Business

World Bank Warns Kenya Of Economic Consequences Over Sh1.2 Trillion Debt.

-

Business5 days ago

Business5 days agoInside Equity Bank’s Sh1.5 Billion Heist: A Web of Deception and Cover-Up

-

Business5 days ago

Business5 days agoThe ‘Untouchable’ Ruth Muthoni Kamau: Inside Kenya’s Sh1.5 Billion Bank Heist

-

Business2 weeks ago

Business2 weeks agoCourt Freezes Kenya’s Afriswiss Commodities Bank Account in Alleged Gold Fraud

-

Politics1 week ago

Politics1 week agoMoses Kuria Resigns from Kenya Kwanza Government

-

News2 days ago

News2 days agoQuestions As Nairobi Woman Dies Mysteriously After Admission to Chiromo Rehabilitation Centre

-

Investigations4 days ago

Investigations4 days agoKPA Boss Ruto Implicated in Sh31.2 Billion Tender Scam

-

Business2 weeks ago

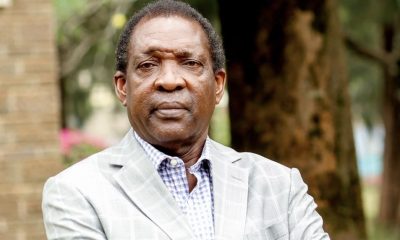

Business2 weeks agoProf. Herman Manyora Appointed as The Nairobi Hospital Chair

-

Investigations6 days ago

Investigations6 days agoNational Irrigation Authority CEO Charles Muasya On The Spot Over Tender Irregularities