News

Wash Wash Paradise: When Lawyers Become Part of The Criminal Enterprise

How Kenya’s legal practitioners have become key enablers in transnational gold fraud schemes targeting foreign investors

In the plush offices of Kilimani’s China Wu Yi Plaza, where legitimate businesses operate alongside shadowy enterprises, a disturbing trend has emerged in Kenya’s “wash wash” economy – the systematic recruitment of lawyers as key facilitators in elaborate gold fraud schemes.

Recent arrests by the Directorate of Criminal Investigations (DCI) have exposed how legal practitioners are no longer just providing professional services to fraudsters, but have become integral players in criminal syndicates that have cost foreign investors millions of dollars.

The Lawyer-Criminal Nexus

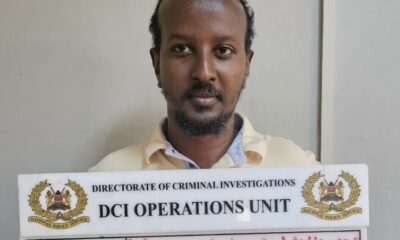

The most recent case involves Michael Otieno Owano, an attorney and proprietor of Otieno M.O. Law Advocates, arrested in connection with a scheme that defrauded a Canadian national of $618,000.

According to DCI investigations, Owano’s law firm received $318,400 directly from the victim, who was promised 250 kilograms of gold for export to Dubai via private jet.

This case illustrates a sophisticated evolution in Kenya’s fake gold industry, where lawyers provide the veneer of legitimacy that criminal enterprises desperately need to convince foreign investors.

“The involvement of lawyers adds a layer of credibility that makes these schemes particularly dangerous,” says a senior DCI detective who requested anonymity. “Victims feel more secure when dealing with registered advocates, not knowing they’re part of the criminal network.”

The Escrow Account Deception

The documents reveal how lawyers have weaponized escrow accounts – traditional instruments meant to protect buyers from fraudsters – into tools of deception.

Thomas Otieno Ngoe and other legal practitioners have been implicated in creating fake escrow arrangements that give victims false confidence in transactions.

In the 2010 Meranti Holdings case documented in the leaked files, Caroline Wamba asked the South African company to open an escrow account with a Nairobi bank for “lifting costs.”

The lawyers involved put disclaimers to absolve themselves, but the money vanished once it landed in their accounts.

“The lawyers put a disclaimer in order to absolve themselves from any liability. The money vanishes once it lands in their accounts,” according to the investigation files.

Recent Cases Expose Expanding Network

The arrest of Kelvin Otieno Onyango alias Kevo Sonko, director of SwiftTaxis Logistics Ltd, in February 2024, revealed another dimension of lawyer involvement.

Onyango was charged with forging mineral export documents in a Sh151 million fraud case. His office in China Wu Yi Plaza had become a hub where “negotiations and finalization of deals were carried out,” according to investigators.

Francis Talla Ouafo, a Cameroonian mastermind arraigned at Milimani Chief Magistrate’s Court in July 2025, operated with a network that included several legal practitioners who provided documentation and banking services for fake gold transactions.

Lupemba Lorenzi Olivier, a Congolese national arrested for defrauding a Gabonese investor, similarly relied on legal accomplices to create the paperwork necessary to convince victims of the legitimacy of his gold deals.

Modus Operandi: How Lawyers Enable Fraud

Investigations reveal a consistent pattern in how lawyers facilitate these schemes:

Documentation Manufacturing: Lawyers create fake mineral dealers’ licenses, export permits, and assay reports purportedly issued by government agencies. The sophistication of these documents, complete with official letterheads and stamps, makes them difficult for foreign investors to detect as fraudulent.

Banking Facilitation: Legal practitioners open and manage accounts that receive victim payments, often using their professional standing to convince banks of the legitimacy of large international transfers.

Negotiation Venues: Law offices provide respectable locations for meetings with potential victims, with some lawyers directly participating in negotiations and providing legal opinions that reassure foreign investors.

