director of the two companies at the center of the fake fertilizer scandal namely Fifty-One Capital Limited and SBL Innovate Manufacturers Limited, was accused of selling fake fertiliser to NCPB for distribution to farmers and forgery contrary to the Penal Code, falsifying crucial tender documents and applying standardisation mark to substandard goods.

Kariuki also faced a separate charge of manufacturing substandard goods for sale and knowingly using wrong labels on the bags of fake fertiliser.

They were charged before Milimani Anti-Corruption Court Magistrate Celesa Okore where they all denied the charges and a pre-trial conference has been scheduled for June 17.

While 51 Capital was purchasing the soil conditioner from African Diatomite at Sh 200, it sold the same to NCPB at Sh 1,700, with the later pocketing Sh 200 as commission for operations. Thus 51 Capital ended up pocketing a cool Sh 1,500 from each kilogram of soil conditioner.

In the document, now tabled before the court, 51 Capital had promised to deliver to the board’s designated regions, depots and silos products meeting the Kenya Bureau of Standards (KEBS) with the payment being made within 14 days after delivery.

Banks fined

In what could likely befall NCBA Bank, the Central Bank of Kenya (CBK) in 2018 found five banks culpable for illegally handling the billions stolen from NYS and fined them millions of shillings.

CBK said the banks violated the law by failing to report the large cash transactions and failing to undertake adequate customer due diligence.

Standard Chartered Bank was fined Sh77.5 million, Cooperative Bank (Sh20 million), DTB (Sh56 million), Equity (Sh89.5 million) and KCB (Sh149.5 million).

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations1 day ago

Investigations1 day agoSOLD TO THE BULLET: How the Bodyguard Handed MP Ong’ondo Were to His Killers

-

Investigations1 week ago

Investigations1 week agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations2 weeks ago

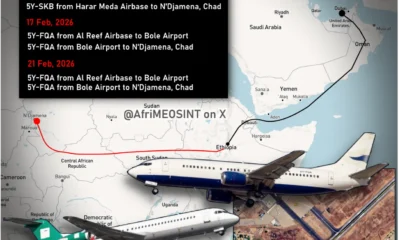

Investigations2 weeks agoTracker Identifies Kenyan-Registered Flights Allegedly Running Errands for RSF