Africa

Top 10 African IMF Debtors Ranked

In July alone, the International Monetary Fund (IMF) has reportedly been reviewing loan disbursements to Egypt and Ethiopia, sparking renewed concerns over Africa’s increasing dependence on IMF support.

Though often described as essential for struggling economies, the long-term impact of rising IMF debt is becoming a growing issue across the continent.

Egypt received $1.2 billion after completing the fourth review of its $8 billion loan programme, bringing its total disbursement to $3.5 billion. However, the IMF warned that Egypt faces “high sovereign stress,” with its external debt projected to rise from $162.7 billion in 2024/25 to over $202 billion by 2030.

Ethiopia, on the other hand, secured $262 million following the third review of its programme, though its financial situation remains delicate.

The country is currently in talks to restructure $8.4 billion in debt with official creditors under the G20’s Common Framework and is also preparing to repay a $1 billion Eurobond.

The dual weight of IMF loans and commercial debt continues to stretch national budgets, slowing down growth-focused projects.

On July 8, the IMF released a new analytical note titled “How to Stabilise Africa’s Debt”, which stressed that debt stabilisation depends largely on “stronger institutions, growth-friendly fiscal reforms, and IMF-supported macro stability.”

Senegal presents a cautionary example. Disbursements were halted after officials admitted to underreporting debt, revising the debt-to-GDP ratio from 74% to over 100%. As a result, S&P downgraded the country, and IMF support remains on hold until a credible recovery plan is in place.

These examples underline a broader issue: although IMF loans can avert economic collapse, they often come with strict conditions, austerity demands, and limited space for domestic priorities.

Without effective debt management, countries risk falling into a repetitive cycle of borrowing and repayment, undermining both economic stability and public confidence.

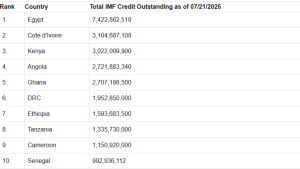

As of July 2025, the IMF’s database lists the African countries with the highest debt burdens to the institution. Compared to last month, credit levels have increased for Egypt, Côte d’Ivoire, Ghana, the Democratic Republic of Congo, Ethiopia, and Tanzania, while other countries have seen reductions.

Top 10 African countries with the highest IMF debt in July 2025.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Investigations1 week ago

Investigations1 week agoBillions Stolen, Millions Laundered: How Minnesota’s COVID Fraud Exposed Cracks in Somali Remittance Networks

-

News1 week ago

News1 week agoUS Moves to Seize Luxury Kenya Properties in Sh39 Billion Covid Fraud Scandal

-

News1 week ago

News1 week agoMAINGA CLINGS TO POWER: Kenya Railways Boss Defies Tenure Expiry Amid Corruption Storm and Court Battles

-

Investigations1 week ago

Investigations1 week agoJulius Mwale Throws Contractor Under the Bus in Court Amid Mounting Pressure From Indebted Partners

-

Americas1 week ago

Americas1 week agoUS Govt Audits Cases Of Somali US Citizens For Potential Denaturalization

-

Business21 hours ago

Business21 hours agoEastleigh Businessman Accused of Sh296 Million Theft, Money Laundering Scandal

-

Americas3 days ago

Americas3 days agoTrump Says US Needs Greenland For Its National Security

-

Business21 hours ago

Business21 hours agoEXPLOSIVE: BBS Mall Owner Wants Gachagua Reprimanded After Linking Him To Money Laundering, Minnesota Fraud