News

Don Bosco Gichana Unearths A Multi Billion Shilling Fuel Hedging Fraud Scheme At Kenya Airways In A Letter To President Uhuru

OPEN LETTER TO H.E. PRESIDENT UHURU KENYATTA: BY DON BOSCO OOGA GICHANA.

RE: AVERT KENYA AIRWAYS FUEL HEDGING FRAUD, IT IS CLEAR DAYLIGHT ROBBERY.

(IT IS A MULTI-BILLION SHILLINGS FRAUD)

First let me start by thanking you for finding time to read this letter. Without wasting your time, let me jump right into the main issue.

Mr. President, KQ (Kenya Airways) is a public company trading at the Nairobi Stock Exchange of which the largest shareholder is the Kenyan Tax Payer through its proxy investment arm, the government of Kenya (GOK).

Your recent purge on corruption is laudable and commendable as long as it is not personalized to target a few in whichever side of the broader political spectrum. In this, you have done exceptionally well to close your ears to your detractors and I applaud you sir. Let it be a blanket graft purge. Don’t fear for The Bible says in 2 Kings “Do not fear, those who are with us are more than those who are with them”.

Verily I tell you Mr. President, those that are with you are more than those that are with them trying to fight you. Tame them and tame the runaway graft and corruption that is eating away at the very fabric of the Kenyan society. Be cautioned that corruption will fight back hard! Fear Not!

NOW PLEASE HEAR ME OUT SIR.

Mr. President, on the 22nd of June while watching Bloomberg news headlines here in prison, I read a heading titled “Kenya Airways could resume fuel hedging in Q3”. Don’t get me wrong, hedging is a common practice among corporations that import or export or that need to repatriate profits back home and can hedge in the forex market to cushion them against foreign exchange volatility. Hedging is not about eliminating risk 100% but reducing the exposure to risk.

But Mr. President what raised my eye brows was not the Bloomberg news headline but rather an article in the Daily Nation on the 23rd of June titled, “KQ back to price hedging after costly gamble”. The article says that two years ago, when the airline tried such a bet which is regarded as an international best practice in the airline industry, prices took a downward trend, contributing immensely to a monumental KES 26 billion loss that that the national carrier booked.

That KQ lost that magnitude of cash on fuel hedging and it caused a big chunk of their bottom line loss is neither here nor there. That is a blatant lie that can’t and will never stand the test of time. It does not add up in the world of financial instruments known as derivatives. It is simply theft laced up with economic sweeteners such as hedging in order to hoodwink the major shareholders who is Wanjiku through the Government of Kenya. Wanjiku just hears of “hedging” but does not know what it entails. Mr. President do NOT get your foot off the gas pedal in matters corruption.

We, the majority, are ready to rise with your measures. This is my way of support in my own small way, from far off in a Tanzania Jail still awaiting trial the 6 years.

Let’s take an example of consumer or buyer of a product such as crude oil… (I chose crude oil because crude oil is positively correlated with the price of jet fuel cracks). Such a buyer prefers upward protection and an oil marketer or seller prefers downward protection. Logic therefore is that a buyer prefers lower prices and a seller higher prices, prices against that need hedging. For a buyer to hedge, he or she trades long FUTURES or buys futures.

KQ claim that they had a fixed price with the supplier so that if the jet fuel prices were to go up they would still buy the jet fuel cracks at that lower fixed price, say at $3.00 a litre. At prevailing market prices of say $4.80 a litre, they would still pay for jet fuel at $3.00 per litre. But instead, prices dropped to $2.50 a litre and they were forced to buy at $3.00 per litre. This is totally unacceptable!

It is trite law that you can’t hedge with your supplier for buyers and sellers have conflict of interest in pricing. A seller wants to sell at a higher price and the buyer at a lower cost price. This automatically creates a conflict of interest. Such a transaction happens physically whereas hedging is done in the ‘futures’ and ‘option futures’ market.

Crude oil futures and options are mostly traded in New York Mercantile Exchange in the US, Intercontinental Exchange in London and most recently this year in Shanghai, China.

Futures market and futures options has investors, speculators and hedgers. The latter mostly deal in oil options as opposed to oil futures. For they are not interested in physical delivery which for NYMEX is done in Cushing, Oklahoma. More specifically European options are settled in cash. Both American and European type of options are available at the NYMEX, one of the largest derivative product market in the world.

Remember, I don’t have any data on me from KQ, I am only relying on the newspaper article. What must have transpired is that some well-known KQ shareholder, knew that global crude oil prices were going or were already on a free fall. I will expound later on how they knew that global crude oil will nose dive so a contract to supply was signed and then a marketer was sublet the contract at the prevailing market prices. As such a contract was penned knowing in advance the futures of the oil prices but still a contract was hurriedly signed at prevailing market prices say of $3.00 per litre. The known mafia shareholder in cahoots with the oil/jet fuel cracks supplier in the contract bound KQ to be supplied for a whole financial year at $3.00 per litre even if the prices were to rise higher. They called that hedging, and even if the price of jet fuel was to drop, KQ was still to pay $3.00 per litre. It sounds like a fair deal but slightly discriminative on the supplier. The supplier was given a letter of credit and went smiling all the way to the bank!

