Kenya Revenue Authority (KRA) has introduced a new mobile phone application that will ease access to its portal for taxpayers thus easing tax transactions and compliance.

The application dubbed “KRA M-Service App “enables taxpayers to access various services offered by the taxman such as taxpayer registration and verification, filing of returns and payment of tax.

The system will widen taxpayer reach, increase revenue collection and enhance tax compliance by making the tax payment process more convenient. It will also reduce the cost of compliance by removing intermediaries.

Taxpayers will be now able to easily register, pay and file returns for Monthly Rental Income (MRI) and Turnover Tax (TOT) obligations through the App.

Registration for Personal Identification Number (PIN) both Kenyan and Alien citizenship as well as perform checks on PIN has also been enabled, Payment Registration Number (PRN), Tax Compliance Certificate (TCC) and confirm identity of KRA staff.

KRA M-Service application further allows taxpayers to file nil tax returns for Income Tax-Resident and Non-Resident, Income Tax Partnership and Income Tax-Company, Value Added Tax (VAT), Pay as You Earn (PAYE), Excise tax and Monthly Rental Income (MRI).

How to access the application

To access and use the Application, taxpayers with smart mobile phones are required to download and install the Application from Google Play Store.

Users with no PIN will be required to register first while those already with PINs can register on the app then login in and choose the particular services they require.

Nil tax return filers will conveniently file returns on their mobile phones by following simple steps;

1. Choose tax returns on the application

2. Select Nil Return,

3. Select the required obligation from the list e.g. VAT, input and confirm the period of the tax return and other details respectively.

Taxpayers will equally have an opportunity to validate KRA employees by checking their identification using the M-Service ‘Jua for Sure’ option hence avoid dealing with imposters and fraudsters.

KRA M-Service App will expand the tax base by on boarding the informal sector players who cannot use computers. The introduction of mobile application KRA M-Service also enhances remote operations while addressing the informal and micro-enterprise sector through ecommerce and m-commerce transactions.

Approximately 37,000 taxpayers have so far downloaded the App for use in accessing various tax services.

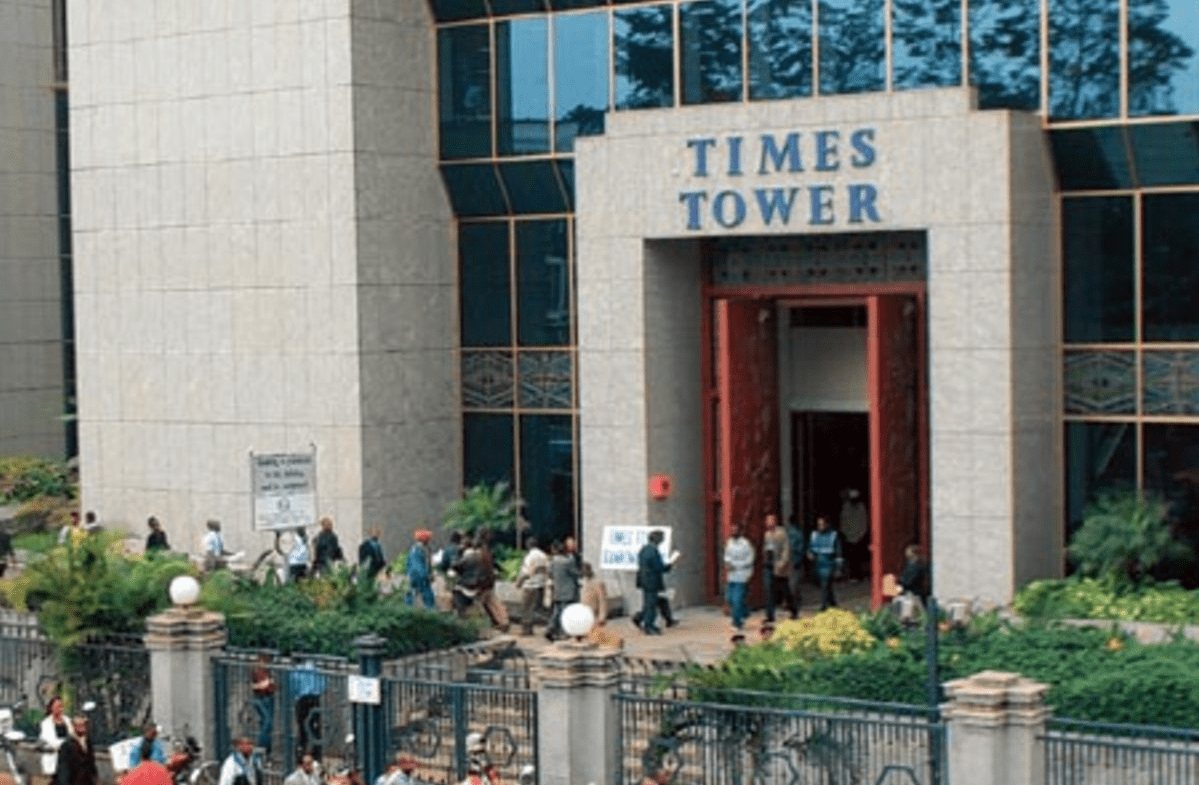

KRA is an agency of the Government of Kenya that is responsible for the assessment, collection and accounting for all revenues that are due to the government, in accordance with the laws of Kenya.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Opinion2 weeks ago

Opinion2 weeks ago

News2 weeks ago

News2 weeks ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago

Investigations1 week ago