Economy

Finance Bill 2025 May Offer Relief to Overburdened Kenyan Workers

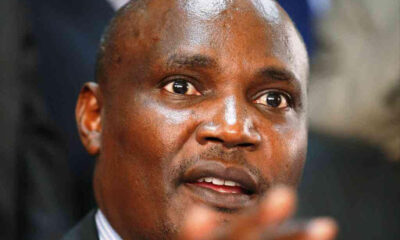

After months of public outcry over shrinking take-home pay and relentless fuel costs, Treasury Cabinet Secretary John Mbadi has finally hinted at sweeping changes in the upcoming Finance Bill 2025.

While addressing Senators on Tuesday, Mbadi admitted the government had missed an opportunity to adjust Pay As You Earn (PAYE) rates in the current budget cycle due to poor performance by the Kenya Revenue Authority (KRA).

However, he promised that Kenyans can expect significant tax relief measures—including revised PAYE, fuel price adjustments, and a corporate tax cut—in the next finance proposal.

These changes could signal a long-overdue shift in the country’s taxation policy and bring much-needed relief to a population fatigued by high living costs and economic stagnation.

Mbadi Opens Door to PAYE and Fuel Tax Reforms in Finance Bill 2025

Treasury CS John Mbadi’s remarks before the Senate offer a glimpse into the upcoming Finance Bill 2025, which he says will prioritize restoring Kenyans’ purchasing power. The government, he explained, had planned to revise PAYE taxes in the current bill but was forced to delay due to KRA’s failure to meet collection targets.

“We made promises to address this,” Mbadi said, “but that was not possible. However, where we have reached, we cannot reduce disposable income.”

Instead, the reforms will be pushed into the 2025 finance cycle—provisions that Mbadi claims will directly address the decline in net incomes among Kenyan workers. PAYE, the tax deducted directly from employee salaries, has been a major burden, with middle- and low-income earners squeezed the hardest.

The upcoming changes could increase disposable income, providing some cushion for households struggling to keep up with inflation and the rising cost of essential goods. Beyond PAYE, Mbadi said the Treasury is reviewing the Road Maintenance Levy (RMF), currently charged at Ksh18 per litre at the pump, a significant contributor to fuel costs.

If lowered, this could have a direct impact on transport fares and commodity prices, offering relief to millions of Kenyans. He also mentioned ongoing discussions around the Housing Levy, indicating that the government may revisit the controversial deductions imposed on salaried workers.

Corporate Tax Cuts to Stimulate Investment and Growth

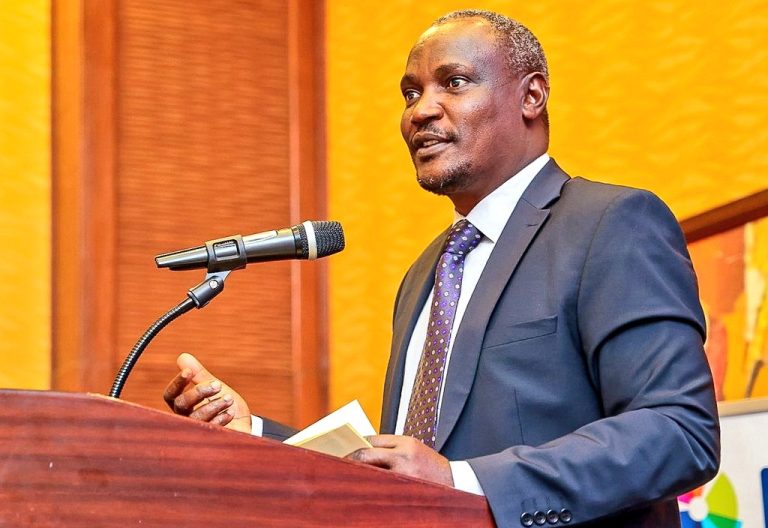

Another bold move in the upcoming Finance Bill 2025 is the proposal to cut corporate tax from 30 to 28 percent. Mbadi believes this will boost investor confidence, enabling businesses to retain more earnings for reinvestment, growth, and job creation.

While this could attract foreign and local firms to expand operations in Kenya, it also comes with a warning. Lowering corporate taxes may lead to immediate revenue shortfalls, which could undermine funding for critical public services like healthcare, education, and infrastructure. To balance this, the government plans to pair the tax cuts with broader economic reforms and improved compliance measures.

“The idea is not to overload the system,” Mbadi explained. “We are reforming the KRA and need to be strategic in rolling out these changes. There must be a balance between tax relief and sustained revenue collection.”

Still, many economic experts remain skeptical. Without a robust strategy to expand the tax base or seal revenue leaks, the reduction in corporate tax may benefit large corporations while limiting state resources meant for public welfare.

Adjustments to Housing Levy and Fuel Taxes Under Review

Mbadi also acknowledged growing dissatisfaction with the Housing Levy, a mandatory payroll deduction introduced by the Kenya Kwanza administration to fund affordable housing. While the government insists the program has long-term benefits, it has been met with resistance from workers who see it as yet another strain on already tight salaries.

“There are discussions on how to make readjustments,” Mbadi said. “Despite it having serious benefits, the individual employees with payslips have complaints about it.”

Revisiting the Housing Levy and Road Maintenance Levy signals that the Treasury may finally be responding to widespread frustrations. Kenyans have decried what they see as excessive taxes on income and consumption, eroding their ability to save, invest, or even meet basic needs.

Any adjustment to fuel-related levies could have a ripple effect across the economy. Transport, agriculture, and manufacturing sectors all hinge on fuel affordability. Reducing RMF, for instance, could ease operational costs, curb inflation, and increase consumer spending—goals aligned with the government’s economic recovery agenda.

The Road Ahead

The Finance Bill 2025 will be a critical test of the Ruto administration’s ability to walk the tightrope between fiscal responsibility and economic justice. Mbadi’s proposed reforms offer hope for a more balanced tax regime, but their success hinges on improved KRA performance, transparency in implementation, and sustained political will.

For the millions of Kenyans currently living paycheck to paycheck, these changes could mean the difference between survival and despair. But without clear accountability mechanisms and a strong economic stimulus plan, even the most well-intentioned reforms risk becoming just another broken promise.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News2 weeks ago

News2 weeks agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Economy2 weeks ago

Economy2 weeks agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Grapevine1 week ago

Grapevine1 week agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Business2 weeks ago

Business2 weeks agoKPC IPO Set To Flop Ahead Of Deadline, Here’s The Experts’ Take

-

Politics2 weeks ago

Politics2 weeks agoPresident Ruto and Uhuru Reportedly Gets In A Heated Argument In A Closed-Door Meeting With Ethiopian PM Abiy Ahmed

-

Investigations1 week ago

Investigations1 week agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Business2 weeks ago

Business2 weeks agoSafaricom Faces Avalanche of Lawsuits Over Data Privacy as Acquitted Student Demands Sh200mn Compensation in 48 Hours

-

Investigations2 weeks ago

Investigations2 weeks agoKenya’s DCI Opens Probe on Russian Man Who Secretly Filmed Sex Escapades With Women — But There’s a Slim Chance They’ll Ever Get Him