Business

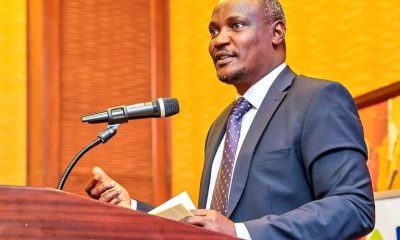

Kenya To Legalize Cryptocurrencies, Says Mbadi

This legislative approach follows a global trend where countries like Morocco, the United States, and Russia are also regulating cryptocurrencies to harness their potential while addressing inherent risks.

NAIROBI – In a significant policy shift, Kenya is drafting legislation to legalize cryptocurrencies, announced by Treasury Cabinet Secretary John Mbadi on Friday. This move acknowledges the widespread, albeit underground, use of digital currencies despite previous bans.

Mbadi highlighted Kenya’s role as a financial innovation leader in Africa, pointing out, “Kenya’s financial sector is a beacon of innovation and growth.” He emphasized the dual role of Virtual Assets (VAs) and Virtual Asset Service Providers (VASPs) in presenting both opportunities and challenges to the financial landscape.

The new policy aims to tackle issues like money laundering, terrorism financing, and fraud, which are risks associated with cryptocurrencies. “We are committed to creating a regulatory framework that leverages the potential benefits while managing these risks,” Mbadi explained.

The draft policy seeks to ensure a “fair, competitive, and stable market” for VAs and VASPs, encouraging innovation and enhancing financial literacy among Kenyan citizens.

This legislative approach follows a global trend where countries like Morocco, the United States, and Russia are also regulating cryptocurrencies to harness their potential while addressing inherent risks.

Mbadi drew parallels with Kenya’s past financial innovations, notably the launch of M-Pesa by Safaricom in 2007, which revolutionized mobile money. “From mobile money to a robust financial system, Kenya has consistently pushed the boundaries of financial inclusion through technology,” he noted.

The policy also reflects on the challenges posed by the anonymous and cross-border nature of VAs, which have been detailed in Kenya’s Virtual Assets/VASPs Money Laundering/Terrorism Financing National Risk Assessment Report finalized in September 2023.

The overarching goal is to position Kenya as a significant player in the global digital finance ecosystem, with the policy providing a flexible framework for domestic and international cooperation, compliance, consumer protection, and risk management.

Virtual assets, driven by technologies like blockchain since Bitcoin’s inception in 2009, have transformed financial transactions but also introduced regulatory challenges. The policy addresses these by aiming for a balanced approach between fostering innovation and ensuring security and regulatory compliance.

The recent global financial crises and the subsequent trust deficit in traditional banking systems have further propelled the interest in cryptocurrencies, not just in Kenya but worldwide.

The Kenyan populace, especially the younger demographic, is increasingly engaging with VAs, attracted by their speed, cost-effectiveness, and anonymity. However, this adoption comes with its set of risks, highlighted by the Kenyan NRA, including capital flight, cybercrime, and consumer protection concerns in an unregulated market.

Mbadi concluded, “This policy draft is a step towards establishing a sound legal and regulatory framework to harness the benefits of VAs while addressing the risks.”

This development marks a pivotal moment for Kenya’s financial sector, promising to integrate it further into the global digital economy while safeguarding against the perils of unregulated digital finance.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News1 week ago

News1 week agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations1 week ago

Investigations1 week agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy1 week ago

Economy1 week agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa2 weeks ago

Africa2 weeks agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Grapevine4 days ago

Grapevine4 days agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Politics2 weeks ago

Politics2 weeks agoSifuna, Babu Owino Are Uhuru’s Project, Orengo Is Opportunist, Inconsequential in Kenyan Politics, Miguna Says