Africa

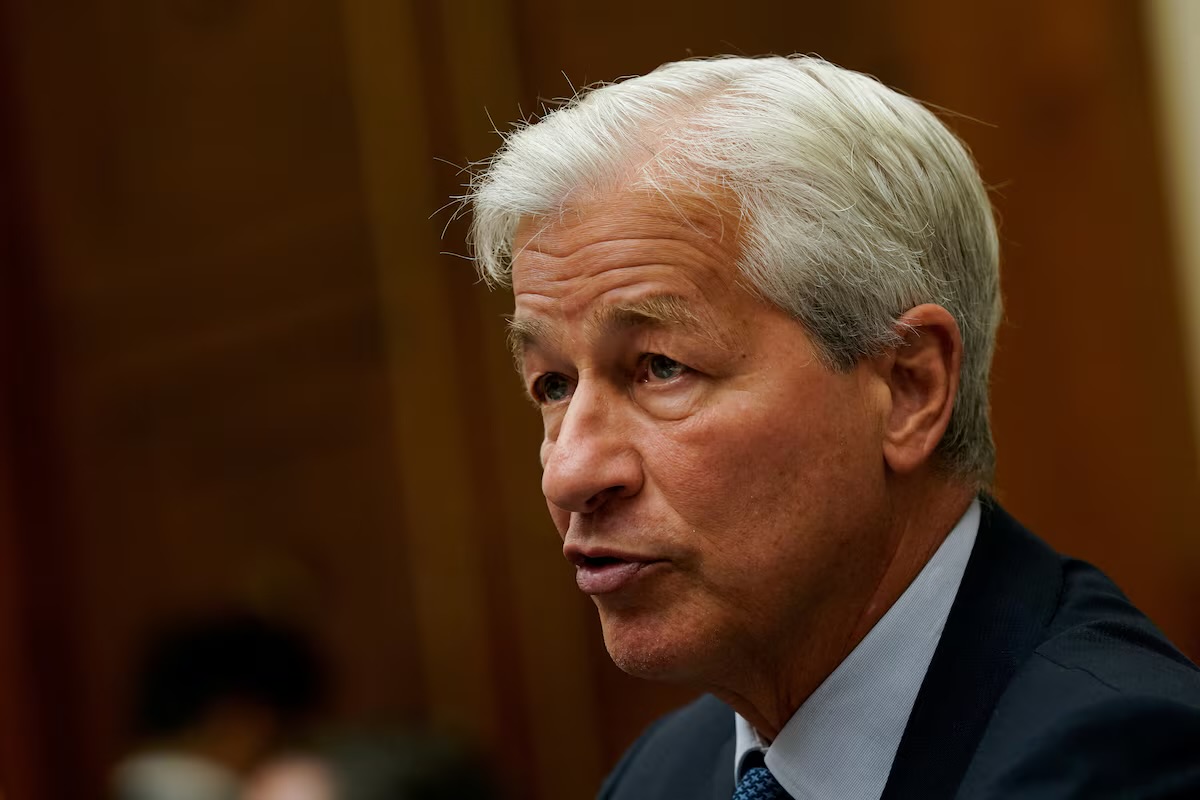

JPMorgan CEO Jamie Dimon Is Set To Visit Kenya Next Month, Marking His First Trip to Africa in 7 Years

Dimon is expected to visit Kenya, Nigeria, South Africa and Ivory Coast during the trip next month, two of the sources said. JPMorgan already has offices in South Africa and Nigeria where it offers asset and wealth management and well as commercial and investment banking services.

Overseas markets have been a key focus area to generate growth for JPMorgan — which has assets of over $4.1 trillion and operations in more than 100 countries.

Kenyan President William Ruto said in February 2023 after a meeting with a senior JPMorgan executive that the bank had committed to opening a new office in Nairobi.

It was not immediately clear how close JPMorgan is to opening in these countries.

Major global banks are seeking to gain a bigger share of sovereign debt and corporate transactions in Africa, analysts said, while also aiming to serve more international companies that have operations on the continent, said Eric Musau, head of research at Nairobi-based Standard Investment Bank.

International lenders are seeking to grow their revenues by offering wealth management services that provide access to investments like offshore equity, debt and mutual funds, Musau added.

Banking giants are also offering private banking services, seeking to differentiate themselves from local and regional lenders that are prevalent in retail markets.

While most consumers on the continent have access to financial services through local and regional commercial banks, private banking “is where the next evolution will be,” said Francis Mwangi, CEO of Kestrel Capital, a Nairobi brokerage.

JPMorgan is among the top five international private banks by assets under supervision and growth in overseas markets is a key priority, it said in May.

In the last five years, about 700 bankers have been involved in expanding into 27 new locations worldwide, generating $2 billion in revenue for its commercial and investment bank, JPMorgan’s President Daniel Pinto told investors in May.

The lender sold its subsidiaries in Angola, Cameroon, Gambia and Sierra Leone last year.

($1 = 128.5000 Kenyan shillings)

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News7 days ago

News7 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Business2 days ago

Business2 days agoWaweru’s Bank Pockets Sh1.16 Billion from KPC IPO While Ordinary Kenyans Fled the Sale

-

Politics2 weeks ago

Politics2 weeks agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

Investigations3 days ago

Investigations3 days agoSOLD TO THE BULLET: How the Bodyguard Handed MP Ong’ondo Were to His Killers

-

News2 weeks ago

News2 weeks agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations1 week ago

Investigations1 week agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS