Investigations

Disgraced Kuscco Boss Arnold Munene Moves To Gag Media After Expose Linking Him To Alleged Sh1.7 Billion Fraud

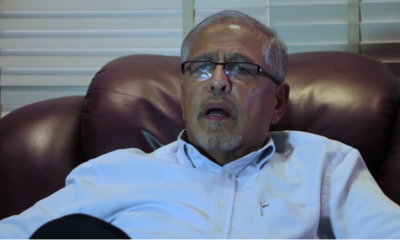

Embattled managing director faces mounting pressure as forensic audit uncovers massive financial irregularities at cooperative umbrella body

The beleaguered managing director of the Kenya Union of Savings and Credit Co-operatives (Kuscco), Arnold Munene, is now scrambling to silence media outlets following damning revelations linking him to a staggering Sh1.7 billion fraud scandal that has rocked the cooperative movement.

In a dramatic escalation of the crisis, Kuscco Housing Co-operative Society has issued a formal demand for retraction and apology from Business Daily, threatening defamation action over what it terms sensational and misleading reporting. The move, coming through law firm J.J. Okore and Associates Advocates, represents a desperate attempt to contain the fallout from explosive findings contained in a forensic audit conducted by PricewaterhouseCoopers.

However, the legal threats have backfired spectacularly after it emerged that Munene himself accessed a massive Sh14.17 million loan under the controversial non-conforming products policy, the very scheme he has been publicly criticizing. This stunning revelation has raised serious questions about the credibility of his crusade against the housing unit and whether his media suppression efforts are designed to cover up his own financial improprieties.

Sources close to the matter reveal that Munene has been frantically reaching out to senior editors and media owners, attempting to suppress further coverage of the PwC audit that uncovered a web of financial improprieties that saw Kuscco hemorrhage Sh13.3 billion, with the housing unit alone accounting for Sh1.69 billion in fraudulent transactions.

The desperate damage control effort comes as investigators close in on Munene and other senior officials implicated in what is shaping up to be one of the biggest financial scandals in Kenya’s cooperative sector. The fraud involved a sophisticated scheme where senior Kuscco officials irregularly obtained massive loans in their names and those of their associates, defaulted on payments, and then doctored the books to cover their tracks.

In a demand letter dated December 11, J.J. Okore and Associates condemned Business Daily’s December 3 article as containing false, misleading, and alarmist statements about KHC’s operations. The law firm claimed the publication failed to verify facts responsibly or seek the cooperative’s response before publication, specifically highlighting what it termed inaccuracies regarding KHC’s ownership structure and loan approval processes.

At the heart of the controversy is the increasingly bitter dispute over control of Kuscco Housing Co-operative Society, where Munene has accused the unit’s chief executive officer, Julius Odera, of attempting to break away from the parent organization. However, industry insiders and legal experts suggest Munene’s public posturing against Odera may be a calculated move to deflect attention from his own role in the scandal.

The legal team representing KHC has fired back at Munene’s claims, arguing that the publication falsely suggested he was responsible for approving loans when this function actually lies with a designated sub-committee in accordance with the organization’s by-laws. More damaging still, KHC clarified that while Kuscco Ltd is a cooperative partner, it holds only a minority share and does not exercise the ownership or control alleged by Munene.

Documents obtained by this publication show that Munene wrote to the Commissioner for Co-operative Development, David Obonyo, in August seeking intervention to stop KHC officials from convening an annual general meeting. In the letter, he requested a review and audit of the housing unit’s books, warning that losing control of KHC would lead to massive financial losses. Critics now view this move as a smokescreen to divert attention from his own questionable financial dealings.

The legal pushback has further referenced a ruling by the Co-operative Tribunal, which reaffirmed KHC’s legal autonomy and independence. The Tribunal rejected attempts by Kuscco Ltd to influence KHC’s operations, affirming that the society retains full control over its governance and decision-making processes, dealing a devastating blow to Munene’s control narrative.

