News

Peter Munga’s Secret Stake in Sh468 Billion Nairobi-Mombasa Expressway Exposed

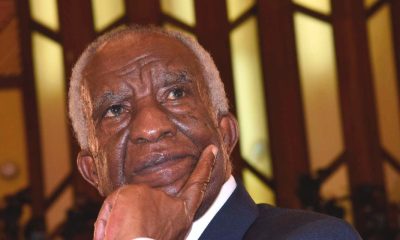

Billionaire businessman Peter Munga is quietly positioning himself at the heart of Kenya’s biggest road project— the Sh468 billion Nairobi-Mombasa Expressway.

Regulatory records reveal that Munga’s family business, Kiewa Group, holds a 50 percent stake in Quickpass Ltd, the Kenyan firm working with Everstrong Capital, a US-based infrastructure investor behind the expressway.

The road, set to be the largest toll highway in Africa, will stretch 440 kilometers and promises to slash travel time between Nairobi and Mombasa from over 10 hours to under 4.5 hours.

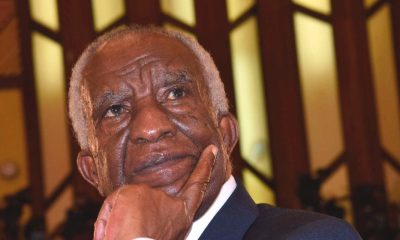

The Nairobi-Mombasa Expressway reflects a wider trend: the move from government-led mega-projects to public-private partnerships dominated by politically connected business figures. [Photo: Courtesy]

Billionaire Peter Munga’s Quiet Return Through Nairobi-Mombasa Expressway

Peter Munga, the founder of Equity Bank and one of Kenya’s most powerful businessmen, has returned to the spotlight—but this time, through infrastructure.

After decades leading Equity Bank before stepping down in 2018, Munga has moved his focus from banking to heavy industries, agribusiness, and now roads.

His latest venture, Quickpass Ltd, is at the center of the Nairobi-Mombasa Expressway deal. Quickpass is a 50-50 joint venture between Munga’s Kiewa Group and Everstrong Capital. Everstrong, incorporated in Mauritius—a secrecy-friendly tax haven—has been largely unknown to the public until now.

The firm’s top boss, Philip Dyk, is described as an “infrastructure dealmaker.” He sits on the Quickpass board alongside Munga’s son Alex Kieme Munga, daughter-in-law Emilly Kanina, and a handful of other figures, including John Paul Ouko and Mandhla Sibanda.

The firm is headquartered in Muthaiga, Nairobi, within Munga’s office compound. The structure offers him both privacy and proximity to key government decision-makers.

Everstrong Capital (Kenya), the local arm of the US firm, owns all 5,124 of its shares and is run by prominent directors, including Henry Kyanda and former US ambassador Kyle McCarter. Despite their influence, Everstrong has stayed off the radar until now.

Lucrative 30-Year Toll Plan Raises Eyebrows

If approved, the Nairobi-Mombasa Expressway will operate under a Build-Operate-Transfer (BOT) model. This means private investors, including Everstrong and its local partner Quickpass, will fund, build, and run the highway for 30 years.

They will recoup their investment by charging motorists toll fees—projected to generate massive profits over the three decades before the road reverts to the state.

The Kenya National Highways Authority (KeNHA) is collaborating with Everstrong on the project. However, a Public-Private Partnership (PPP) committee recently rejected Everstrong’s Project Development Report, citing failure to meet certain key criteria.

Still, the door remains open. Everstrong and KeNHA can resubmit the proposal after addressing the gaps. Critics worry about the opacity of the entire arrangement.

Everstrong’s offshore registration in Mauritius shields it from full ownership disclosure. This raises questions about who exactly stands to benefit from the billions expected in toll revenues.

Munga himself remained cagey when asked about the project, telling reporters on the phone: “But isn’t it a good project?” He promised to call back but never did. His strategic silence only deepens speculation about his actual level of involvement.

Shifting Power to Private Hands in Kenya’s Infrastructure Sector

The Nairobi-Mombasa Expressway reflects a wider trend: the move from government-led mega-projects to private-public partnerships dominated by politically connected business figures. Munga’s case illustrates how tycoons are tapping into this wave.

The former banker is now deeply embedded in the country’s infrastructure web, with a powerful alliance between his family and foreign investors.

Munga’s investment profile extends beyond roads. He holds 75 million shares in Britam and controls 92 percent of Equatorial Nuts Processors, a leading macadamia processor near Maragua.

He also owns EH Venture Capital and EHL 2022, with 405 million shares in various ventures valued at over Sh3.4 billion. Everstrong Capital, meanwhile, is quickly building a reputation across East Africa.

Apart from the expressway, it has invested in energy (such as the Athi River-based Gulf Power Plant), telecoms (SealTowers), and e-mobility (EV Africa). Its growing influence in Kenya’s infrastructure space is being built quietly, yet aggressively.

Still, the government’s rejection of the Project Development Report shows that the mega deal isn’t sealed yet. There are regulatory hurdles to clear before construction can begin. Whether Everstrong and Quickpass can meet these requirements—and whether the public will eventually learn the full list of beneficiaries—remains to be seen.

For now, the Nairobi-Mombasa Expressway symbolizes not only Kenya’s push for better transport but also the hidden forces reshaping the nation’s infrastructure landscape.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News2 weeks ago

News2 weeks agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations2 weeks ago

Investigations2 weeks agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy2 weeks ago

Economy2 weeks agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Grapevine1 week ago

Grapevine1 week agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Business2 weeks ago

Business2 weeks agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Arts & Culture2 weeks ago

Arts & Culture2 weeks agoWhen Lent and Ramadan Meet: Christians and Muslims Start Their Fasting Season Together

-

Business2 weeks ago

Business2 weeks agoKPC IPO Set To Flop Ahead Of Deadline, Here’s The Experts’ Take

-

Politics2 weeks ago

Politics2 weeks agoPresident Ruto and Uhuru Reportedly Gets In A Heated Argument In A Closed-Door Meeting With Ethiopian PM Abiy Ahmed