News

Kingsway Tyres and Automart on The Spot Over Sh2.4B Tax Evasion Scandal

The management of the Kenya Revenue Authority is under scrutiny for awarding tax waivers worth Sh3 billion to businesses through questionable dealings.

Due to collusion among KRA officials, certain lawyers, and firms, the government has been losing billions of shillings in the recomputation of taxes, waivers, and abandonment.

According to court documents, KRA filed a tax demand of Sh2.4 billion against Kingsway Tyres and Automart Limited following an assessment in 2004.

The tax assessment included more than Sh1.7 billion for income tax, more than Sh272 million for VAT, and the remaining amount for auctioneer fees. To enforce the demand, KRA attached Kingsway’s property through Speedman Commercial Agencies Limited.

However, on September 27, 2004, the taxman agreed to negotiate with Kingsway Tyres and Automart. During these negotiations to offset their tax obligations, Kingsway Tyres and Automart committed to deposit Sh1.5 million every week on Fridays.

KRA requested Speedman Commercial Agencies Limited to release the goods, and the previously closed offices of Kingsway were reopened.

Kingsway Tyres and Automart took the case to court to challenge the Sh2.4 billion tax demand. Unfortunately, they lost the case, and the ruling was delivered on May 16, 2006.

The ruling against Kingsway Tyres and Automart cleared the path for KRA to collect the Sh2.4 billion they had sought in 2004, as all obstacles were removed.

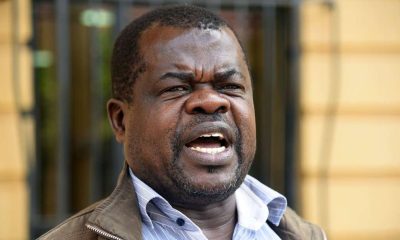

Following the failure of Kingsway Tyres and Automart to pay the taxes, two petitioners, namely Okiya Omtatah (now Busia Senator) and Mohamed Ahmed Mohamed, took the matter to court on July 2, 2014.

They challenged the alleged violation and infringement of fundamental rights and freedoms as stated in articles 27, 40, 46, and 47 of the Constitution, as well as the KRA Act, regarding tax evasion and the failure to comply with the court’s 2004 order to pay taxes.

Omtatah and Mohamed also contested the validity of Kingsway Tyres and Automart’s decision to “change its name and pin from P000606825c to Kingsway Tyres Limited pin number P051116728X” in order to obtain a clean tax compliance status and evade paying Sh2.4 billion in tax arrears.

They included several parties in the case, such as the KRA Board of Directors, Kingsway Tyres and Automart, Kingsway Tyres Limited, the Attorney General, the Director of Criminal Investigations, the Director of Public Prosecution, and the Ethics and Anti-Corruption Commission.

Other individuals involved in the case were former KRA Commissioner Generals Michael Waweru and John Njiraini, former EACC chair Mumo Matemo, and Speedman Commercial Agencies Limited.

KRA, represented by their lawyers Waweru Gatonye and Company advocates, made an application in 2019 seeking consent to collect the Sh2.4 billion from Kingsway Motors. The condition was that Omtatah and Mohamed would agree to withdraw the inclusion of several other people as defendants in the case, leaving only KRA, Kingsway Tyres, Automart, and Kingsway Tyres Limited.

The application was granted, but KRA was required to file a response, which they have failed to do so since 2019. As a result, the final determination of the cross-petition involving Speedman auctioneer, KRA, and Kingsway Tyres and Automart is still pending, awaiting KRA’s response.

KRA Board chairman Antony Mwaura said they would pursue all firms that received undue tax abandonment, waivers, and refunds. They will also investigate if there was collusion between staff members and these firms.

“As part of my achieving the target, I will ensure that KRA relook all the waivers, abandonment and exemptions that were offered to companies,” said Eng Mwaura. He said also on his radar were tax refunds that were offered to firms fraudulently.

“Through the help of Treasury, we will ensure unnecessary tax exemptions are reversed,” said Mwaura.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations2 weeks ago

Investigations2 weeks agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations7 days ago

Investigations7 days agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners