News

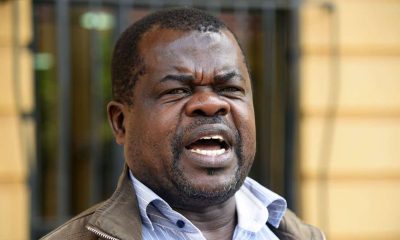

Okiya Omtatah and Others Sues President Ruto, Uhuru For Sh13 Trillion Kenya’s Odious Debt Crisis

A bombshell petition filed in Kenya’s High Court has accused former President Uhuru Kenyatta and President William Ruto of overseeing the accumulation of Kshs 13.1 trillion in odious debt, described as loans borrowed unlawfully and not used for the benefit of Kenyans.

The petition, led by activist Okiya Omtatah and four co-petitioners, alleges rampant constitutional violations, fraudulent financial practices, and systemic oversight failures that have plunged the nation into a debt crisis, with taxpayers bearing the brunt.

What is Odious Debt?

The petition defines odious debt as loans incurred by government officials without public consent, in violation of the law, or for purposes such as corruption, repression, or personal enrichment, rather than public benefit. According to the petitioners, Kenya’s legal framework, including the Constitution and the Public Finance Management Act (PFMA) of 2012, clearly governs public borrowing, restricting it to financing development projects or managing short-term cash flow. Any deviation from these stipulations renders the debt odious and, therefore, not repayable by the public.

Scale of the Crisis

The petitioners claim Kenya’s total outstanding public debt, as reported by the Central Bank of Kenya on December 27, 2024, stands at Kshs 10.79 trillion, comprising Kshs 5.6 trillion in domestic debt and Kshs 5.188 trillion in external debt. However, they argue the odious portion amounts to Kshs 13.1 trillion, factoring in overpayments and discrepancies between the Central Bank and National Treasury records. Of this, Kshs 6.95 trillion is traceable to unauthorized borrowings over the past decade (2014/2015 to 2024/2025), including fraudulent internal debt rollovers worth Kshs 2.5 trillion.

The petition highlights Eurobond loans totaling Kshs 919.45 billion (USD 7.1 billion) borrowed between 2014 and 2021, and an additional Kshs 208.32 billion (USD 1.46 billion) in February 2024, as prime examples of odious debt. These loans, the petitioners assert, were not tied to development projects, were not approved by Parliament, and violated constitutional provisions by being used to repay existing debts—a recurrent expenditure forbidden under the law.

Allegations Against Key Figures

The petition names former President Kenyatta and President Ruto as central figures in the debt scandal. Kenyatta is accused of borrowing Kshs 6.607 trillion between 2014 and 2022, of which Kshs 4.606 trillion was unauthorized and unaccounted for. Ruto, in just two and a half years since 2022, is alleged to have borrowed Kshs 3.135 trillion, with Kshs 2.25 trillion deemed odious. The petitioners demand that both leaders, along with former and current officials—including Treasury Cabinet Secretaries, the Controller of Budget, the Auditor-General, and others—refund the principal amounts plus interest and costs.

Oversight Failures and Institutional Complicity

The petition also targets key oversight institutions for failing to curb the crisis. The Controller of Budget is accused of authorizing withdrawals from the Consolidated Fund to repay odious loans, while the Auditor-General is faulted for not auditing the legality and effectiveness of Eurobond proceeds and other debts. The National Assembly faces criticism for amending the PFMA in 2014 without Senate involvement, introducing provisions that allowed loan proceeds to bypass the Consolidated Fund and permitted the Executive to issue sovereign bonds without parliamentary approval.

The IMF’s Role

In a bold move, the petitioners have sued the International Monetary Fund (IMF) for advancing an “on-lent loan” hidden under Special Drawing Rights (SDRs) disbursements, which was rolled over in 2023/2024 and 2024/2025 at Kshs 10 billion annually. They argue this loan violates Kenyan borrowing laws and seek a declaration that the IMF can be sued in Kenyan courts for lending money in contravention of national law.

Financial Burden on Taxpayers

The petition underscores the crippling impact of odious debt on Kenyans, noting that 86% of tax revenue in the 2024/2025 financial year—approximately Kshs 1.94 trillion—is budgeted for debt repayment. With 71% of the public debt classified as odious, the petitioners calculate that 82% of every tax shilling, including 82% of the 30% corporate tax, is funneled toward servicing these illegitimate loans. This, they argue, exacerbates Kenya’s economic woes, with the government resorting to unsustainable borrowing to finance unrealistic expenditure estimates.

Discrepancies and Fraudulent Practices

The petition reveals stark discrepancies in financial records. For instance, while the National Assembly authorized Kshs 2.79 trillion in borrowings from 2014 to 2024, actual borrowings reached Kshs 9.74 trillion, leaving Kshs 6.95 trillion unaccounted for. In the 2014/2015 financial year alone, Kshs 270.78 billion was borrowed beyond the budgeted amount, with no trace of its use. The petitioners also highlight a suspicious Kshs 19.65 billion payout in January 2025, disguised as state officers’ salaries and allowances, which they suspect funded Kenya’s failed bid for the African Union chairmanship.

Call for Justice

The petitioners are seeking sweeping relief from the High Court, including declarations that odious debts are not repayable by Kenyans, that lenders advancing illegal loans cannot pursue repayment, and that unconstitutional PFMA provisions be quashed. They also demand a permanent prohibition on unauthorized borrowing and repayment of odious debts, alongside orders compelling implicated officials to refund the misappropriated funds.

A Nation at a Crossroads

As Kenya grapples with this unprecedented legal challenge, the petition raises critical questions about governance, accountability, and the future of public finance. Omtatah and his co-petitioners argue that the odious debt crisis is not just a financial burden but a betrayal of the Kenyan people, who have been forced to pay for loans that never served their interests. The outcome of this case could redefine Kenya’s approach to borrowing and set a global precedent for addressing odious debt.

Odious Debt - Press SummaryKenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Grapevine6 days ago

Grapevine6 days agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

Investigations4 days ago

Investigations4 days agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy3 days ago

Economy3 days agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein’s Girlfriend Ghislaine Maxwell Frequently Visited Kenya As Files Reveal Local Secret Links With The Underage Sex Trafficking Ring

-

News2 weeks ago

News2 weeks agoState Agency Exposes Five Top Names Linked To Poor Building Approvals In Nairobi, Recommends Dismissal After City Hall Probe

-

News2 days ago

News2 days agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya