A Nairobi real estate company director has been charged with defrauding an investor of Sh6.4 million in a housing development scheme that never materialized, with authorities suggesting more victims may come forward.

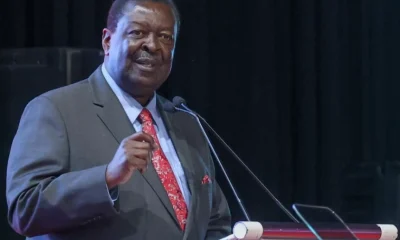

Abdiwahab Adan Maalim, director of Vaad Limited, appeared before the Milimani Law Courts on Tuesday to face fraud charges related to a stalled housing project in Syokimau.

He pleaded not guilty and was released on a Sh1 million bond with an alternative Sh100,000 cash bail.

According to court documents, Maalim is accused of taking millions from an investor for construction of a house in the company’s Oakside Phase 2 project in Mavoko Municipality, despite never breaking ground on the development.

The Economic and Commercial Crimes Unit of the Directorate of Criminal Investigations (DCI) launched an investigation after receiving a complaint on December 30, 2024.

Their findings revealed that Maalim had entered into a contractual agreement dated September 22, 2022, for construction of a house valued at Sh13 million.

The agreement required an initial deposit of Sh3 million with subsequent installments to be paid periodically. Construction was scheduled for completion within 24 months of signing the contract.

“The complainant fulfilled their payment obligations, disbursing a total of Sh6.4 million within seven months of signing the agreement,” DCI report says.

“However, our site visit confirmed that no construction work had commenced, despite the project’s completion date having long passed.”

Investigators visited the Syokimau property and found that neither foundation work nor any other construction activity had been initiated at the site, more than a year after the agreed completion deadline.

The case has been scheduled for mention on May 12, 2025.

In a concerning development, DCI officials revealed they have received multiple additional complaints against both Maalim and Vaad Limited.

These cases are currently under active investigation.

“We urge anyone who may have fallen victim to fraudulent schemes orchestrated by Mr. Maalim or his company to come forward and file reports at DCI Headquarters,” DCI said.

This case highlights growing concerns about real estate fraud in Kenya’s property market, where off-plan purchases and development agreements have become increasingly common, sometimes leaving investors vulnerable to unscrupulous operators.

Legal experts recommend that property investors conduct thorough due diligence, including verification of land ownership, developer credentials, and project approvals before making substantial payments.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

News2 weeks ago

News2 weeks ago

News4 days ago

News4 days ago

Investigations2 weeks ago

Investigations2 weeks ago

News5 days ago

News5 days ago

Politics1 week ago

Politics1 week ago

Investigations1 week ago

Investigations1 week ago

News2 weeks ago

News2 weeks ago

Investigations1 week ago

Investigations1 week ago