News

HELB Faces Class Action Suit After Court Rules Interest Cannot Exceed Double the Loan

Justice Mabeya found that HELB’s practice of allowing interest and penalties to exceed the principal amount discriminated against its borrowers.

The Higher Education Loans Board is bracing for a potential class action lawsuit following a landmark High Court ruling that declared the institution cannot demand more than double the principal amount borrowed by loan beneficiaries.

The ruling, delivered by Justice A. Mabeya in the case of Mugure and two others versus HELB, has opened the door for thousands of former students who have struggled under the weight of ballooning loans to seek redress.

Already, angry borrowers on social media are threatening legal action against the state corporation, with some accusing it of predatory lending practices that have trapped graduates in cycles of debt.

The case that sparked this potential legal storm involved three former students who argued that HELB had imposed excessive interest and penalties that caused their loans to spiral out of control.

In one particularly striking example, a youth with a disability took out a loan of Sh82,980 in July 2004 at an interest rate of 2 percent.

By July 2016, the amount he owed had ballooned to Sh540,464.10, more than six times the original sum.

Another petitioner borrowed Sh146,090 in July 2016, only to see the outstanding balance grow to Sh335,207.28 by March 2021.

A third loan of Sh135,000 obtained in July 2016 had increased to Sh336,573.83 by February 2021.

At the heart of the court’s decision was the application of the in duplum rule, a legal principle derived from Latin meaning “in double.”

The rule prevents interest from continuing to accumulate once it equals the principal amount borrowed.

HELB had argued this principle only applied to commercial banks under Section 44A of the Banking Act, but Justice Mabeya disagreed.

The judge ruled that the in duplum rule is grounded in public interest and therefore applies to all lenders, including statutory bodies such as HELB.

He noted the rule was introduced to protect borrowers from unending interest accumulation and to ensure fairness in lending.

Justice Mabeya found that HELB’s practice of allowing interest and penalties to exceed the principal amount discriminated against its borrowers.

He pointed out that borrowers in the banking sector are protected by the in duplum rule, yet HELB borrowers, most of whom are students from financially challenged backgrounds, had no such protection.

This disparity, he ruled, violated Article 27 of the Constitution, which guarantees equality and non-discrimination.

The court also found that the petitioners’ socio-economic rights under Articles 43(1)(e) and (f) and consumer rights under Article 46(1)(c) of the Constitution had been violated.

The judge emphasized that many students finish school without immediately securing jobs, making it difficult to repay their loans quickly.

Allowing interest and fines to compound indefinitely was unfair and contrary to the purpose of the HELB fund.

While the court did not strike down Section 15(2) of the HELB Act, which provides for penalties, it ruled that the section must be read together with the in duplum rule.

This means HELB may impose fines and interest, but only up to the point where the total reaches double the principal. All further interest and fines must stop beyond that point.

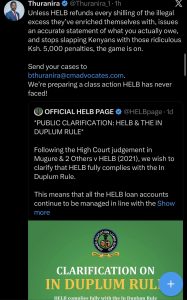

Following the judgment, HELB issued a statement on December 3, 2025, clarifying that it fully complies with the in duplum rule and that all loan accounts continue to be managed in line with the judgment.

The institution said it remains committed to fair, lawful, and transparent loan management for all beneficiaries.

However, this assurance has done little to calm the anger among borrowers who feel they have been exploited. On social media platform X, a lawyer, one Brian Thuranira responded to HELB’s clarification with a threat of legal action, writing: “Wameogopa the class action suit, but we will sue regardless! Your appetite has become insatiable, many comrades are suffering because of you! Did you have to wait for my tweet so that you can abide? We are coming for you, get your legal team in order!”

The challenge for potential plaintiffs in a class action suit will be proving that HELB violated the in duplum rule before the judgment was issued.

Legal experts note that courts typically do not apply rulings retroactively unless there is clear evidence of unconstitutional conduct.

The ruling comes at a time when HELB is grappling with a massive default crisis. CEO Geoffrey Monari has repeatedly warned that the fund’s sustainability is under threat, with over 380,000 defaulters collectively owing Sh42 billion.

He has noted that many of the country’s most educated professionals, including lawyers, accountants, doctors, and engineers, are among the worst culprits, despite being gainfully employed.

HELB operates on a revolving fund model, meaning repayments from past beneficiaries are used to fund current students.

The high default rate has raised concerns about the board’s ability to continue supporting needy students seeking higher education.

In recent months, HELB has intensified its loan recovery efforts, with over 120,000 defaulters already listed with Credit Reference Bureaus.

The board is also pursuing legal reforms to gain authority to freeze bank accounts of those able but unwilling to pay.

The court’s ruling, however, may complicate these recovery efforts.

While borrowers are still required to repay what they owe, the cap on interest and penalties could significantly reduce the amounts HELB can collect from long-term defaulters.

This could potentially affect the fund’s ability to support new students, creating a difficult balancing act between protecting borrowers’ rights and ensuring the sustainability of higher education financing in Kenya.

For now, HELB beneficiaries who believe their loans have exceeded the double principal threshold are being advised to contact the institution through its official customer support channels to have their accounts reviewed and adjusted in line with the court’s ruling.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business3 days ago

Business3 days agoCooking Fuel Firm Koko Collapses After Govt Blocks Sh23bn Carbon Deal

-

Business2 weeks ago

Business2 weeks agobetPawa Empire Crumbles: Mr Eazi’s Betting Gambit Unravels Amid Partner’s Shadowy Deals

-

Business1 week ago

Business1 week agoMinnesota Fraud, Rice Saga, Medical Equipment Deal: Why BBS Mall Owner Abdiweli Hassan is Becoming The Face of Controversial Somali Businessman in Nairobi

-

Politics1 week ago

Politics1 week agoYour Excellency! How Ida’s New Job Title From Ruto’s Envoy Job Is Likely to Impact Luo Politics Post Raila

-

Investigations2 weeks ago

Investigations2 weeks agoEXPOSED: SHA Officials Approve Higher Payments for Family, Friends as Poor Patients Pay Out of Pocket

-

News1 week ago

News1 week agoKenya Stares At Health Catastrophe As US Abandons WHO, Threatens Billions In Disease Fighting Programmes

-

Business2 days ago

Business2 days agoABSA BANK IN CRISIS: How Internal Rot and Client Betrayals Have Exposed Kenya’s Banking Giant

-

News2 weeks ago

News2 weeks agoDCI Probes Meridian Equator Hospital After Botched Procedure That Killed a Lawyer