Reality however is crude oil futures and options, when I say crude oil gasoline, Brent, Natural gas, heating oil, jet fuel, Naphtha and propane are all inclusive. These futures contracts and futures options contracts are delivered monthly, not quarterly nor semi-annually nor annually! For instance, there are futures prices for crude oil for August 2019, 2020 etc. The marketers know very well that there is a price guideline for every moth in form of discount or premium to the prevailing market prices. So how did Kenya Airways get into a long term contract on the hedging monster?

Toward the tail end months of 2014, OPEC + Russia increased crude oil output to protect themselves from U.S share oil products whose increased output was eating into their market share. Given also U.S light crude oil trading in the NYMEX trades at a discount compared to the international Benchmark Brent Oil. In June, the spread between the two hit an all-time high of $11.00. The end result of crude oil war between OPEC + Russia vs U.S was an oil glut in the market. This fundamental aspect of supply was in place until January 2017 when OPEC + Russia agreed to oil production cut of 1.6 million barrels per day.

Mr. President, we didn’t just wake up one day and Brent crude prices plummeted from $100 to $26 per barrel in January 2016. It happened in phases or gradually, and for such movement to happen, some fundamental of supply or demand must have been breached. We also have technical indicators that show if the short term or long term prices are in a down, sideways or uptrend. Crude oil prices are very volatile and exposed to geo-political tensions also. For instance, Brent oil reached an all-time high of $145.61 per barrel in January 2008 and a low of $26 per barrel in January 2016. But the record low was $2.23 per barrel in May 1970.

If Kenya Airways management mean well or if I was to consult for them, I would have had month by month contract from the best shortlisted suppliers premiums based on the daily global or rather NYMEX or ICE prices. For instance, for a premium of $0.25, if NYMEX future prices for today is $2.00 per litre, then I would be supplied at $2.25 per litre. The figures I am using are only figurative and not actual figures.

For upscale price protection, if for KQ to remain competitive, it must be supplied at price levels of $3.80 per litre. First is to approach a hedge fund or commodity futures broker who in both cases specializes also in Energy derivatives. For simplicity, I will use litres, but the standard is barrels and one contract is worth 1000 barrels. I will buy jet fuel call options.

With March 2019 jet fuel futures trading at $3.00 per litre in August, KQ decides that in order to protect its profit margin, the cash market price must not be allowed to exceed $3.80 cents per litre. The cost to buy the call option is $0.25 cents per litre (premium) to hedge my first option.

Net buy price = $3.25 per litre ($3.00 August price + $0.25 premium)

In February, jet fuel prices have risen as expected, March futures are trading at $4.80 per litre. KQ exercises the 1 March $3.00 calls. The closing of the resulting futures position at $4.80 per litre leaves KQ with a net $1.55 per litre. Gain on the option ($1.80 minus premium $0.25)

$4.80 per litre (Feb price) – $3.25 per litre (Net buy price)

= $1.55 per litre net gain.

When the $1.55 per litre futures market again is used to offset the $4.80 per litre paid to KQ Jet fuel supplier. The effective price for jet fuel is reduced to $3.25 per litre (0.55 per litre) below the price ceiling established with the March $3.00 call option.

Suppose then the prices fell as with the case with KQ?

If the prices had fallen below the $3.00 per litre to $2.50 per litre, KQ option losses would be limited to the $0.25 per litre premium paid for the call option, which would be allowed to expire worthless. While KQ would benefit from a lower jet fuel cracks purchase price as per the contract.

Mr. President, if they were smart enough, the conspirators could have signed such a fraudulent contract and then buy crude oil put options which offer downside protection, with a recognized international hedge fund. The fraudulent contract would have provided upside protection and the downside would have provided both the supplier and KQ fat profits. The suppliers could have benefited from the corrupt proceeds and KQ could have used the proceeds from the profitable hedge to cover up on the loss they incurred in the fraudulent contract. The price drop was a boon and not a bane as KQ would want to portray.

Mr. President, I earlier wrote that from the end of 2014, there were tell-tale signs that there was an oversupply of crude oil in the global market. Demand was also affected, because China, the largest consumer and importer of crude oil economy was in a semi recession. This also affected other commodities of which China is the largest importer such as copper, platinum, palladium, silver, aluminum, iron ore etc.

Come 2017 OPEC + Russia agreed to cut oil outputs in order to shore up prices in order to shore up prices, balance supply and demand and remove an oil glut.

From this, it was crystal clear that oil prices were to skyrocket. Kenya Airways could have benefited from that fraudulent contract because that contract enabled KQ to buy at a fixed price. They should have signed another contract when crude oil was trading at below $50 per barrel. That meant up to May 2018 when Brent crude hit $80.00 per barrel, KQ could have bought their fuel at almost half the price of the prevailing market price. Instead they claim they stopped fuel hedging because it had cost them previously. The truth is that the conspirators could have lost all the loot they had made in their previous fraudulent contract. The end result is that KQ spent over $25 billion on fuel alone! Incredulous theft indeed!