The PwC audit revealed that 240 loans valued at Sh1.11 billion were issued in flagrant violation of lending limits, with officials of Kuscco, KHC, and the Kuscco Housing Fund leading in irregular borrowing. Among those fingered is Odera, who obtained a Sh10 million loan against savings of only Sh940,700, representing a multiplier of 10.6 times the approved limit. He also secured a top-up loan of Sh4.5 million against savings of Sh228,000, translating to an outrageous multiplier of 19.7 times, nearly four times the maximum allowed threshold of five times.

But the revelation that Munene himself borrowed Sh14.17 million under the same non-conforming products scheme has exposed breathtaking hypocrisy at the highest levels of Kuscco. While publicly demanding accountability from others, he was privately benefiting from the very lending irregularities he now condemns.

The scandal has sent shockwaves through the cooperative movement, with member saccos now questioning how such massive fraud could have gone undetected for years under Munene’s watch. Kuscco serves as the umbrella organization for thousands of savings and credit cooperatives across the country, holding billions of shillings in member investments.

The organization is now desperately trying to recover at least 70 percent of the Sh8.8 billion principal amount that saccos had invested in the entity. Recovery efforts include auctioning houses and land belonging to 684 individuals who defaulted on Sh1.7 billion in loans issued under the housing fund, as well as selling stakes in the insurance arm.

The Commissioner for Co-operative Development has appointed assistant commissioner Fondo Nzovu and senior co-operative auditor John Kariuki to investigate the matter. The probe concluded last week, though no formal findings have been released, fueling speculation about potential criminal prosecutions.

Legal experts say the findings provide a strong basis for criminal charges against Munene and other officials involved in the fraud. The scale of the theft and the systematic falsification of records to conceal it point to a well-orchestrated conspiracy that may have operated for years.

KHC has demanded a retraction of the Business Daily article and a public apology, warning that it will pursue legal action for defamation. However, the seven-day deadline has elapsed with no indication that the publication intends to comply, suggesting confidence in the veracity of its reporting.

Meanwhile, Munene’s attempts to muzzle the media have backfired spectacularly, drawing even more attention to the scandal and his own questionable dealings. Journalists and media freedom advocates have condemned the intimidation tactics, vowing to continue exposing corruption in the cooperative sector.

The saga has also exposed deep governance failures at Kuscco, with questions being raised about the effectiveness of board oversight and internal controls. How senior officials were able to loot billions of shillings from an organization meant to safeguard the savings of ordinary Kenyans remains a troubling question that demands urgent answers.

The dispute highlights ongoing tensions between Kuscco Ltd and KHC, particularly over governance and the management of cooperative societies. It also underscores broader challenges within Kenya’s cooperative sector, including questions of institutional independence and financial transparency.

As pressure mounts, all eyes are now on the office of the Director of Public Prosecutions to see whether criminal charges will be filed against Munene and his associates. For now, the embattled managing director appears to be fighting a losing battle to contain the damage from one of the most spectacular corporate scandals in recent memory, with his own financial dealings now under intense scrutiny.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News4 days ago

News4 days agoTemporary Reprieve As Mohamed Jaffer Wins Mombasa Land Compensation Despite Losing LPG Monopoly and Bitter Fallout With Johos

-

Business2 weeks ago

Business2 weeks agoPanic As Payless Africa Freezes With Billions of Customers Cash After Costly Jambopay Blunder

-

Investigations1 week ago

Investigations1 week agoHow SportPesa Outfoxed Paul Ndung’u Of His Stakes With A Wrong Address Letter

-

Investigations4 days ago

Investigations4 days agoFrom Daily Bribes to Billions Frozen: The Jambopay Empire Crumbles as CEO Danson Muchemi’s Scandal-Plagued Past Catches Up

-

News2 weeks ago

News2 weeks agoSCANDAL: Cocoa Luxury Resort Manager Returns to Post After Alleged Sh28 Million Bribe Clears Sexual Harassment and Racism Claims

-

Sports3 days ago

Sports3 days ago1Win Games 2025: Ultimate Overview of Popular Casino, Sports & Live Games

-

Investigations1 week ago

Investigations1 week agoInside the Deadly CBD Chase That Left Two Suspects Down After Targeting Equity Bank Customer Amid Insider Leak Fears

-

Business4 days ago

Business4 days agoHass Petroleum Empire Faces Collapse as Court Greenlights KSh 1.2 Billion Property Auction