Regulatory Exploitation: Some lawyers exploit their knowledge of Kenyan mining and export regulations to create believable narratives about licensing requirements and export procedures.

The Kenya Revenue Authority Connection

The 2011 case involving KRA Assistant Commissioner Joseph Cheptarus, who was murdered while investigating a gold syndicate, highlighted how deeply these networks penetrate Kenya’s institutions.

Current investigations suggest some lawyers have cultivated relationships with KRA officials to provide authentic-looking tax clearance certificates for non-existent gold exports.

International Diplomatic Incidents

The lawyer-enabled schemes have reached such proportions that they’ve triggered international diplomatic interventions.

The 2011 emergency visit by DRC President Joseph Kabila and the 2019 concerns raised by UAE Vice President Sheikh Mohammed bin Rashid Al Maktoum demonstrate how these frauds are affecting Kenya’s international relationships.

Weak Prosecution Record

Despite the scale of these crimes, Kenya’s prosecution success remains dismal.

Among prominent cases involving lawyers and fake gold, only Kevin Obia has been successfully convicted, receiving a mere Sh300,000 fine or one-year imprisonment option for defrauding an Austrian national of Sh15.7 million.

The weakness of Kenya’s legal framework is evident in Section 313 of the Penal Code, which prescribes only three years imprisonment for obtaining money through false pretenses – a penalty that pales compared to the millions of shillings these schemes generate.

The Political Protection Problem

Interior Cabinet Secretary Fred Matiang’i’s 2022 warning that “up to 40 percent of holders of elective office” could be “well-known wash-wash dealers” appears to extend to the legal profession. Some lawyers involved in these schemes reportedly have political connections that complicate prosecution efforts.

The Ethics and Anti-Corruption Commission’s (EACC) submitted adverse reports against 241 politicians, but the electoral commission cleared most, citing legal provisions.

This same weak vetting mechanism appears to apply to lawyers, with the Law Society of Kenya struggling to discipline members involved in criminal enterprises.

The lawyer-enabled fraud schemes have transformed upscale Nairobi neighborhoods into criminal hubs. Kilimani, Kileleshwa, Riverside Drive, and Westlands – areas traditionally associated with legitimate professional services – now house what investigators describe as “safe havens for the purveyors of dirty money.”

The economic impact extends beyond individual victims.

Kenya’s grey-listing by the Financial Action Task Force (FATF) for being a “wash wash playground” has international implications for the country’s banking and investment environment.

The Technology Evolution

Recent cases show how lawyer-enabled schemes have adapted to digital currencies.

The Canadian victim in the Otieno Owano case was instructed to transfer USDT 300,000 to a cryptocurrency wallet, showing how legal practitioners are adapting traditional escrow fraud to new financial technologies.

The systematic involvement of lawyers in Kenya’s fake gold industry represents a disturbing evolution in transnational crime.

When legal practitioners – bound by professional ethics and public trust – become criminal facilitators, they undermine not just individual victims but the integrity of Kenya’s legal system itself.

The DCI’s recent arrests signal a potential crackdown, but without stronger laws, better institutional coordination, and professional accountability mechanisms, Kenya risks becoming a permanent haven for lawyer-enabled fraud schemes that target foreign investors and damage the country’s international reputation.

As investigations continue, the question remains whether Kenya’s justice system can overcome the powerful networks that have made “wash wash” not just a criminal enterprise, but a parallel economy where lawyers, politicians, and criminals operate with apparent impunity.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine1 week ago

Grapevine1 week agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Grapevine5 days ago

Grapevine5 days agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

Investigations3 days ago

Investigations3 days agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein’s Girlfriend Ghislaine Maxwell Frequently Visited Kenya As Files Reveal Local Secret Links With The Underage Sex Trafficking Ring

-

News2 weeks ago

News2 weeks agoState Agency Exposes Five Top Names Linked To Poor Building Approvals In Nairobi, Recommends Dismissal After City Hall Probe

-

Economy2 days ago

Economy2 days agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoM-Gas Pursues Carbon Credit Billions as Koko Networks Wreckage Exposes Market’s Dark Underbelly