News

Ruto’s Bold Bet on NSSF Deductions Aims to Hit Ksh1 Trillion in Savings by 2027

President William Ruto has defended the government’s controversial increase in NSSF deductions, saying it is a game-changing policy meant to strengthen Kenya’s financial independence.

Speaking in Nairobi, Ruto hailed the new savings model as a bold step toward reducing the country’s debt burden and building a pool of local capital.

With a Ksh1 trillion national savings target by 2027, the president insists Kenyans must embrace the culture of saving.

But as more workers feel the pinch of rising monthly deductions, the debate continues—are these contributions a burden or a necessary path to self-reliance?

NSSF Deductions Spark Fierce Debate as Ruto Sets Ksh1 Trillion Target

President William Ruto is not backing down from the controversial policy mandating higher contributions to the National Social Security Fund (NSSF). While critics accuse the government of overburdening already struggling workers, Ruto argues the deductions are the cornerstone of Kenya’s new economic strategy.

Speaking during a public address at Co-operative University in Karen, Ruto revealed that since independence, Kenya only managed to save Ksh320 billion in total. But under his administration, Ksh280 billion has been added to the NSSF within just two years.

The president boldly projected that national savings would hit Ksh1 trillion by 2027—a feat he believes is not just possible but necessary.

Ruto linked the accelerated savings growth to the government’s strategic reforms, including the phased implementation of the NSSF Act, 2013. “By the end of this year, we will have doubled what we saved in six decades,” he said, calling the increase in contributions a “serious step for a serious country.”

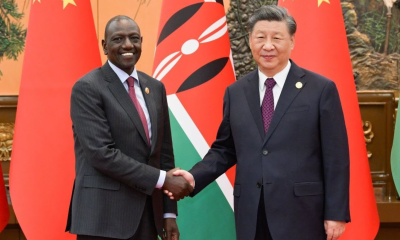

He compared Kenya’s savings-to-GDP ratio, currently between 10–12 percent, with China’s 65 percent and Tanzania’s stronger savings base.

“Savings is a very important component of any meaningful progress of a country,” he stated, urging Kenyans to view the deductions not as a penalty but as an investment in the nation’s future.

Deductions Seen as a Path to Financial Independence

One of the core arguments for the higher NSSF deductions is to reduce Kenya’s dependence on foreign debt. With more money pooled into national savings, the government can raise funds domestically, especially through the sale of government bonds.

While NSSF assets cannot be directly used as collateral, the presence of a “captive” capital pool allows the state to fund infrastructure, housing, and other development projects with fewer strings attached.

The NSSF Act’s third phase, which took effect in February 2024, saw monthly contributions rise from a maximum of Ksh2,160 to Ksh4,320.

This marked the second major hike since the 2013 reforms kicked in. The government maintains this is part of a structured, long-term plan that will benefit citizens during retirement while also helping to stabilize the economy.

Ruto emphasized that Kenya cannot move forward without a strong savings culture. “This is the direction a serious country must take,” he reiterated.

So far, the new structure has helped grow NSSF’s total assets to nearly Ksh600 billion—two years ahead of projections.

Officials argue that this growth proves the reform is working and that more people are now financially protected for old age.

Mounting Pressure on Workers Amid Sharp Rise in NSSF Deductions

However, the push for higher contributions has not come without criticism. Many Kenyan workers, especially those in the private sector and lower-income brackets, are struggling to keep up with the increased deductions.

Trade unions and civil society groups have voiced concern that the rapid implementation of new rates is squeezing households already facing high costs of living.

Some have accused the government of rushing reforms without offering enough public education or alternative saving options.

Others fear that the expanded pension pool could be mismanaged or siphoned off through corruption, a worry not unfounded given Kenya’s history of graft scandals.

Still, the government appears determined to press on. Ruto has framed the move as one of the few realistic ways to escape the debt trap and ensure long-term prosperity.

He acknowledged the public discomfort but insisted that the discomfort today would lead to security tomorrow.

“This is about our future,” he said. “We cannot keep borrowing to survive. We must build from within.”

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business5 days ago

Business5 days agoSAFARICOM’S M-SHWARI MELTDOWN: TERRIFIED KENYANS FLEE AS BILLIONS VANISH INTO DIGITAL BLACK HOLE

-

Politics2 weeks ago

Politics2 weeks agoRuto’s Reshuffle Storm As Moi, Ida Odinga Tipped To Join His Cabinet

-

Business2 weeks ago

Business2 weeks agoEquity Bank CEO James Mwangi Kicked Out of Sh1 Billion Muthaiga Mansion

-

Investigations2 weeks ago

Investigations2 weeks agoWhose Drugs? Kenya Navy Seizes Drug Ship In Mombasa Carrying Sh8.2 Billion Meth

-

News1 week ago

News1 week agoBLOOD IN THE SKIES: Eleven Dead as West Rift Aviation’s Chickens Come Home to Roost in Kwale Horror Crash

-

News2 weeks ago

News2 weeks agoMILLER ON THE ATTACK: Lawyer Cecil Guyana Miller Sues Whistle-blower as Vigilante Blogger Maverick Aoko Sounds Alarm

-

Business2 weeks ago

Business2 weeks agoPlanned Rironi–Mau Summit Expressway to Offer Two-Tier System — Sh8 Per Km for the Wealthy, Free Route for All Others

-

Investigations2 weeks ago

Investigations2 weeks agoEXPLOSIVE DOSSIER: THE SECRET FILE THAT COULD DESTROY CAREERS – INSIDE KERRA’S SHOCKING CERTIFICATE SCANDAL