Business

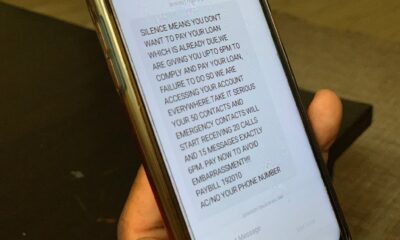

Google Has Suspended Hundreds Of Unlicensed Loan Apps In Kenya

-

Investigations5 days ago

Investigations5 days agoInvestigation Exposes Alleged Sex Crimes at Alliance Girls High School Amid Institutional Cover-Up

-

Business2 weeks ago

Business2 weeks agoHumphrey Kariuki: The Kenyan Billionaire Who Lost State Privileges After Alleged Multibillion Tax Evasion

-

News2 weeks ago

News2 weeks agoHeavy Police Presence As All Roads Heading To State House Are Blocked

-

Grapevine1 week ago

Grapevine1 week agoCS Alfred Mutua Embroiled in Custody Battle After A ‘Quick’ Moment With Kenyan Girl in Dubai

-

News2 weeks ago

News2 weeks agoPolice Cordon Parliament with Razor Wire Ahead of Gen-Z Anniversary Protests

-

News1 week ago

News1 week agoOle Kina Fragrance Sets Kenyan Market Abuzz with Million-Shilling Expansion

-

News2 weeks ago

News2 weeks ago“I Knew Going to State House Was a Wrong Decision,” Omtatah Confesses

-

Opinion1 week ago

Opinion1 week agoWhy Ruto Dumped Isiolo Governor Abdi Guyo: A Political Betrayal in the Making