Business

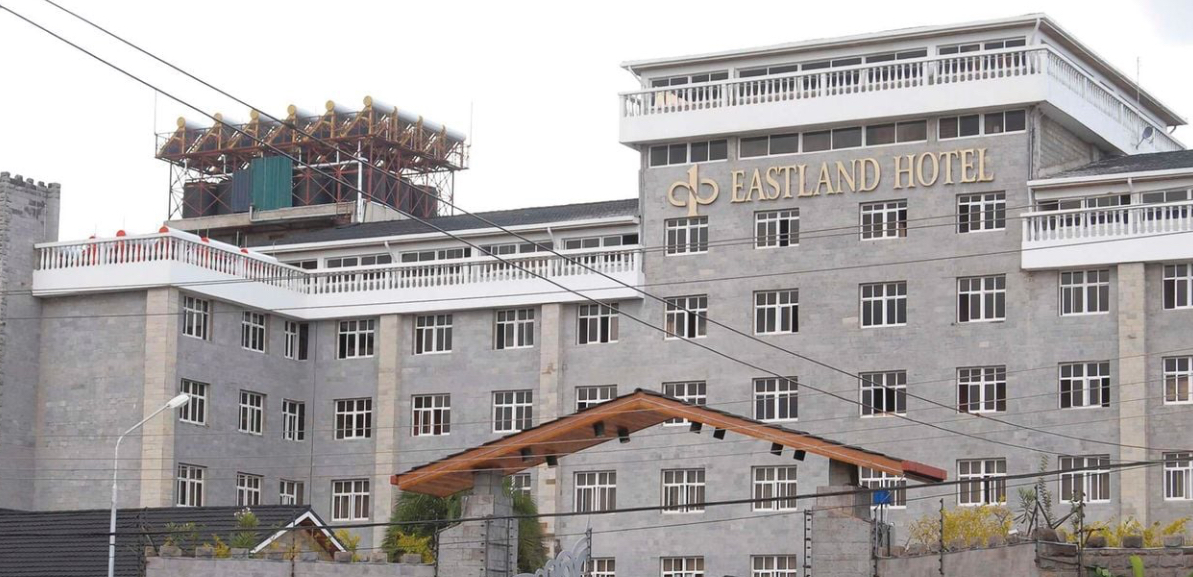

Cash-Strapped Eastland Hotel in Kilimani Put Under Receivership Over Debt

Under Kenyan law, receivership applies to debts contracted before September 2015, when the Insolvency Act introduced administration procedures that prioritize business rescue before considering liquidation.

Equity Bank Kenya has moved to place Nairobi’s Eastland Hotel under receivership following the property’s failure to service an undisclosed debt, marking another significant enforcement action by the lender as it intensifies efforts to recover funds from struggling borrowers in Kenya’s hospitality sector.

The bank announced the appointment of Kamal Anantroy Bhatt and Jai Kamal Bhatt of Anant Bhatt LLP as joint receivers and managers of Eastland Hotel Limited, effective September 9, 2025. The receivership notice, published in local dailies, transfers all operational control of the four-star Kilimani property to the appointed receivers, stripping the hotel’s directors of their powers over business operations and assets.

This latest action underscores Equity Bank’s increasingly aggressive stance toward debt recovery amid rising credit risks across Kenya’s banking sector. The move adds Eastland Hotel to a growing list of businesses that have fallen under court-supervised control in 2025, following the bank’s earlier placement of TransCentury Plc under receivership and East African Cables into administration after court protections expired in June.

The hospitality industry has been particularly vulnerable to financial distress in recent years, grappling with elevated financing costs and an uneven recovery from the pandemic’s impact on business travel. Mid-tier properties like Eastland Hotel have faced mounting pressure from the proliferation of short-term rental platforms such as Airbnb, which have disrupted traditional hotel pricing models by offering flexible accommodation options that appeal to both leisure and corporate travelers.

The sector’s challenges have been compounded by aggressive expansion across various hotel categories, intensifying competition in an already strained market. This oversupply has coincided with a broader economic environment that has squeezed consumer spending and reduced corporate travel budgets.

Equity Bank’s financial results reveal the broader context of its enforcement actions, with the group’s non-performing loan ratio climbing to 13.7 percent in the six months ending June 2025, up from 12.9 percent in the corresponding period the previous year. This deterioration in asset quality has prompted the bank, along with other major lenders, to pursue more assertive recovery strategies through legal mechanisms like receivership and administration.

The appointment of receivers typically signals either a significant covenant breach or extended payment defaults, giving the secured creditor legal authority to take control of pledged assets to recover outstanding loans. Under Kenyan law, receivership applies to debts contracted before September 2015, when the Insolvency Act introduced administration procedures that prioritize business rescue before considering liquidation.

While Equity Bank has not disclosed the specific amount owed by Eastland Hotel, the receivership represents another example of how Kenya’s financial institutions are adapting to challenging economic conditions by moving quickly to protect their interests when borrowers default. The trend reflects a broader shift in the banking sector’s approach to credit risk management as institutions seek to maintain asset quality amid economic uncertainties.

The fate of Eastland Hotel now rests in the hands of its receivers, who will determine whether the business can be restructured and returned to viability or whether its assets will need to be liquidated to satisfy creditor claims.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News1 week ago

News1 week agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations2 weeks ago

Investigations2 weeks agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy1 week ago

Economy1 week agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa2 weeks ago

Africa2 weeks agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Grapevine6 days ago

Grapevine6 days agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

News2 weeks ago

News2 weeks agoTragedy As City Hall Hands Corrupt Ghanaian Firm Multimillion Garbage Collection Tender