News

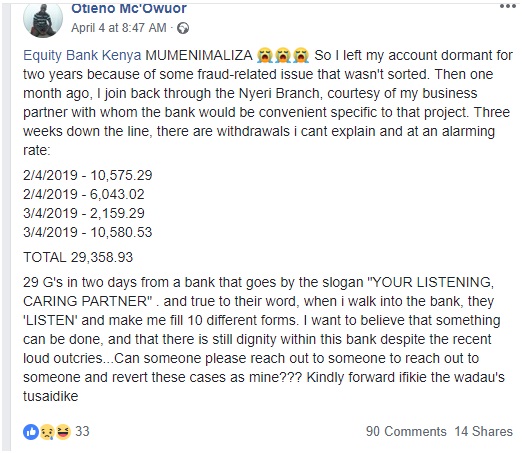

Your Money Is Not Safe With Equity Bank

-

Investigations6 days ago

Investigations6 days agoInvestigation Exposes Alleged Sex Crimes at Alliance Girls High School Amid Institutional Cover-Up

-

Grapevine2 weeks ago

Grapevine2 weeks agoCS Alfred Mutua Embroiled in Custody Battle After A ‘Quick’ Moment With Kenyan Girl in Dubai

-

News2 weeks ago

News2 weeks agoOle Kina Fragrance Sets Kenyan Market Abuzz with Million-Shilling Expansion

-

Opinion2 weeks ago

Opinion2 weeks agoWhy Ruto Dumped Isiolo Governor Abdi Guyo: A Political Betrayal in the Making

-

Americas6 days ago

Americas6 days agoHow A Nigerian Yahoo Boy’s Elaborate Plan to Scam Trump Backfired As FBI Goes After Him

-

News1 week ago

News1 week agoOutrage as Kenya Agrees to Buy Defence Equipment From UK in Ksh12.5 Billion Deal

-

Politics2 days ago

Politics2 days agoMoses Kuria Resigns from Kenya Kwanza Government

-

News6 days ago

News6 days agoIrony of Lydia Mathia Seeking Court Interventions Months After Calling Court Orders ‘Mere Papers’ While Spearheading Evictions