KQ could have saved almost half the amount had they hedged by buying crude oil futures options or even crude oil futures.

Apart from supply reduction of 1,600,000 barrels per day (bpd), demand had also improved because China’s economy had improved tremendously. In my May 2018 New Year’s message, I also predicted Brent oil to hit $100.00 per barrel. Indeed Brent crude was at an all-time high of $60.00 per barrel. Indeed Brent crude oil in 1H 2018 has hit $80.00 per barrel. Many commodity analysts joined me in June saying the crude oil prices will hit $100.00 per barrel notable one being Morgan Stanley that has raised its oil price forecast by $7.50 per barrel to $85.00 on expectation of more outages from Angola, Iran and Libya.

Crude oil Brent was on target to hit $100.00 per barrel but major oil consumers China and India complained to OPEC cartel of rising inflation due to high oil prices, it’s strange that KQ, a consumer complained of lower prices. Trump joined the fray also and urged Saudi Arabia to ramp up crude oil production saying “oil prices are too high, OPEC is at it again. Not good!” Trump tweeted. The pact was meant to run till the end of 2018 which obviously could have had oil prices surpass even $100.00 per barrel because Venezuela’s collapse in oil production due to financial constraints and fresh Iranian sanctions that raised fears of supply crunch. The markets were overheating.

OPEC and non OPEC Energy ministers met in Vienna Austria between June 21 and 23 of 2018. Crunch talks on a landmark pact curbing oil output, with Saudi Arabia and Russia hoping to persuade their peers to increase production again. Resistance was led by Iran, deeply wary of any move by regional rival Saudi Arabia that could push down oil prices at a time when Tehran faced renewed sanctions. Iran and Venezuela also objected. Since OPEC operates on the principle of unanimity, they agreed to end oil curbs.

Mr. President, on the very day OPEC + Rusiia arrived at the decision to ramp up production so as to lower global crude oil prices coincided with KQ CEO Sebastian Micosz announcement of plans to restart fuel price hedging in Q3 2018. The daily nation reported that the airlines executives were already in talks with banks and other firms in the energy sector to finalize on the technical aspect of the process.

Is it then a coincidence or an orchestrated conspiracy to completely kill KQ which is already on its deathbed? OPEC and + Russia agreement means prices will drop. Last year and 1H 2018 when OPEC + Russia curbed production, Kenya Airways did not hedge the fuel, and here comes Vienna meeting and the oil cartels agree to rump up production to lower the price, immediately the economic hitmen are back with their controversial fuel hedging scheme. To make matters worse, the executives of KQ claim to be in talks with banks and Energy firms!

I repeat again its trite edging principle that you can’t hedge between a buyer and seller for there is already a pricing conflict of interest. WHY IS KQ IN TALKS WITH ENERGY FIRMS???????

Your Excellency, it took Joseph in the Bible who then was in Jail to be called to interpret the dream the King had and he was eventually made the Prime Minister of Egypt. Mr. President, t had taken me in detention without trial here in TZ being my sixth (6th) year to unravel a multi-billion theft scam that has been bedeviling KQ for more than a decade now. The perpetrators of the scheme are major shareholders and political financiers. Ownership of the energy firm is well known!

Mr. President Sir, this has taken me a while to compile and many hours of research. I have no internet, no phone and no communication gadget other than the television where I am lucky to get the Bloomberg channel. Using close friends who have stuck with my ordeal since it started, I ask them to get me newspapers, they google and print for me whatever I ask them to and they bring it to me. I then study these closely, make comparative research and then do my analysis. I rate my success in this at a minimum of 97% always right. I have taken out the 3% because I am human and may sometimes miss a little part out. You have a team of good researchers, put them to work and you will find I am completely right. If need be, I can ask that you be provided by all my stock predictions and blog posts and you will know I completely understand what I have written above.

Sir, Mr. President, all I ask of you is this, MAY THIS NOT GO IN VAIN. PLEASE SIR.

Thanking you for your indulgence and patience in reading this.

Yours,

Don Bosco Ooga Gichana.

Arusha Main Prison,

Tanzania

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations1 day ago

Investigations1 day agoSOLD TO THE BULLET: How the Bodyguard Handed MP Ong’ondo Were to His Killers

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations1 week ago

Investigations1 week agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations2 weeks ago

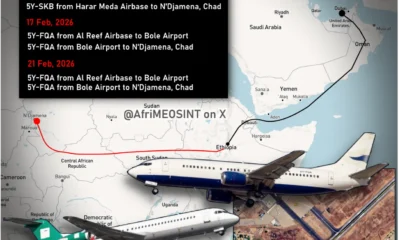

Investigations2 weeks agoTracker Identifies Kenyan-Registered Flights Allegedly Running Errands for RSF